Our Group organises 3000+ Global Conferenceseries Events every year across USA, Europe & Asia with support from 1000 more scientific Societies and Publishes 700+ Open Access Journals which contains over 50000 eminent personalities, reputed scientists as editorial board members.

Open Access Journals gaining more Readers and Citations

700 Journals and 15,000,000 Readers Each Journal is getting 25,000+ Readers

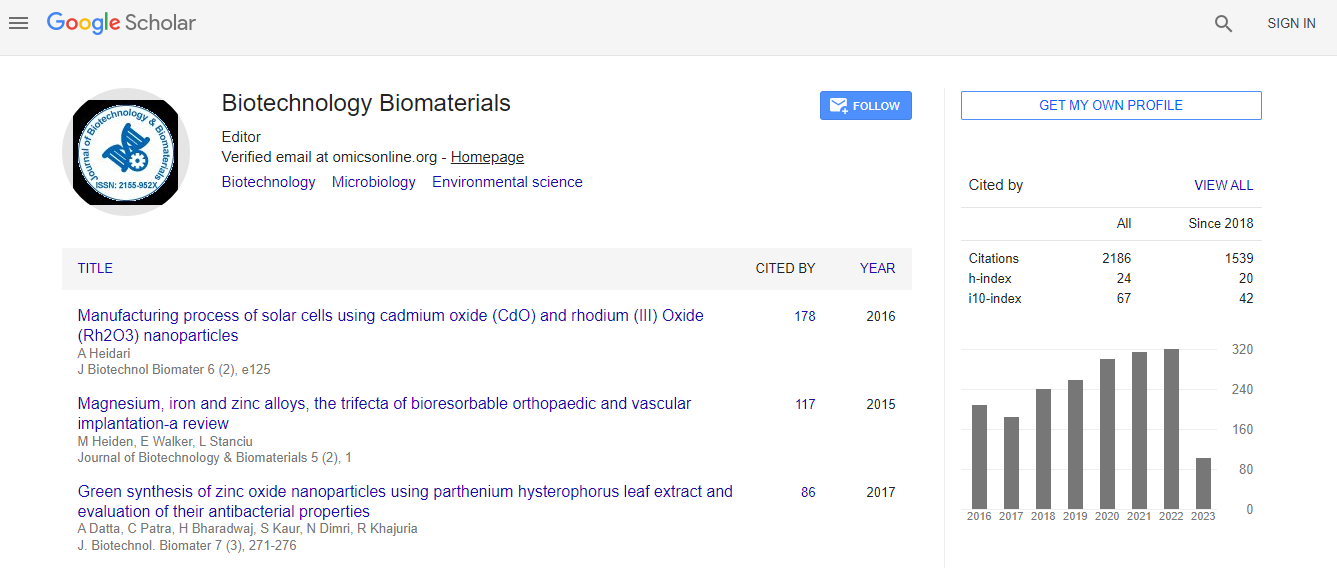

Google Scholar citation report

Citations : 3330

Journal of Biotechnology & Biomaterials received 3330 citations as per Google Scholar report

Indexed In

- Index Copernicus

- Google Scholar

- Sherpa Romeo

- Open J Gate

- Genamics JournalSeek

- Academic Keys

- ResearchBible

- China National Knowledge Infrastructure (CNKI)

- Access to Global Online Research in Agriculture (AGORA)

- Electronic Journals Library

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- SWB online catalog

- Virtual Library of Biology (vifabio)

- Publons

- Geneva Foundation for Medical Education and Research

- Euro Pub

- ICMJE

Useful Links

Recommended Journals

Related Subjects

Share This Page

Investment modeling for biofuels and biochemicals

World Bio Summit & Expo

Lawrence D Sullivan

Lawrence D Sullivan & Company, Inc. USA

Keynote: J Biotechnol Biomater

Abstract

Many technical, financial and economic factors exist in biomass growth and subsequent processing. These factors are the need for abundant, low cost water and vital nutrients; the careful regulation and soundly engineered containment of genetically engineered organisms; the separation, processing, and conversion of the raw materials to usable products; as well as the need for material transportation. Rewards are expected for investment risks and beta coefficients in this emergent industry. We are reporting on the efficacy of the Capital Asset Pricing Model (CAPM) as used by financial firms to determine forecasted investment returns on biomass companies and projects. The production of biomass should fit the CAPM typically used for agriculture Paretian rent calculations, mineral extraction and petroleum (oil & gas) exploration & production with a Return on Capital Employed (ROCE) that is above 15%. The subsequent processing of the biomass must fit the CAPM for petrochemical intermediates, petrochemicals, plastics, thermoplastics, basic chemicals and petroleum refining using conventional data from ROCE in the range of 9-14%. The ROCE for historic extraction and conversion of natural resources is then discussed using the CAPM model by many financial firms (hedge funds, equity funds, and venture capital funds) and governments, in addition to industrial corporations, who invest in renewable energy companies and projects.Biography

Lawrence D Sullivan is a leading academic, management and engineering consultant in oil, natural gas and biotechnologies used by the petroleum industry. He is a Top 2% Gerson Lehrman Group Member in the Council of Advisors where he consults with leading financial and industrial as well as governmental, legal and academic institutions. His career spans 35 years of leadership in the development and successful implementation of new technologies in the energy industry. He is an Adjunct Professor at Trident Technical College and The Citadel. Additionally, Larry is a principal with Lawrence D. Sullivan & Company, Inc. with his partner, Carla M. Wood. Lawrence.

Email: Sullivan@TridentTech.edu

Spanish

Spanish  Chinese

Chinese  Russian

Russian  German

German  French

French  Japanese

Japanese  Portuguese

Portuguese  Hindi

Hindi