The Effect of Exchange Rate and Crude Oil Price Volatility on the Performance of the Petroleum Downstream Industry in Ghana

Received: 05-May-2022 / Manuscript No. OGR-22-62856 / Editor assigned: 09-May-2022 / PreQC No. OGR-22-62856(PQ) / Reviewed: 25-May-2022 / QC No. OGR-22-62856 / Revised: 06-Jun-2022 / Manuscript No. OGR-22-62856(R) / Accepted Date: 18-Jun-2022 / Published Date: 20-Jun-2022 DOI: 10.4172/2472-0518.1000244

Abstract

The study purpose and statement of the research problem encapsulate this section. It also entails the methodology used to answer the research questions as well as the findings and recommendations of the research.

This research seeks to assess exchange rate volatility’s impact on crude oil prices on performance in the downstream petroleum industry. The research seeks to achieve three goals: to evaluate existing trends in downstream petroleum space production during the research period, to examine the short and long-term relationship between interest rate unpredictability and the downstream petroleum industry, and to investigate the impact of exchange rate volatility on the downstream performance variable of the petroleum industry. The research utilized descriptive design to describe the effect of the exchange rate volatility on the performance of the Ghanaian downstream petroleum industry. Thus, a quantitative approach. Then again, the study conducted a descriptive analysis to generate tables and charts for petroleum price, exchange rate, interest rate, and inflation variables. Eventually, the examination results uncovered that there is a positive pattern in the performance of the downstream oil industry. A short and long-term correlation between the volatility of the exchange rate and the output of the downstream oil industry has been revealed. The review further found that the exchange rate had a positive impact on the output of the downstream oil industry.

Introduction

This section of the chapter consists of the study background, problem statement, research objectives, research problems, research methodology, study significance, study scope, study limitation, and chapter disposition.

Study Background

Movement of the exchange rate in an economy influences the increase in oil prices internationally. Ghana’s demand for oil consumption makes it vulnerable to international price changes in the commodity. The importation of oil to meet its demand as a result of its relevance in the light of the economy. To Dawson (2007), when there is an increase in oil prices in an oil importing country normally results in a significant depreciation of its local or home currency since more of the local currency will be used to buy the same amount of oil as before. Chen and Chen in trying to ascertain the determinant of changes in real oil prices found out that the dominant factor resides in the significant movement of the real exchange rate [1].

Consequently, during the time of the global market declined in the prices of oil in the year 2014, domestic prices of oil did not decline but rather continue to rise. The level of volatility in the exchange rate was high during this period. The decline in economic growth in 2012 due to external and domestic macroeconomic shock lead to 10-15% to below 5% in 2014 and 2015. The government of Ghana was forced to import oil to generate electricity since the supply of gas from the West African Gas Pipeline was low in volume and unreliable. Trade disequilibrium results in a high level of volatility in the exchange rate in oil importing countries.

Problem statement

There have been many ups and downs in the Ghanaian economy exchange rate system. Exchange rate movement that has been persistent for most periods, however, witnessed fluctuations in another period. In the year 2000, the rate of depreciation of the cedi against the US dollar declined to 13.2% in 2002 from 49.8%. According to Aryeetey and Harrigan (2000), the oil prices shock in this period significantly contributed to the Ghanaian economic mishap.

The rate of depreciation of the Ghanaian cedi rise to 20.1% in 2008 and by the third quarter of 2012, its depreciation declined to 18%. As at the end of 2013, a cumulative depreciation was 14.6% and 26.1% by the second quarter of 2014 with an average of 31.2% by the end of the same year. Indisputably, the exchange rate’s volatility influences the performance of the downstream petroleum industry. Also, the overall growth of an economy suffered from the obstacle of frequent depreciation and an increase in the price of oil. The oil price volatility brought about the poor growth rates during these periods. Fosu and Aryeetey (2008) asserted that GDP per capita declined from 1973 to 1983.

More importantly, the real influence of exchange rate volatility on the performance of the downstream petroleum industry is uncertain in Ghana Amartey, B. (2017). Then again, according to Cote (1994) and Insah and Chiaraah (2013), existing literature was focused on the impact of a few macroeconomic variables without considering the variable of exchange rate volatility.

Therefore, this study seeks to analyze the impact of volatility in the exchange rate on the output of the Ghanaian downstream petroleum space.

Aim and objectives of study

This research aims at investigating the impact of exchange rate volatility on the performance of the Ghanaian downstream petroleum sector.

To accomplish the aforementioned aim, the study sought to;

i. Examine the trends of the performance of the petroleum downstream industry in Ghana from 2008 to 2018.

ii. Assess the short and long term nexus between the exchange rate and the performance of the Ghanaian petroleum downstream sector.

iii. Analyse the impact of crude oil price volatility on downstream petroleum industry performance in Ghana.

Research questions

i. What are the performance trends of the Ghanaian petroleum downstream space from 2008 to 2018?

ii. What is the short and long term nexus between the exchange rate and the performance of the Ghanaian petroleum downstream sector?

iii. What is the influence of crude oil price volatility on the Ghanaian petroleum downstream sector’s performance?

Study scope

The study was informed by the annual dataset spanning from the period 2008 to 2018 with evidence from the petroleum downstream industry. The study will make use of the year-on-year (YOY) exchange rate, inflation, and the interest rate on the performance of the Ghanaian downstream petroleum sector.

Literature Review

Introduction

This section discusses existing and current literature on the definition of the depreciation of exchange rates and inflation. The related theories on the influence of exchange rate volatility on the output of the downstream petroleum industry in Ghana have also been discussed in this chapter.

Historical overview of the petroleum industry in Ghana: Ghana is a fairbeginnerin the international petroleum scene and is best known for its gold mining and cocoa industry. The oil discovery and prospecting history in Ghana, however, is dated back to 1896. The study of Ghana’s petroleum industry shows the following four main historical phases.

Phase 1- Petroleum policy overview: The oil mining activity in Ghana dates back to 1896 under British Colonial rule in what was then the Gold Coast. In the Tano Basin, which is now in the western region of Ghana, the first shallow onshore wells drilled. Exploration took wildcat drilling forms without a systematic method. There were estimates of the number of onshore exploratory wells drilled during this initial time in the Tano Basin in the initial phase from 1896 to 1957 ranging from 17 to 21 onshore wells. The Gulf Oil Company marked the end of the initial 61-year period in Ghana’s petroleum exploration history through the acquisition of four onshore exploration licenses and the drilling of four wells. The most crucial aspect of this process from a legal perspective was the absence of a legal system dedicated to the petroleum industry. Minerals Act 1962 (Act 126) issued petroleum exploration and development licenses from 1962 until 1984.

