Short Communication Open Access

Rent Assessment in the System of “Smart Regulation” Rare Earth Business

Bogdanov SV* and Chernyy SA

State University of Management, Moscow, Russia

- *Corresponding Author:

- Bogdanov SV

State University of Management, Moscow, Russia

Tel: +7-915-330-57-65

E-mail: bsv-29@yandex.ru

Received Date: June 24, 2014; Accepted Date: July 07, 2014; Published Date: July 28, 2014

Citation: Bogdanov SV, Chernyy SA (2014) Rent Assessment in the System of “Smart Regulation” Rare Earth Business. J Powder Metall Min 3:123. doi: 10.4172/2168-9806.1000123

Copyright: © 2014 Bogdanov SV, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Visit for more related articles at Journal of Powder Metallurgy & Mining

Abstract

Russian deposits are quite comparable level of rent in respect of the mastered foreign sources of raw REE. This confirms the necessity of activation of works on extraction and processing of ores. Deposits are highly profitable rare for modern business. Further improvement and increasing the efficiency of Russian rare earth business it is advisable to take into account the opportunities of application of system “smart regulation”. The core of this system is a complex and systematic regulatory impact assessment, which involves the integration of all stakeholders in the process of making and implementing decisions on state regulation in order to achieve maximum economic and social benefits in the implementation of state intervention at all levels of government.

The increased demand for Rare Earth Metals (RE?) due to the active development of the industries which end users of these products. It is known that about 20-30% of final consumption of REE falls on state-controlled military and space industry, where rare earth elements are positioned in the structure of construction materials, optical and electronic equipment. Sharp price changes on the world market over the past few years, the increasing demand in high-tech industries for specified products and monopolization of export deliveries of Chinese manufacturers REE formed 4-7% of their deficit on the market. This deficit is expected to continue in the coming 2-3 years, and on some elements, as shown by the preliminary analysis of a conjuncture of the world market (Table 1), can be significant, even crucial.

| The Risk Of Price Growth | Elements | |||

|---|---|---|---|---|

| Critical | Y | Dy, Tb | ||

| High | Gd, Ho | Er | Eu | |

| Average | Sm | Nd | ||

| Low | Yb | Pr, La, Ce | ||

| Risk levels | Low | Average | High | Critical |

| The Risk Meet Demand | ||||

Table 1: Matrix pricing risks and meet the demand of REE up to 2015.

Mineral resources base of modern rare-earth business is very diverse and heterogeneous in its mineralogical composition and geographical location. Various kinds of mineral raw materials are divided into primary (natural) and secondary (anthropogenic) sources and deposits of these elements are characterized by a complex structure of ores. In each field there are many industrial extracted metals with similar characteristics. Their selective extraction in the form of oxide or metal difficult or even technically impossible, so in terms of real production of mineral raw materials are extracted components that includes most or all items, and then distinguish them in total concentrate, which remove individual metals. Many technologies for oxides and metals of high and ultra-high purity are critical, as evidenced by the importance of their application in various industries and products both civil and military purposes [1-3].

It is known that rare earth metals relatively widely distributed in the earth’s crust, however, their natural concentration in the ore is small. Because of this, only a small portion of deposits profitable for development at the modern level of technology development. The main industrial sources of rare earth minerals are the latest, monazite, loparite and ion absorption of clay. Bastnasite and monazite ores are responsible account for over 80% of all known reserves of REE. More than half of the world reserves of REE is in the fields of latest China and the US, monazite deposits became widespread in Australia, Brazil, China, India, Malaysia, South Africa, Sri Lanka, Thailand, deposits of loparite in Russia. Other resources REE related field’s xenotime, ion adsorption clay, phosphorite, Apatite, eudialyte and other.

By known data of the British Geological survey (British Geology Survey) world mineral-raw material base of rare-earth metals presents 53 deposits. Main current fields are located on the territory of the people’s Republic of China (including the largest Deposit of Bayan Obo), United States of America (processing is conducted by the company Molycorp Corp. on the basis of warehouse stocks of ore concentrates field Mountain Pass), Russian Federation (extraction of rare-earth metals is carried out on the basis of the Lovozero deposits) and India (extraction of rare-earth metals is carried out from the coastal placers). In 2011 on the assessment of the U.S. Geological survey (USGS), the total world reserves and resources REE amounted 113, 8 million tons that allows providing the world production of REE products in terms of the oxides according to various expert level to 135 thousand tons per year [4]. Russia is in second place by the volume of reserves and resources of REE. The state balance of the Russian Federation considered sixteen rare earth deposits [5]. Significant reserves of REE allow considering the mineral resource base of Russia as a promising direction for long-term development projects in the field of complex extraction and processing of rare-earth metals. According to the forecast of the resources and content of rare-earth metals deposits in territory of the Russian Federation (Lovozersky, Tomtor, Chuktukon) are objects of a world scale. In present in Russia is 1,5-2,0 thousand tons of REE per year (about 2% of world production)and extraction of rare-earth metals is carried out only at LLC “Lovozersky GOK” (LLC “Lovozersky GOK”, Murmansk region), as associated products to mined tantalum and niobium. At the site of production manufactured loparite (integrated titanium-tantalum-niobium-rare earth) concentrates. Processing of loparite concentrate is carried out at JSC “Solikamsk magnesium plant” (Perm region). The basic volume of production is exported in the form of collective concentrates of rare-earth metals with a low degree of processing. Over the forecast period up to 2020 according to the Russian experts of State Corporation “Rosatom” assumes a significant change in the volume and structure of consumption of REE in Russia and the approach of her to the world practice [6,7].

