Our Group organises 3000+ Global Conferenceseries Events every year across USA, Europe & Asia with support from 1000 more scientific Societies and Publishes 700+ Open Access Journals which contains over 50000 eminent personalities, reputed scientists as editorial board members.

Open Access Journals gaining more Readers and Citations

700 Journals and 15,000,000 Readers Each Journal is getting 25,000+ Readers

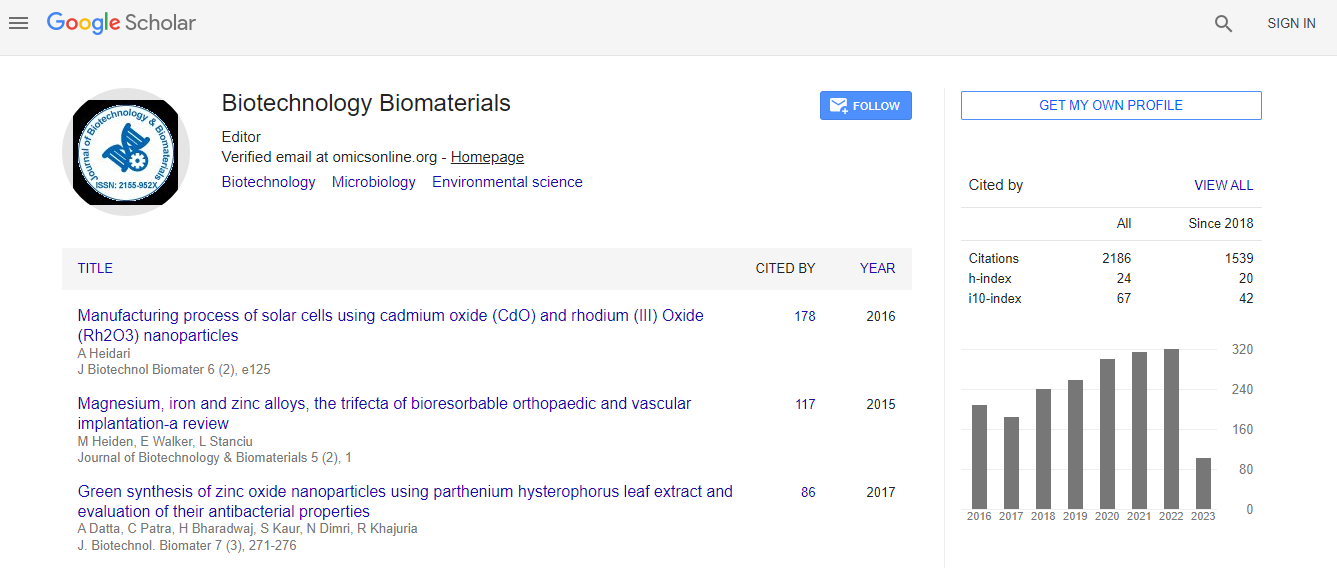

Google Scholar citation report

Citations : 3330

Journal of Biotechnology & Biomaterials received 3330 citations as per Google Scholar report

Indexed In

- Index Copernicus

- Google Scholar

- Sherpa Romeo

- Open J Gate

- Genamics JournalSeek

- Academic Keys

- ResearchBible

- China National Knowledge Infrastructure (CNKI)

- Access to Global Online Research in Agriculture (AGORA)

- Electronic Journals Library

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- SWB online catalog

- Virtual Library of Biology (vifabio)

- Publons

- Geneva Foundation for Medical Education and Research

- Euro Pub

- ICMJE

Useful Links

Recommended Journals

Related Subjects

Share This Page

Early phase value scan for biotechnology innovation

17th EURO BIOTECHNOLOGY CONGRESS

Mark Nuijten

A2M, Netherlands

ScientificTracks Abstracts: J Biotechnol Biomater

Abstract

Background: Registration of a medicinal product by EMA or FDA used to be the main determinant for the future sales forecast of the product and would justify a higher valuation of the share of the company, especially for a biotech company with only a limited number of products. Contrary, new emerging requirements for reimbursement authorities, payers and drug policy changes are increasingly going to determine the actual future sales and the actual post-launch costs. The current most important criteria for coverage decisions are effectiveness, cost-effectiveness and budgetary impact, which are taken into consideration to make a value for money decision. As the future financial performance of a pharmaceutical company is directly related to the free cash flow of a new drug, an appropriate assessment of the potential sales forecast of a portfolio of forthcoming new drugs is an important predictor of the economic value of a pharmaceutical company. Today, such an assessment should include the estimated effects of the new emerging requirements for reimbursement authorities, payers and the effects of other pharma policy changes, as pay-for-performance based financial agreements. Objective: This presentation aims to provide a strategic value scan for biotechnology products at the early onset of the development program considering the emerging hurdles for market access. The application of the early phase scan will be based on a hypothetical new innovative drug in breast cancer. Methods: The outcomes of the strategic value scan are determined by the key decision criteria: efficacy and safety, cost-effectiveness, budget impact and additional criteria may be included depending on the disease area. The input of the strategic scan is based on a sales forecast model, a cost-effectiveness model, and a pricing model, which are interacted and executed simultaneously. The strategic value scan will provide guidance on the position of the new product in the treatment pattern for each scenario and the expected comparators in each position. The cost-effectiveness model and pricing model will provide upper limits for the pricing potential for each scenario and the expected comparators in each position. These outcomes can be linked with a discounted cash flow model to optimize the economic value of the biotechnology company taken into considerations the hurdles for reimbursement and market access. The value scan includes various scenarios (e.g. negative, base case and optimistic) for the expected clinical profile of the new product and the positioning of the new product in the treatment pattern (e.g. 1-line, 2-line, 3-line treatment). It is important to predict the incremental benefit of the new product versus the relevant expected comparators at each possible position. Changes in design of the forthcoming clinical trial or positioning of the new product may increase the economic value of the company. For example, health economic data (effectiveness and resource utilisation) may be collected alongside the forthcoming clinical trial, which may be used as input for the health economic models. Conclusion: We present a novel approach for the early phase valuation of biotechnology products from a broader perspective by bridging concepts from health economics, market access, pricing and the economics of business economic valuation.Biography

Mark Nuijten trained as a Physician and worked in clinical practice before completing an international MBA from Erasmus University, Rotterdam. He completed his PhD in Health Economics at the Erasmus University, Rotterdam, in 2003 and the thesis entitled as “In search of more confidence in health economic modeling”. He was Board Director of ISPOR (2002-2004) and Chair of the Management Board of Value in Health (2002-2004). He is a pioneer in the field of Healthcare Innovation in Biotechnology and Nutrition, and has been the first classical health economist successfully applying and developing sales forecast methodologies for valuation of biotechnology companies. Prior to setting up A2M, he was a partner with MEDTAP International. As a VP Business Development for Europe, he established global Pricing and Reimbursement Consultancy Services for MEDTAP. Before MEDTAP, he was a Managing Director of the Quintiles office in the Netherlands.

Spanish

Spanish  Chinese

Chinese  Russian

Russian  German

German  French

French  Japanese

Japanese  Portuguese

Portuguese  Hindi

Hindi