Phase 2-Offshore exploration: The second oil exploration phase in Ghana was in the post-independence period from 1957 to 1979. This process initiated offshore exploration with the concentration of interest in the mainland shelf for all 22 continental shelf exploration blocks fully approved by 1968. This period is the offshore phase of Ghana’s petroleum industry. Primarily, the early exploration was carried out by Soviet and Romanian teams with Romania’s Industrial Export Company at the center of both offshore and onshore exploration activities in the Kata Basin. The minimum requirement for exploration license holders is characterized by this phase to drill at least one well at a total depth of 12000 ft within 18 months of the exploration agreement However, the only significant discovery was the Salt pond Oil Field which came on-stream in 1978 after Signal / Amoco Group first discovered it in 1970. In the end, the exploration effort remained minimal during this period.

Phase 3- Legislative and institutional developments specific to the sector: The 1971 and 2001 period marks the most important phase in Ghana’s petroleum industry from a legal perspective, resulting in a range of statutory instruments for the petroleum industry. This was aimed at establishing a robust regulatory framework for sector governance. The predecessor to these legislative instruments was the Law to 16 June 1983 on the Ghana National Petroleum Corporation [PNDC 64] which defined the institutional structure for upstream petroleum activities. This law can honestly be known as the foundation of Ghana’s petroleum legislation. There has been a corresponding increase in exploration efforts that continue to produce promising results. There has been a related rise of the legislative and regulatory instruments relevant to inspectors. The Ghana National Petroleum Corporation (GNPC) was founded in 1983 to provide the institutional basis for Ghana’s upstream oil operations. Section 2 outlines the GNPC’s “Objects.” These include discovery, production, manufacture and disposal of petroleum products. The corporation is also responsible for ensuring the maximization of petroleum resource benefits to the nation. These benefits also include technology transfer, capacity building, national training in the acquisition of petroleum industry skills and technical expertise, and sound environmental practices in petroleum production.

Downstream petroleum industry in Ghana

The oil and gas industry is one of the greatest and most assorted businesses. With administrations running from transport, power, warming, oils, and a large group of synthetic and petrochemical items, this industry addresses the day by day life of individuals. A stunning 30 billion barrels of oil are expended every year universally. Around 26 % of overall energy consumption is accounted for by petroleum products (Ministry of Energy, 2010) [2] and around 70 % of Ghana’s industrial energy needs [3]. The Energy Ministry appraises that by 2015, the interest for significant oil based commodities in Ghana will ascend by 5.3% yearly. Projects have additionally been required to raise this number if financial development is supported. The worldwide cycles of investigation, mining, refining, transport and promoting of oil based commodities are essential for the oil business. By and large, the business is part into three essential areas (upstream, midstream, and downstream). In meeting most vehicle needs, the segment is noteworthy, giving force and filling in as a reason for the petrochemical business and the endurance of other basic ventures. On the other hand, various gracefully chain arrangements going from unrefined determination to item appropriation at the retail outlet are bit by bit being executed by downstream oil conveyance.

The National Petroleum Authority (NPA)

The National Petroleum Authority (NPA) has released an authoritative demonstration to control the downstream oil industry in Ghana (NPA Act 2005, ACT 691). The Regulator, as a controller, guarantees that the market remains effective, manageable, fair and ensures that consumers obtain cash rewards at the same time. The downstream oil part in Ghana incorporates the creation and refining of unrefined petroleum, just as the deal, showcasing, and dispersion of the nation’s refined oil based goods. Import, trade, re-send out, handling, transport, preparing, refining, stockpiling, conveyance, promoting, and selling of oil based goods are the business tasks of the business. The area is one of the key sub-parts and a significant supporter of Ghana’s GDP. The business right now flaunts in excess of 5,000 specialist co-ops and a yearly market volume of about GHS12 billion ( US$ 4.01 billion), speaking to around 10% of the GDP of the nation, as per 2014 assessments. The business works intimately with overall makers, for example, BP, Glencore, Vitol, Trafigura, and so forth to gracefully around 80% of the nation’s existing utilization of oil based commodities.

Oil Marketing Companies (OMCs) in Ghana

There are organizations that are dynamic in the oil business downstream. Notwithstanding unadulterated advertising, these organizations additionally refine and sell oil they acquire from seaward oil investigation and creation firms. The purchase price of these companies is directly related to international crude prices. This means that low prices are positive for oil marketing companies. Oil marketing firms are very crucial in Ghana’s broader oil industry. They are active in importing, exporting to neighboring countries, and selling petroleum products throughout Ghanaian territory to end consumers. Locally based oil companies make most of the supply chain decisions to those nations. Increased numbers of oil marketing firms have also resulted in increased competition both for the distribution system available and for customers. In the Ghana’s oil and gas industry, oil marketing business is a very lucrative venture due to the increasing number of petroleum consumers.

Association of Oil Marketing Companies in Ghana: The Association addresses the mutual premiums of Ghanaian organizations in the exhibition of oil and oil related goods, collaborating with main modern partners, including the Ministry of Energy, the Ministry of Finance and Economic Planning, the Bank of Ghana, the National Petroleum Authority (NPA), the Energy Commission, the EPA, Tema Oil Refinery (TOR), the Board of Governors of Revenue Agencies (RAGB), Regular Board of Ghana, Customs and Preventive Service of Ghana Fire Service (CEPS), Internal Revenue Service (IRS) and Bulk Oil Storage and Transportation Co. Ltd, the Tax Agencies Board of Governors (RAGB), and the Daily Board.

Bulk Distribution Companies (BDCs)

The BDCs are active and responsible industry players who are partnering with allied national development agencies while organizing and fostering healthy cooperation and competition among members. There are currently 23 BDCs representing more than 76 % of the Ghanaian market’s petroleum supplies. The BDCs are a group of companies to strategize, promote, and strengthening stakeholder collaboration in the downstream petroleum sector and collaborating with allied national development agencies through the guidelines set out by the regulators in the industry.

The Government of Ghana joined The Bulk Oil Storage and Transportation Company Limited (BOST) as the sole investor in December 1993 under the Companies Act., 1963 (Act 179) as a private limited liability corporation. BOST’s order is to set up a public organization of capacity tanks, pipelines and other mass transportation organizations, rent or rent out piece of storerooms to create income, hold Ghana’s Strategic Reserve Stocks to claim, oversee and build up a public organization of oil pipelines and storage spaces, deal with the National Petroleum Authority’s (NPA’s) ‘zonalization’ strategy and to build up the cross country flammable gas foundation.