For realization of this concept of business development in Russia workers of various ministries and departments of the Russian Federation, state Corporation Rosatom, Rostekhnologi, employees, departments, research institutes, Universities are widely discussed various ways of forming and create a full technological chain on manufacture the products with high level of technological readiness [8,9] their natural and technogenic raw materials. The corresponding emphasis is on the first technological redistribution in full cycle of manufacture of rareearth metals, which includes the complex of measures on carrying out exploration work and preparation of fields for exploitation. In this regard, of particular interest for economic assessment preferences and prospects of development and exploitation of deposits of rare-earth metals for the enterprises and companies carrying out their projects.

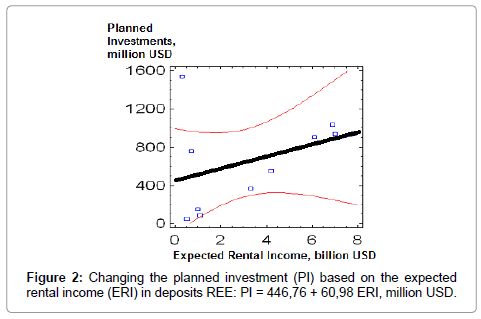

In this work the possibility of using the expected rental income as an indicator to assess the preferences and economic importance of developed deposits from positions of rent payments which must be made by the owner of the field at its subsequent operation. This allows to perform calculations on the economic attractiveness of rare-earth business at the stage of field development and to avoid certain difficulties in making strategic decisions on the further development of this business in the conditions of lack of information in the press about the specific technical and economic indicators discussed and implemented in the present business projects intake products containing rare-earth metals.

From the ore extracted on deposits of rare earths, usually by flotation technology at the first stage of its processing produce concentrates containing mixed REE with the content of useful components in quantities of 60 to 95%. Concentrates subjected to subsequent chemical and metallurgical processing, and then the resulting products are divided into pure oxides, or other complex chemical compounds, or perhaps pure metals and alloys. Subsequently, commercial output is realized by consumers. To assess the feasibility of obtaining concentrate from natural raw material of a certain field, you can use the well-known formula for determining differential and specific rent

(1)

(1)

where i - is the number of the Deposit; DRi - annual differential rent Deposit i monetary units; SDRi - specific differential rents received by developers fields of 1 t of ore concentrates containing rare-earth metals, monetary units /t; Mi - is the mass of ore concentrate, obtained by the i-th field for the year, t; PRVi - potential recoverable value of rare earths from 1 ton of ore concentrate, monetary units; ZZ - closing costs monetary units.

Given that the minerals containing rare-earth metals are nonrenewable natural resources, assessment of the expected rental income during the operation of the Deposit of rare earths, as a source of minerals, can be given by the formula

(2)

(2)

where RIi - rental income if possible exploitation source of natural resources, monetary units; t - the period of mine, years; j- is the discount rate.

According to specialists, developing deposits of rare-earth metals, when computing the value of j is accepted at the level of 10%, which corresponds to a cautious estimate of the rate of return on the relevant projects, taking into account forecasts of reduction of prices on REE [8,9]. When calculating the share of the rent for each field of the value of REE in 1 ton of a concentrate, calculated in current prices in the world market, was deducted relevant closing costs (ZZ), which represent the costs for mining, ore processing, and logistical costs associated with the delivery of concentrate from the field to further processing. These costs are characteristic of the enterprise that works on most poor extracted raw materials, with the lowest content of useful component and most difficult conditions of conducting production and business activities in the sector under consideration. When calculations as closing costs used the cost of loparite concentrate is the only mineral raw material from which, mainly, produced REE in Russia. From the economic point of view Lovozero field selected as the most costly and technically difficult for the industry, because of its ore is very poor in content of rare earths. According to experts they contain 2,3...2,4% of loparite [10]. In addition, this Deposit is located on the Kola Peninsula, where natural climatic conditions are severe, and transport costs of shipping from loparite concentrate for further processing in the Perm region is quite significant. In the calculations assumed that closing costs equal to the cost of loparite concentrate produced at LLC “Lovozersky GOK” and shipped to JSC “Solikamsk magnesium plant”. The cost of this concentrate is close in its meaning to the selling price, in recent years much has changed, due to world market prices for rare-earth products and domestic costs of production, transportation and processing of raw materials. Based on data for 2011-2012 and expert opinions LLC “Infomain”, as well as the information set forth in the project development of the municipality “the Lovozero region” [11, p. 51-52], the value of the closing costs in the calculations estimated to be equal to 3600 USD/t. In the assessment of the magnitude of potential recoverable value of REE from 1 ton of ore concentrate one or another field of loss of main component not considered and relied on its percentage in the appropriate grade. This assumption allowed to maintain differentiation deposits of the level of concentration of rare earths in the rocks and gave an opportunity to define the maximum threshold value of rental income.

