Our Group organises 3000+ Global Conferenceseries Events every year across USA, Europe & Asia with support from 1000 more scientific Societies and Publishes 700+ Open Access Journals which contains over 50000 eminent personalities, reputed scientists as editorial board members.

Open Access Journals gaining more Readers and Citations

700 Journals and 15,000,000 Readers Each Journal is getting 25,000+ Readers

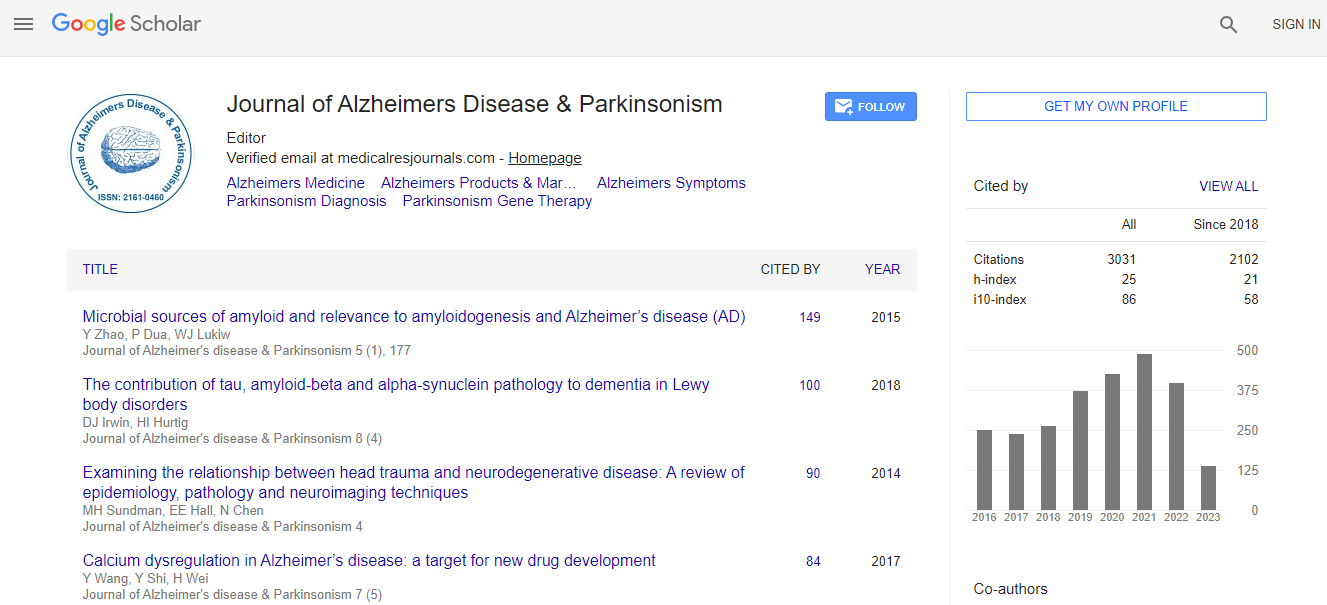

Google Scholar citation report

Citations : 4334

Journal of Alzheimers Disease & Parkinsonism received 4334 citations as per Google Scholar report

Journal of Alzheimers Disease & Parkinsonism peer review process verified at publons

Indexed In

- Index Copernicus

- Google Scholar

- Sherpa Romeo

- Open J Gate

- Genamics JournalSeek

- Academic Keys

- JournalTOCs

- China National Knowledge Infrastructure (CNKI)

- Electronic Journals Library

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- SWB online catalog

- Virtual Library of Biology (vifabio)

- Publons

- Geneva Foundation for Medical Education and Research

- Euro Pub

- ICMJE

Useful Links

Recommended Journals

Related Subjects

Share This Page

The enigma of EroomâÂ?Â?s law and the Wall Street math stifling Alzheimer′s drug discovery

11th International Conference on Alzheimers Disease & Dementia

Max Tokarsky

InvestAcure, USA

Posters & Accepted Abstracts: J Alzheimers Dis Parkinsonism

Spanish

Spanish  Chinese

Chinese  Russian

Russian  German

German  French

French  Japanese

Japanese  Portuguese

Portuguese  Hindi

Hindi