The midstream petroleum industry in Ghana

The midstream oil part of Ghana remains generally lacking. The main petroleum treatment facility in the nation situated at Tema was opened in 1963 and has a plan ability of 45,000 bpd. Notwithstanding, support issues have since diminished its ability to around 30,000 bpd and the unit is yet to deal with any raw petroleum delivered locally. The Tema Oil Refinery (TOR) was all the while running at around half of its nameplate limit in mid-2019, yet before the years over, its administration anticipated that a return should full limit. In December 2019, TOR signed an agreement to process 11 million barrels of crude with the oil and energy company Woodfields Energy Resources with the intention of signing similar agreements with other international traders such as international investment firms Gemcorp and BP.

Ghana National Gas Company: The main gas organization in Ghana will be Ghana National Gas Company (GNGC). The assortment, refining, showcasing and transport of petroleum gas assets is the duty of Ghana Gas. In industrialization, gas from Ghana has assumed a significant job. Ghana Gas produces gaseous petrol based energy for homegrown, business and modern use. By sparing Ghana a huge number of Cedis and adding to the nation’s capacity creation, Ghana’s gas has assumed a significant function in Ghana’s economy. Ghana contributes up to 50 % of the district’s use of Liquefied Petroleum Gas (LPG). Ghana gas produces LPG that is exported by end customers and off-takers to and auctioned. Around 90% of Ghanaians, therefore, use LPG for cooking and other domestic purposes. Twyford, a ceramics company from Ghana, currently depends on Ghanaian gas for industrial use. The gas assists in the development of ceramic tiles for industrial use on walls and floors. The gas is used to power various industrial machines used in the production of ceramics and to heat the manufactured tiles as well. In addition to supplying gas to the Wangkang Company, Ghana Gas limited the capacity of its industrial production machines to a ceramics manufacturing company. Volta River Authority (VRA), a Ghanaian power distribution company, provides gas from Ghanaian gas.

Gas is transported through the pipelines to VRA and then used for the nation’s power generation.

This generation of gas power has helped to reduce the “dumsor” of the country and made a huge contribution to Ghana’s power generation.

The West African Pipeline Company: A limited liability corporation that oversees and operates the West African Gas Pipeline Company Limited (WAPCo) is the West African Gas Pipeline (WAGP). In Badagry, Nigeria, and in Cotonou-Benin, Lomé-Togo, Tema, and Takoradi, the organization has separate workplaces. The organization’s key mandate is to supply flammable gas from Nigeria in a clean, secure and viable way to customers in Benin, Togo and Ghana at reasonable costs. (36.9%), Chevron West African Gas Pipeline Ltd, Shell Overseas Holdings Limited (17.9%), Takoradi Power Company Limited (16.3%), Nigerian National Petroleum Corporation (24.9%), SocieteTogolaise de Gaz (2%), and Societe BenGaz S.A. WAPCo (2%) say (2%). The 687 kms West African Gas Pipeline (WAGP) connects the latest Escravos- Lagos pipeline to the Itoki Natural Gas Export Terminal of the Nigeria Gas Company in Nigeria and continues to the Lagos beachhead. It flows offshore from there to Takoradi, in Ghana.

Theoretical review

Purchasing power theory: As indicated by Constatin, Loana, and Tudor (2018), buying power equality alludes to a hypothetical conversion scale that empowers you to buy similar number of merchandise and enterprises in every nation. It is a hypothetical expense, as it isn’t utilized by any administration. In financial matters, the guideline of buying power equality (PPP) has two employments. As a transformation factor, the first is to change over information from a group of one public cash into another. The information is normally under a public bookkeeping plan, despite the fact that the level of detail will fluctuate from the total national output (GDP) to the sorts of consumption that are profoundly disaggregated. The utilization of PPP brags a body hypothesis (principally list number hypothesis) and usage that have developed steadily over the years (mainly inter-country comparisons of GDP and its components), and path-breaking studies continue to appear in the field. The use of PPP is better than current exchange rates for certain data conversion purposes and is now widely accepted. There is no broad agreement among economists for the second application of PPP. The reference here is the theory of the PPP exchange rate, which has remained a rather unsophisticated theory. Over the last century, this has scarcely advanced in sophistication, but government agencies use it to compare countries that use their production at various exchange rates. It could be used for figuring out where to get the cheapest hamburger in the world. The buying power balance calculation tells you how much it would cost if all nations were to use the US dollar.

Moreover, if something purchased around the world was sold in the United States, it clarifies what it would cost. There has to be a U.S. dollar value assigned to something. This includes goods not commonly available in the U.S. For starters, there aren’t too many ox carts in the USA. For starters, there aren’t too many ox carts in the USA. For every nation in the world, the World Bank calculates the PPP. This requires a map showing the ratio of PPP relative to the U.S. The PPP for many developed countries is calculated using different official exchange rate measures. The PPP and OER metrics are more similar to those used in developed countries. Their arrangements for living are close to those in the US. PPP was created after World War I. Most countries had depended on the gold standard before that. One country’s exchange rate showed you how much gold the currency was worth. In order to pay for the fighting, several nations discarded the gold standard. All the money they needed to generate inflation they were printing out. After the battle, Gustav Ca, the Swedish economist, to achieve the new parity, Gustav Cassel proposed multiplying the pre-war value of each currency by the rate of inflation.

This formed the base for today’s PPP. The parity of purchasing power is based on an economic principle that prices of goods and services should be comparable over time between countries. For the highest price, foreign trade enables consumers to shop around. This comparison shopping helps everyone’s buying power to achieve parity given ample time.

Quantity theory of money: There is a long tradition that explains the long-term behavior of inflation rate and currency’s rate of depreciation (appreciation) according to economic theory. This theory was popularized by economists (Milton Friedman and Anna Schwartz) in their book “A Monetary History of the United States, 1867-1960” after it was first formulated by the Polish mathematician Nicolaus Copernicus in 15177. This tradition was about the Money Quantity Theory (QTM). However, a higher rate of domestic demand growth (in the case of agile global growth rates) contributes to lower inflation. This implies that a higher rate of domestic production growth (for a given foreign growth rate) contributes to domestic currency appreciation. One important source concerns the variations in the inflationary regime faced by countries. Some countries, however, have witnessed high inflation, while others have experienced low inflation. A branch of economics that studies various money theories is monetary economics. The quantum theory of wealth is one of the main research areas for this branch of economics. According to this theory, the general price level of products and services is proportional to the money supply of an economy.

Empirical review

Exchange rate volatility and downstream petroleum performance: There have been numerous studies on the long-term impact on the output of the downstream petroleum industry of exchange rate volatility. Research into the effects of exchange rate volatility on imported petroleum was motivated by the oil crisis in the 1970s. However, before the rapid increase in petroleum products in 1973, inflation was another widespread factor in most LDCs [4, 5]. Moreover, domestic prices were also affected by the world price rise and exchange rate dynamics [6]. Several studies have found that volatility in exchange rates has a long-term effect on oil prices and the performance of the downstream petroleum industry. In the long US dollar appreciation, several researchers find a increase in the price of oil [7-10]. A research on oil prices and the real US dollar-euro exchange rate was conducted by Clostermann and Schnatz and a long-term relationship was found [11]. After analyzing 16 OECD countries’ actual US dollar exchange rate, Chaudhuri and Daniel discovered a cointegrating relation. Also, Chen and Chen found out that the volatility of real exchange rates significantly affects real prices of oil using a panel of G7 countries [1].