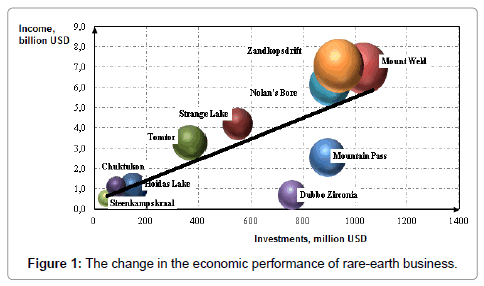

The results of calculations of the authors of work [12] showed that for most of the known deposits in the short term, rent, as the basis of economic interest of developers of projects on development of deposits of rare-earth metals, remains very significant. Its annual comparable with the planned volume of capital expenditure for the implementation of projects on development of fields, which is especially vividly illustrated for canadian and African sources of raw materials. Biggest annual differential rents can get the company on deposits Zandkopsdrift, Mount Weld, Mountain Pass, and Nolan’s Bore. This is primarily due to the significant planned annual volume of production of rare earths, which constitute 20...44 thousand tons in terms of the oxides of rare-earth metals.

Expected rental income depends on the size of differential rents associated with the volumes of extraction of rare-earth metals for the whole planned period of operation of natural resources and, in General, is defined by amount of margin Deposit. With significant field life (several decades), there is almost a direct proportional dependence between the annual differential rents and rental income from exploitation of the Deposit. It should be noted that the reduction in the value of rent in the long run is determined by the change in the composition of ores included in the extracted raw materials, as well as the balance of light and heavy REE. Apparently, most of the 70% decline in rents can be predicted for the “Ce” fields, while for “yttrium” fields these losses can be significantly reduced. This tendency should be taken into account in connection with the present rapid changes in global, national and regional prices on different products with REE.

Despite the decreasing world prices for products with REE, commercial attractiveness of rare-earth business still remains quite high due to significant growth of consumption of this product. The analysis of dependence of the impact of expected rental income in the amount of planned investments in the development of the largest foreign and domestic deposits (Figures 1 and 2) pointed out the positive dynamics of this complex investment process.

It should be noted that such Russian deposits are quite comparable level of rent in respect of the mastered foreign sources of raw REE, which confirms the need to intensify work in this direction. For Russian deposits: Katuginskoye and Tomtor rent indices are close to the average world, to Alluiv (Lovozero field) and Chuktukon - 1.5...2 times lower than average. These fields are highly profitable rare for modern business.

Further improvement and increase in the efficiency of the national rare-earth business expedient to be carried out taking into account the possibilities of applying the system of the so-called “smart regulation”, existing, for example, in OECD countries. The core of this system is a complex and systematic regulatory impact assessment, which involves the integration of all stakeholders in the process of making and implementing decisions on state regulation in order to achieve maximum economic and social benefits in the implementation of state intervention at all levels of government. The mechanisms of this system are complex, based on the concept “evidence-based law making” and the inclusion of the addressees of the regulation in the decision-making process. In addition to forecasting calculations, the mechanism includes procedures to monitor the actual impact of regulatory legal acts (RLA), a retrospective analysis of the actual effects of the RLA, mandatory public consultations and other forms of public discussion. Elements of this system in Russia are already actively used in government, legislative bodies and the business community. The system consists of 3 components:

1. Integrated assessment of regulatory impact at all stages of statemanagement cycle, from design acts, decisions, to retrospective clearing and simplifying existing legislation; including-usage requirements clear and accessible language of law-making;

2. Cooperation of the Executive, legislative and oversight bodies;

3. Enhance the participation of groups of interests of organizations and citizens, which uses IT- resources and technologies at increase of terms of public consultations to 12 weeks.