Ricken carried out research and found out that international oil price shocks are affected by oil exporting countries’ exchange rates depending on political and legal entities [12]. Theoretically, literature postulated that volatility of the exchange rate does not affect oil prices if there are strong institutions with a smooth fiscal expenditure pattern. Empirical studies found out that oil prices in 33 oil exporting countries with the nondiscriminatory and strong legal system and standard bureaucratic processes are less affected by real exchange rate volatility.

The effect of exchange rate volatility on the performance of the downstream petroleum industry is still unclear and recent findings may be country-related or depend on the period. Hence, there is a need to unearth how exchange rate volatility affects the downstream petroleum industry taking into consideration other macroeconomic variables in the Ghanaian economy. Lowinger revealed that a variable exchange rate imposes additional costs concerning higher inflation rates for relatively open economics [5]. The findings showed that higher petroleum prices in developed nations that import oil have led to domestic inflation. A research by Canetti and Greene did not find a common trend in African countries regarding the causes of inflation [13]. Furthermore, in some cases, the exchange rate channel appears to be more efficient, while in others, the growth of money supply has a longer-term effect. The inflationary process in Sierra Leone was investigated by Kallon for the period 1967-1987 using quarterly data [14]. The evidence shows that part of the inflation of Sierra Leone is imported from the rest of the globe in literature on inflation and exchange rate dynamics, says Agenor and Montiel that the amount of domestic prices appears to be decided by the purchasing power parity exchange rate (PPP) [15]. Using uncontrolled VAR and the Johansen multivariate cointegration method, Rowland conducted a detailed analysis of the exchange rate pass-through to domestic prices in Colombia [16]. In both systems, impulse-response functions were used. Based on the study’s outcome, the pass-through in Columbia was incomplete. After a one-year lag, the unregulated VAR system yielded a pass-through coefficient of 0.08, while the Johansen system yielded a 0.15 coefficient. The fact that different findings were obtained by the two methods also led to further study to facilitate the application of both approaches. Perera used the autoregressive distributed lag (ADL) model for the period 2002 to 2004 to measure petroleum price changes (diesel prices were used as a proxy) for Sri Lankan inflation [6]. The study found that if the price of diesel increased by 10%, the Sri Lankan CPI would directly increase by 0.19%. As a consequence, although the indirect impact is greater than that of the direct impact, its effect is delayed. The downside of this analysis is that the other important factors in the domestic price determination of Sri Lanka were not taken into account. Using a structural VAR model, Mwase examined the impact of changes in exchange rates on consumer prices in Tanzania [17]. The study indicates that in the late 1990s, exchange rate pass-through to inflation decreased amid the currency’s depreciation.

Oil price volatility and exchange rates: Literature has empirically shown that oil price volatility is associated with changes in Gross Domestic Product (GDP), exchange rates, unemployment, interest rates and inflations [18, 19]. The increment in crude oil prices hugely contributes to economic development via the transfer of wealth among oil dependent economics in a form of trade balance which leads to trade disequilibrium [7]. The disequilibrium in trade results in high exchange rates volatility, especially for oil importing economics.

Oil prices and exchange rate: The weight assigned to the sources of exchange rate determines the variations that exist in the realm of exchange rates. Models that are underpinned by structuralism places much emphasis on supply related variables viz cost of wages, performance, inflation as a critical determinant of exchange rate. This model further suggests the need for monetary polymakers to be more strategic in identify the changes and effect of the supply related components for decision making.

However, monetarist oriented models rather focus on the behavior of money stock and price on exchange rate within a specific time. Parsimonious models also focus on how inflation behaves in diverse markets considering equilibrium deviations. Exchange rate depreciation transpires when more of domestic currency is required to attain foreign currency. The appreciation of the exchange rate results in the decrease in oil price. The reverse is true.

When the dollar depreciates, it will result to asurge in oil demand since importing economics like Ghana will require less Ghana Cedis to purchase oil. The presence of a positive relationship between the volatile exchange rate and oil prices is clear, according to Grisse [20]. Exporting and importing states are not immuned from the impact of exchange rate volatility. The increment in oil prices insinuates that, more of a domestic currency (Ghana cedi) will be desired to purchase the same quantity of oil. A rise in the supply of Ghana cedi when constant with dollar supply brings about the price of the foreign currency say the US dollar to rise and result in exchange rate depreciation.

Exchange rate volatility determinants: The levels of production, the Ghanaian bank’s independence, inflation, the availability of foreign and domestic money are factors that lead to exchange rate variations. The country’s economic conditions mean that the exchange rate varies. In an anelastic and free currency system, the exchange rate is the value of the home currency when traded for an global currency, however, in a constant currency system, the government affects the exchange rate system by trading the local currency in the international exchange market to keep the peg to another foreign currency [21]. The increase in trade balance as a result of an innovation that hit foreign price levels of internationally tradable goods and nominal interest rates increases the volatility of the exchange rate, however, volatility in foreign prices decreases exchange rate volatility [22].

More recently, Grydaki and Fountas attempted to investigate the factors that influence the volatilities of output and exchange rate [23]. They created a model and assumed that price is affected by unexpected innovations, rational anticipation holds, and capital mobility. Their findings conform to the findings of other studies in the literature [22, 24, 25].

Exchange Rate Volatility (ERV): The insistent variation of the exchange rate is referred to as exchange rate volatility. According to Curto and Pinto the measurement of exchange rate is executed in terms of ‘coefficient of variation’ which is the fraction of standard deviation and mean [26]. These measurements can be done on year by year or month by month basis. Volatility in price has the tendency of being high for stock, goods and services especially when demand and supply susceptible to random shocks [27]. More importantly, a robust economic foundation ensures the existence of a relatively stable market. Government’s policy activities such as the fulfillment of macroeconomic goals, acts as a determinant of exchange rate volatility. For instance, the Ghanaian Financial Sector Adjustment Programme (FINSAP) - introduced financial reforms that reduced exchange rate volatility during the 1980s.

The monetary model of exchange rates: This model insinuates that the procedure for attaining balance between the total demand stock and money supply is determined by exchange rates [28]. Thus, there exists a positive nexus between money demand and national income amid an inverse relationship between money supply and exchange rate. Then again, the aforementioned theory proposes that the domestic monitory authority is a determinant of exchange rate. Selecting a monetary and exchange-rate policy framework is one of the most crucial decisions that economic policymakers (and in many cases ultimately politicians) are called upon to take.

For many reasons the option is far-reaching. First, the policy structure has broad implications for all economic actors. Second, key macroeconomic outcomes (inflation, competitiveness, responsiveness to economic shocks) are affected. Thirdly, only occasionally experience rarely goes through major changes in policy systems although they can evolve. Fourthly, different frameworks have a different institutional requirement-for example, central bank demands.

For several African countries, in the sense of a competitive exchange rate, discussion on monetary policy decisions is structured around the transition from monetary aggregate targeting to inflation targeting. It is a legitimate and significant topic, and could well be useful for such a transition. Such options, however, are only part of the range of available monetary policy options, which in turn encompass a range of exchange rate policy choices. The key anchor in many other countries is a fixed or pegged exchange rate, with monetary assuming a more passive role.

This policy option, which depends on the specific characteristics of a country or economy, does not have a correct response.

Conceptual review

The concept of exchange rates: The price at which a foreign currency can acquire a domestic currency is called exchange rate [29].

The concept of inflation: The insistent increase in the prices of goods and services is referred to as inflation. In these circumstances, the supply of money exceeds the demand for it. The economy goes into an inflationary pressure when attempts are made to finance economic deficits Hudson [30]. Delayance in the deployment of money into the Ghanaian economy and the finalizing of projects has the tendency of eliciting incongruence between additional demand for products and services. According to Carriero, Clark and Marcellino, such incongruences have denting effects on the economy [31].

Conceptual framework

The exchange rate policy: Exchange rate policy encapsulates the type of the design and deployment tactics serving as a prerequisite to the attainment of a stable and realistic exchange rate for the local currency. Then again, these tactics must be in congruence with the consistent with the stated macroeconomic policy.

The exchange rate can be described as the price for which a foreign currency can be acquired in domestic currency [29]. It is a vital price in an economy that influences most other prices and, indeed, the general level of prices. Subsequently, the movements and levels of exchange rate have immense implications for balance of payment equilibrium, export competition among others. According to Kraft and Furlong, the government, business stakeholders and the public take keen interest in aforementioned implications (Figure 1) [32].

Research Methodology

Introduction

The methodological approaches are examined in this section. This methodology comprises the design of research, population, data collection techniques, mathematical models, and the tools of data analysis adopted in the study.

Research design

To start with, research design refers to the blueprint for data collection and analysis. It also involves the organizing of data collected and analysed intended to add purpose to research. Research design is categorized into three main approaches namely explorative, descriptive, and causal research design (Awasthi, 2012).

The descriptive design was used to illustrate the influence of exchange rate volatility on downstream petroleum performance in Ghana. Also, a purely quantitative method was used to measure the influence of exchange rate volatility on the performance of the Ghanaian downstream petroleum sector using different statistical techniques. The analysis also used data through time series and data sources elucidated by the model specification.

Population

In this study, companies in the Ghanaian petroleum sector constitute the population of the research. Data was collected in the researcher’s quest to achieve the research objectives.

Data collection

The research utilised secondary data to attain the study aims. Secondary data is touted for ease and the least costly way to collect and analyses data. Notwithstanding, there exist some pitfalls to secondary data such as i. Specific data for the ongoing study is very difficult to discover, ii. Units of Calculation are Distinctive, iii. Limited data access, iv. Out-of-date information. The study used a year-on-year (YOY) exchange rate, inflation, interest rate on the performance of the Ghanaian downstream petroleum sector to enhance the researcher in computing the impact exchange rate has on downstream petroleum prices.

Data selection: The study used yearly exchange rate, inflation, interest rate data sets, and from 2008 to 2018. Prices of petroleum were extracted from the National Petroleum Commission, Ministry of Energy, and the World Bank. This covered an 11-year period. It included the period 2008 to 2018 with evidence from the Ghanaian petroleum industry. Data was also collected from Bank of Ghana paying more attention to inflation, interest rate, and exchange rates over the aforementioned period.

Data source: Data on downstream petroleum prices in Ghana were collected from the National Petroleum Authority while interest rate and the exchange rate were directly compiled from the Bank of Ghana. Data on inflation and economic growth which is measured by the Gross Domestic Product was gathered from the Ghana Statistical Service. Data was also gathered from the World Bank, National Petroleum Authority, Ministry of Finance, and the Ministry of Energy to achieve the objectives of the study.

Data processing and analysis

Data processing: There are some computer-based applications used by researchers in the analysis of their data. These include Stata, Microsoft Excel, R Studio, the Social Sciences Statistical Pack. The researcher therefore made use of excels in organising and processing the data. STATA is used as a tool of analysis due to the researchers’ better knowledge and its usability and accessibility.

Data analysis: Data analysis is data-based activities and methods that permit the author to explain the evidence, identify patterns, establish theories, and test hypotheses. This includes the study of statistical data, modeling, data quality, and outcome interpretation. To interpret the research results, this analysis utilized descriptive and inferential statistics. A descriptive analysis was also carried out in the study to develop tables and charts for exchange rate, interest rate, and inflation rates and the movement of the price of petroleum. The analysis of the results was informed by the scientific hypothesis and the decision rules of mathematical models.

Mathematical model

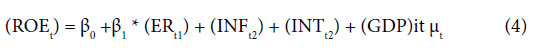

1.6.1. Regression model: The model is used to assess the influence of exchange rate, inflation, and interest rate on the Ghanaian downstream petroleum sector.

The model is as follows:

ROE it = α +βERit + β2INFit+ β3ITRit +β4GDPitέit

Where α is constant, β1, β2, β3, β4, and β5 are coefficients of variables, έ is the error term. ER- stands for exchange rate

INF- stands for Inflation

ITR - stands for Interest Rate

GDP- stands for Gross Domestic Product

Correlation test

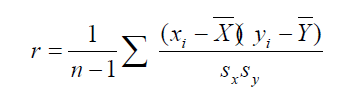

Correlation test is used to determine the relationship between two specific variables. To find the short-term association between exchange rate and the downstream price of petroleum products, the Pearson correlation approach is used. The Pearson r is estimated as follows:

X and Y refers to mean of the exchange rate and price petroleum products.

SxSy = Standard Deviation between the exchange rate and prices of petroleum.

n = number of observations in the sample

The r value ranges between +1 and -1:

• r > 0 shows a positive relationship between the exchange rate and prices of petroleum products: as one goes up, the other also goes up.

• r < 0 shows a negative association: as one goes up, the other goes down.

• r = 0 shows no association.

Co-integration test

The co-integration is used to measure the long term association between wo variables. The model is as follows:

Where:

ROE is the performance of downstream petroleum product

ER, INF and INT, stand for exchange rate, Inflation, Interest rate, and Gross Domestic Product respectively.