Review of scientific aspect of the development prospects of rare earth show that you can use nonlinear evolutionary partial differential equations. Exploring their decision points “singularity” in time, it should be noted that this evolutionary problem is characterized by the existence of unbounded solutions. This indicates its global insolubility in time. However, in the process of the evolution in time, close to the point of singularity (exacerbations), many of unbounded solutions are some common features that are the cause of the effect of localization solutions in the conditions of aggravation. Separate classes of quasilinear equations can have a finite set of positive solutions with very diverse spatial structure. For example, if we assume that the process of implementation of innovation technical and economic activities in rare-earth business occurs gradually by a mechanism similar to the diffusion, it is possible to take advantage of the known solutions of a quasilinear parabolic equation of the form

(3)

(3)

Where σ >0, β >1- fixed constant;

u = u (m, x) ≥ 0-gradient of funds invested in production;

m-designation of funds; x-direction of cash flow.

The analysis of the solutions of equation (3) has shown that using known mathematical methods of selection sustainable solutions at various stages of design, development and mastering of production processes of commercial products can reduce costs while achieving the strategic objectives of creation and development of national rareearth industry [13]. The management of each operating company can maintain its production and business activities, while finding and purchasing the raw materials, selling of produced and residual products, hiring and paying labour and carrying out financial transactions with the banking system, creating new production, diversifying its business. Using the known methods of the description of the life cycle of economic activity of industrial firms in a closed multi-sector model of the economy of market type, as well as lowering of the equation and the corresponding mathematical transformations, it should be noted that it is possible to assess the conditions that separates the initial data under which production system viable and when it crashes. This allows you to determine the range of the average productivity in business diversification on operating enterprises producing a wide range of commercial products and oriented to production of new types of hightech rare earth products. Thus, at major Russian companies, such as company LLC “Lovozersky GOK”, JSC “Solikamsk magnesium plant”, JSC “Chepetsky mechanical plant”, JSC “Apatit”, JSC “Akron”, CJSC “North-Western phosphorous company” is quite acceptable and it is advisable to create the holding of the unique specialized on production of rare earth products with complex processing of own and purchased raw materials and immobile man-made waste.

Financing of works on creation of the holding on the basis of constructive public-private partnership can be carried out on the basis of the following provisions:

• The government remains important functions of strategic management of industrial policy and control in the sphere of ensuring consumer product quality, and environmental security.

• Operational control can be transferred to joint-stock and private business structures.

• The failure of States to compensate for the losses of the enterprise during its production and economic activity and the withdrawal of the state from the ownership of the enterprise.

• Losses are to be covered by the excess profits of real consumers of a commodity output on the domestic market and profit from foreign trade operations in world regional markets (control over the fiscal authorities).

• Goal is to achieve optimal public effect.

References

- Investor presentation of Lynas Corporation ltd.

- Kingsnorth D (2012) Rare earth industry: A delicate balance act / Presentation of IMCOA&CurtinIniversity for Technology Metal Summit, Toronto.

- US Department of Energy (2011) Critical materials strategy / Report of US Department of Energy.

- Humphries M (2013) Rare Earth Elements: The Global Supply Chain, USA.

- Russian federation (2014) Rare Earth metals, Russia.

- Rosatom JSC (2011) Prospects of extraction, production and use of rare-earth metals. The 1-St all-Russia scientific-practical conference,141.

- Rosatom, JSC (2012) International conference on Rare earth elements: Geology, chemistry, production and application 169.

- Rare Earth Industry Assessment and Price Forecast from 19.04.2012 / Report of Asian Metal Ltd. for Tantalus Rare Earths AG.

- Investor Presentation. September, 2012 Brief Overview of Greenland Minerals&Energy Ltd.

- The review of the market of rare earth elements in the CIS.[8th Ed] supplemented and revised. / Report – Moscow.

- Hamphries M (2010) Rare earth elements: The global supply chain / CRS for Congress Report, USA.

- Chernyy SA, Bogdanov SV, Safronov IA (2014)Attractiveness of deposits of rare-earth metals on the basis of the expected rental income. Electrometallurgy1: 26-31.

- Bogdanov SV, Grishaev SI, and Yazev VA (2013) Diversification of the Rare-Earth Business in the Existing Enterprises. Russian Metallurgy 2013: 960–963.

Relevant Topics

- Additive Manufacturing

- Coal Mining

- Colloid Chemistry

- Composite Materials Fabrication

- Compressive Strength

- Extractive Metallurgy

- Fracture Toughness

- Geological Materials

- Hydrometallurgy

- Industrial Engineering

- Materials Chemistry

- Materials Processing and Manufacturing

- Metal Casting Technology

- Metallic Materials

- Metallurgical Engineering

- Metallurgy

- Mineral Processing

- Nanomaterial

- Resource Extraction

- Rock Mechanics

- Surface Mining

Recommended Journals

Article Tools

Article Usage

- Total views: 13377

- [From(publication date):

October-2014 - Dec 19, 2024] - Breakdown by view type

- HTML page views : 9001

- PDF downloads : 4376