β0 is constant

β1 is coefficient of (ERt)

μt is error term

Hypothesis

H0: there is no long-term relationship between exchange rate volatility and the performance of the petroleum industry

Ha: there is a long-term relationship between exchange rate volatility and the performance of the petroleum industry

Decision rules

If the trace statistic > Critical Value: Reject H0a and Trace Statistic ≤ Critical Value: Accept H0

Analysis and Discussion of Findings

Introduction

This chapter consists of research findings, descriptive statistics on the data used for the study, trend analysis for the past on the downstream output of petroleum. The results of the report, descriptive statistics on the data used, trend analysis of the output of the downstream petroleum industry over the past 11 years, analysis of the relationship between volatility in the exchange rate and the downstream petroleum industry in Ghana are included in this chapter. The chapter also discusses exchange rate, interest rate, and inflation effect on the performance of the downstream petroleum industry in Ghana.

Table 1 above presents descriptive statistic of the statistics offering a description of the dependent and independent variables. From the table, Goil and Total reported mean ROE of 21.102 and 32.75 respectively. Also, the standard deviations of their ROEs were 5.574 and 22.152. this implies that on average, Total Ghana Limited has a return on equity of 32.38% whiles Goil Ghana limited has an average return on equity of 21.10% The mean price on petroleum of the sampled data was 2.243 and a standard deviation of 0.167. However, the average (mean) on the exchange rate was reported as 2.724 and a given standard deviation of 1.336. Moreover, inflation and interest rate recorded means of 0.139 and 33.654 respectively. Inflation and interest rate both had a corresponding standard deviation of 0.033 and 7.427. Meanwhile, the Gross Domestic Product (GDP) reported a mean of 4.707 and a standard deviation of 0.089. The minimum value of the Gross Domestic Product was 4.534 and a maximum value of 4.816.

| Variable | Obs | Mean | Std.Dev | Min | Max |

|---|---|---|---|---|---|

| ROE (Total) | 11 | 32.375 | 22.152 | 11.191 | 95.472 |

| ROE (Goil) | 11 | 21.102 | 5.574 | 16.598 | 35.645 |

| Exchange rate | 11 | 2.724 | 1.336 | 1.214 | 4.613 |

| Inflation | 11 | 0.139 | 0.033 | 0.071 | 0.176 |

| Interest rate | 11 | 33.653 | 7.427 | 21.24 | 43.66 |

| GDP | 11 | 4.707 | 0.089 | 4.534 | 4.816 |

| Crude Oil | 11 | 2.394 | 0.203 | 2.03 | 2.639 |

| Petroleum Prices | 11 | 2.243 | 0.167 | 1.946 | 2.478 |

Table 1: Descriptive Statistics.

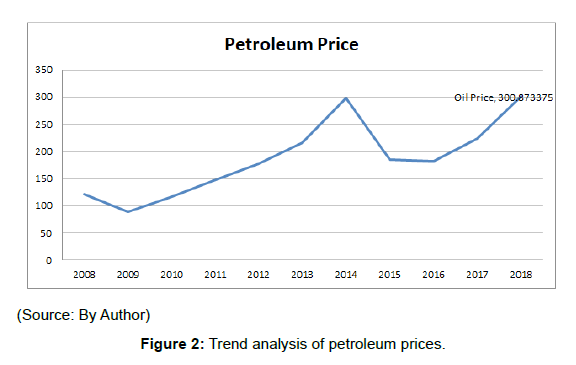

Figure 2 shows a pictorial view of the trend analysis of the movement of oil prices from 2008 to 2018 using 2008 as the basis year. There was a general increase in the prices of petroleum from 2008 to 2018. From the figure above, it can be seen that there was a slight decline in the price of petrol from 2008 to 2009. Moreover, the industry witnessed an increase in petroleum prices from 2009 up to 2014 where it reaches its peak and declined in 2015. From the year 2015, the sector experienced another increase in prices from 2016 to 2018. This indicated that there is a general increase in petroleum prices over the years. This is consistent with the fact that flexible exchange rates would curb the boom-and-bust syndrome as well as turn the country towards a trajectory of growth.

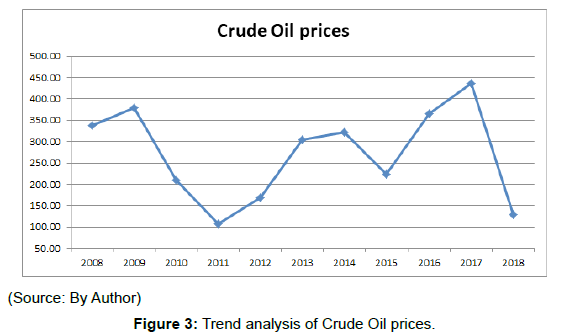

Figure 3 shows a pictorial view of the trend analysis of the movement of crude oil from 2008 to 2018 using 2008 as the base year. There is a general decrease in crude oil prices from 2008 to 2018. From the figure above, it is evident there is an increase in the price of crude oil from 2008-2009. Moreover, the industry witnessed a decrease in crude oil prices from 2009 up to 2011 where it reaches its begun to increase up to 2015. From the year 2015, the sector experienced another increase in prices from 2015 to 2017 where the prices of crude declined in 2018. This is a clear indication that there was a general decrease in prices of crude over the years.

Figure 4 above shows the performance of the downstream petroleum sector over the study period. This is represented by the financial performance of two companies known as Total Ghana limited and Goil Ghana limited. It can be seen that there was a steady increase in the performance of the sector from 2008 to 2013. Also, the sector experienced a sharp increase in petroleum prices in 2014. However, the downstream petroleum sector experienced a decline in 2015 where the performance of the industry began to increase from 2015 to 2018. This means that the performance of the downstream petroleum sector over the study period was impressive.

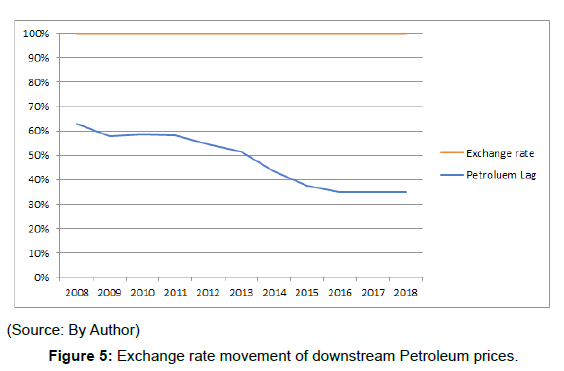

Figure 5 shows a pictorial view of the trend analysis between the movement of oil price and exchange rate from 2008 to 2018 using 2008 as the base year. There exist a direct linear relationship between exchange rate movement and petroleum. From the figure above, it is evident that exchange rate and petroleum prices move in the same direction indicating a positive relationship between the variables.

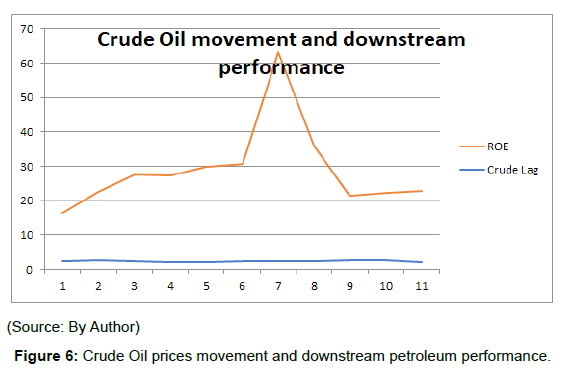

In assessing the movement between crude oil price and downstream petroleum performance, Figure 6 shows a pictorial view of the trend analysis of the movement of crude oil prices and downstream petroleum performance from 2008 to 2018 using 2008 as the base year. From Figure 6, there exist a direct linear relationship between the movement of the exchange rate and the price of crude. The volatility associated with the movement of exchange rate and crude oil price in Ghana is very strong due to the directional linkage between them.

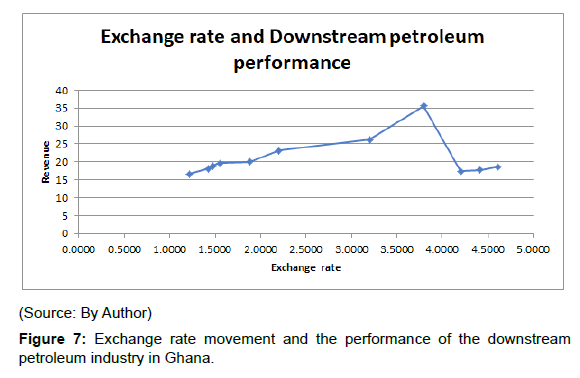

Figure 7 shows a pictorial analysis of the exchange rate movement and downstream petroleum industry performance in Ghana. The findings revealed an increasing trend in the exchange rate performance exchange rate and that of the performance of the downstream petroleum industry.

From the diagram above, increase in crude oil prices contributes significantly to downstream petroleum industry performance in Ghana. This finding is similar to the finding by who ascertained that volatility of exchange rate contributes to the development of economics through the transfer of wealth among oil dependent economics in a form of trade balance which leads to trade disequilibrium all other things being equal [7]. For instance, ROE of firms in the downstream petroleum sector would increase due to the persistent decline in the exchange rate. There is interrelationship between oil price and exchange rate volatility [20].

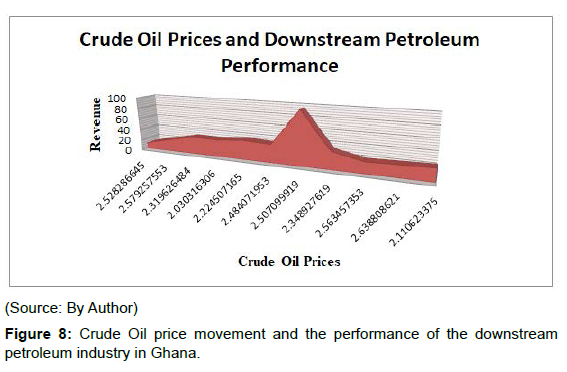

Exchange rate volatility affects oil price changes in both importing and exporting countries. An increase in oil prices means more of a domestic currency says Ghana cedi will be desired to buy the same quantity of oil as it used to be. Numerous researchers found that the long term US dollar appreciation brings about a rise in the oil price [7, 8] (Figure 8).

Unstable crude oil prices affect the inflows of capital due to the rapid price fluctuations which reduce foreign investor investment inflows since a sector with stable crude oil prices easily attracts investors. The above chart is an indicator that there is a natural relationship between the fluctuation of crude oil and the output of the downstream petroleum sector. The rate at which high crude oil price volatility affects the performance of the downstream petroleum industry in Ghana is since it does not control the world price of oil. Consequently, crude oil levels and movements have far-reaching implications for the performance of the downstream petroleum industry in Ghana. Because of their widespread impact, crude oil developments are a matter of interest and often a concern, to the government, the business community, and the general public [32].

The correlation between the various independent variables and the explained variable i.e. the performance of the downstream petroleum industry which is represented by ROE (Total) is presented in the table above Table 2. The correlation is tested at a 5% significance level. From the table, it was evident that the exchange rate had a strong relationship with the downstream petroleum price with a correlation coefficient of 0.68. Inflation, on the other hand, showed a weak relationship with the downstream petroleum price with a reported correlation coefficient of 0.0977. Moreover, the interest rate had a weak and insignificant relationship with downstream petroleum price given a correlation coefficient of 0.1158. The finding is consistent with the study conducted by Grisse which ascertained that there is consistency in the interrelationship between oil price and exchange rate volatility [20]. However, these findings are inconsistent with the study by Novotny who ascertained that there is an inconsistent linkage between the exchange rate and the performance of the downstream petroleum sector [33].

| ROE | Exchange rate | Crude | Petrol | Inflation | Interest rate | GDP | |

|---|---|---|---|---|---|---|---|

| ROE (Total) | 1 | ||||||

| Exchange rate | 0.68 | 1 | |||||

| Crude | 0.0102 | 0.1133 | 1 | ||||

| Petrol | 0.4803 | 0.7467 | -0.1212 | 1 | |||

| Inflation | 0.0977 | 0.46 | -0.0394 | 0.1886 | 1 | ||

| Interest rate | 0.1174 | 0.877 | -0.1373 | 0.7585 | 0.521 | 1 | |

| GDP | 0.1873 | 0.6183 | -0.3157 | 0.8564 | 0.0142 | 0.7933 | 1 |

Table 2: Relationship between exchange rate and crude oil prices and the performance of the downstream petroleum industry in Ghana.

Table 3 above shows the co-integration used to ascertain the longterm relationship between petroleum prices and the exchange rate. It is evident from the table that there exists a long-term relationship between petroleum price and exchange rate. Previous studies have also shown a certain degree of cointegration between petroleum prices and the exchange rate. In this case, the null hypothesis is rejected. This implies that there exists a long-term relationship between the exchange rate and the downstream petroleum industry. Ricken carried out research and found out that international oil price shocks are affected by oil exporting countries’ exchange rates depending on political and legal entities [12]. However, theoretically, literature postulated that the volatility of the exchange rate does not affect oil prices if there are strong institutions with a smooth fiscal expenditure pattern.

Hypothesized No. of co-integration |

Parameters | LL | Eigenvalue | Trace value | 5% critical value |

|---|---|---|---|---|---|

| 0 | 20 | -28020 | 0.0805 | 192.576 | 183.89 |

| 1 | 27 | -27998 | 0.0683 | 156.408 | 138 |

| 2 | 32 | -27979 | 0.06 | 124.36 | 100.24 |

| 3 | 35 | -27962 | 0.0411 | 94.0982 | 67.15 |

| 4 | 36 | -27951 | 0.0326 | 44.5472 | 68.52 |

Table 3: Results of the co-integration test.

Number of Obs = 11F (3, 7) =

References

- Chen SS, Chen HC (2007) Oil prices and real exchange rates. Energy Econ 29: 390 404.

- http://www.energymin.gov.gh/

- Amponsah R, Opei FK (2014) Ghana’s downstream petroleum industry: An evaluation of key supply chain difficulties and benefits for growth. Int J Pet Oil Explor Res 1: 1-7.

- Salvatore D (1984) Petroleum prices, exchange rates, and domestic inflation in developing nations. Rev World Econ 120: 580-589.

- Lowinger TC (1978) Domestic inflation and exchange rate changes: The less-developed countries’ case. Rev World Econ 114: 85-100.

- Perera KKCK, Rathnasiri PG, Senarath SAS, Sugathapala AGT, Bhattacharya SC, et al. (2005) Assessment of sustainable energy potential of non-plantation biomass resources in Sri Lanka. Biomass Bioenergy 29: 199-213.

- Amano RA, Van NS (1998) Oil prices and the rise and fall of the US real exchange rate. J Int Money Finance 17: 299-316.

- Coudert V, Miguon V, Penot A (2007) Oil price and the dollar. Energy Stud Rev 15.

- Benassy-Quere A, Valerie M, Alexis P (2007) China and the correlation between oil cost and the dollar. Energy Policy 35: 5795-5805.

- Beckmann J, Czudaj R (2013) Oil prices and efficient dollar exchange rates. Int Rev Econ Finance 27: 621-636.

- Clostermann J, Schnatz B (2000) The determinants of the euro-dollar exchange rate-Synthetic rudiments as well as a non-existing money. Appl Econ Q 46: 207-230.

- Rickne J (2009) Oil Price and actual Exchange Rate Unpredictability in Oil-Exporting Economies: The Function of Governance. IFN Working paper 810.

- Canetti E, Greene J (1992) Monetary growth and exchange rate depreciation as causes of inflation in African countries: An empirical analysis. J Afr Dev 1: 37-62.

- Kallon KM (1994) An econometric analysis of inflation in Sierra Leone. J Afr Econ 3: 199-230.

- Agenor P, Montiel P (1999) Macroeconomics development. Princeton University Press, Princeton, New Jersey, USA.

- Rowland P (2003) Exchange rate pass-through to domestic prices: the case of Colombia. Borradores de Economía 254.

- Mwase N (2006) An empirical investigation of the exchange rate pass-through to inflation in Tanzania. IMF Working Papers 06/150.

- Shaari MS, Hussain NE, Abdul RH (2013) The effects of oil price changes and exchange rate volatility on unemployment: Evidence from Malaysia. Int J Res Bus Soc Sci 2: 72-83.

- Blanchard OJ, Gali J (2007) The Macroeconomic Effects of Oil Shocks: Why are the 2000s so different from the 1970s? National Bur Econ Res.

- Grisse C (2010) What Drives the Oil-Dollar Correlation?. Federal Reserve Bank of New York, New York 1-22.

- Mensah L, Obi P, Bokpin G (2017) Cointegration test of oil price and US dollar exchange rates for some oil-dependent economies. Res Int Bus Finance 42: 304-311.

- Turnovsky JS, Bhandari JS (1982) The extent of capital mobility and stability of an open economy under coherent expectations. J Money Credit Bank 14: 303-326.

- Grydaki M, Fountas S (2009) Exchange rate unpredictability and output unpredictability: a theoretical approach. Rev Int Econ 17: 552-569.

- Driskill R, McCafferty S (1980) Exchange-rate unevenness, real and financial shocks, and the extent of capital mobility under coherent expectations. Q J Econ 95: 577-586.

- Betts C, Devereux MB (1996) The exchange rate in a model of pricing-to-market. Eur Econ Rev 40: 1007-1021.

- Curto JD, Pinto JC (2009) The coefficient of deviation asymptotic allocation in the case of non-iid random variables. J Appl Stat 36: 21-32.

- Ji Q, Fan Y (2012) How does oil price unpredictability affect non-energy product markets? Appl Energy 89: 273-280.

- Nick G, Szaller Á, Bergmann J, Várgedő T (2019) Industry 4.0 readiness in Hungary: model, and the first results in connection to data application. IFAC-PapersOnLine 52: 289-294.

- Gomis-Porqueras P, Kam T, Waller C (2017) Nominal exchange rate determinacy under the hazard of money forgery. Am Econ J Macroecon 9: 256-273.

- Hudson M (2011) How economic theory came to disregard the function of debt. Real-world Econ Rev 57: 2-24.

- Carriero A, Clark TE, Marcellino M (2018) Measuring uncertainty and its impact on the economy. Rev Econ Stat 100: 799-815.

- Kraft ME, Furlong SR (2019) Public policy: Politics, analysis, and alternatives. 7th Edn CQ Press 1-544.

- Novotný F (2012) The link between the Brent crude oil price and the US dollar exchange rate. Prague Econ Pap 21: 220-232.

Indexed at, Google Scholar, Crossref

Indexed at, Google Scholar, Crossref

Indexed at, Google Scholar, Crossref

Indexed at, Google Scholar, Crossref

Indexed at, Google Scholar, Crossref

Indexed at, Google Scholar, Crossref

Indexed at, Google Scholar, Crossref

Indexed at, Google Scholar, Crossref

Indexed at, Google Scholar, Crossref

Indexed at, Google Scholar, Crossref

Indexed at, Google Scholar, Crossref

Indexed at, Google Scholar, Crossref

Indexed at, Google Scholar, Crossref

Indexed at, Google Scholar, Crossref

Indexed at, Google Scholar, Crossref

Indexed at, Google Scholar, Crossref

Citation: Najimu A, Mahama AS (2022) The Effect of Exchange Rate and Crude Oil Price Volatility on the Performance of the Petroleum Downstream Industry in Ghana. Oil Gas Res 8: 244. DOI: 10.4172/2472-0518.1000244

Copyright: © 2022 Najimu A. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Select your language of interest to view the total content in your interested language

Share This Article

Recommended Journals

Open Access Journals

Article Tools

Article Usage

- Total views: 4398

- [From(publication date): 0-2022 - Dec 22, 2025]

- Breakdown by view type

- HTML page views: 3855

- PDF downloads: 543