Research Article Open Access

Professional Ethics as Instruments for Effective and Efficient Financial Management in the Nigerian Public Sectors: A Scientific Approach

Dr. Akabom Ita Asuquo*, Dr. Aniefiok Udoh AkpanDepartment of Accounting, Faculty of Management Sciences, University of Calabar, Nigeria

- *Corresponding Author:

- Dr. Akabom Ita Asuquo

Department of Accounting

Faculty of Management Sciences

University of Calabar, Nigeria

E-mail: drakabom3@gmail.com

Visit for more related articles at International Journal of Advance Innovations, Thoughts & Ideas

Abstract

Ethics are essential in discharging professional services to clients and society at large. In accounting practice, ethnics constitute the corner stones for reliable professional work. This study which adopted scientific approach was centred on the application of professional ethics towards proper financial management in the public sectors. Research instrument was developed and administered for relevant data. Data collected were analysed with appropriate statistical tools in order to test the authenticity of the research hypothesis. The analysis revealed that there is no significant relationship between professional ethics and effective/efficient financial management in the Cross River State Public Sector, used as case study. Further findings showed that a large difference exists between observed and expected acceptance of the significance of ethical standard in accounting practices in public sector. Consequently, it was concluded that ethical standards established by accounting professional bodies

in Nigeria and the Nigerian Accounting Standard Board are not instrumental in ensuring that funds are adequately managed in the public sectors. Therefore, the Nigerian public sectors which are the reporting jurisdiction should evaluate their financial system to make sure that ethical standards are put in place to ensure effective and efficient and or scientific management of their funds.

Keywords

Professional ethics, financial management, public sector, accounting standards, effectiveness and efficiency.

Introduction

Over the year, most public organizations in Nigeria have clearly demonstrated their deficiencies in the provision of timely and accurate financial information. The nature of work carried out by accountants and auditors requires a high level of ethics because many users of financial statements rely heavily on the yearly financial statements prepared by them to make informed financial decisions.

It is true that the responsibility for the success of an organization lies squarely on the operating managers. Managers on their part depend on the financial information provided by the accountants within and outside the organizations to successfully perform their primary functions. However, the rate of failure of government organization has often been linked to wrong policy decisions which often are caused by inaccurate financial statements. Deductively therefore, one can say that the use of professional ethics in accounting practices plays an invaluable role in effective and efficient financial management in the public sector organizations. Hence, the purposes of this study were to determine the relevance of professional ethics in the management of government funds, and to expose the value of effective professional ethics system to the operators of public organizations in Nigeria.

Research Question

The study adopted the following research questions which helped to uncovered hidden ideas about the research problem:

• Could there be an effective and efficient financial management through the application of professional ethics in the accounting practices?

• Is the financial statement prepared with full compliance to professional ethics in line with generally accepted accounting principles?

• Does the existence and effectiveness of professional ethics standards depend on internal factors such as organizational plans, policies and programs or external factors such as federal government policies and internal standard policies?

Conceptual Framework

What is ethically acceptable in one culture may not be ethically acceptable in another culture. Based on this postulation, the philosophical approaches to ethics are usually discussed from various viewpoints. This is sometimes referred to as different schools of thoughts and for each school of thoughts ethical theorists will be pointing to different bases for the formulation of ethics. These theories are discussed below:

Deontology Theory

This is theory of duty or obligation. Where ethical theories are formulated on deontological basis, an ethical requirement is justified because it is a good theory in itself. The ethical requirement is based on the “act” and whether it is right or not. An example of the application of this basis is the ethical requirement for professional integrity as this connotes a sense of duty or moral obligation to act truthfully or honestly.

Teleology Theory

This theory is concerned not with the act itself but rather with the consequences of the particular act. Hence it is sometimes referred to as “end-based ethics” or consequentialism.” Where ethical theories are formulated on teleological basis the ethical requirement on its own may neither be good nor bad in itself but the intended result of applying it is considered good. An example of the application of teleological basis on ethical requirement is when one considers the end as justifying the means.

Agency Theory

This theory deals with the people who own a business, and all others who have interest in it. The agency theory postulates that the day to day running of the business enterprise whether public or private is carried out by managers as agents who have been engaged by the owners of the business. Theory is on the notion of the principle of two sided transactions which holds that any financial transactions involve parties both acting in their own best interest but with different expectations (Kaliski, 2001).

Professional Ethics As Instrument For Proper Financial Management In The Public Sector

Professional ethics go a long way in ensuring that the funds entrusted to the government are properly utilized for the benefit of all the citizens. As a professional accountant striving for objectivity in all business and professional judgment, ethics give him the consideration relevant to the task towards the proper reporting on the financial statements. Every accountant should only accept the job that he can competently carry out with display of professional ethics and by so doing he will in the course of his work identify the loop holes in the system for proper corrective action to be taken. Application of professional ethics enables every accountant to be able to behave with integrity and eliminate all biased that would impair his judgment. When professional ethics are applied the financial management objective is made easier because the accountant follows the code as specified by the institute having in mind that anything contrary will pose serious problems to him.

Budget preparation which is a core financial activity in the operations of the public sector organizations will be adequately financed if the ethical standards are applied during its preparation and this would go further to reveal areas of waste and by so doing the deficit or surplus of any budget would be reduced to the barest minimum. Ethics enable the government to analyze performance indicators as seen in the establishment unit cost with comparative figures from the previous period. The use of trend analysis will be applied which is aimed at identifying the area that need specific attention towards investing, financing and di-investing decisions to ensure the proper management of funds (ICAN, 2009; Smith, 2002; and Scott, 1998).

Effects of Unethical Practices

The effects of unethical practices are reflected not only on the individual but also on his profession, his professional body and indeed the society at large. It has a multiplier effect.

In recent times the world has witnessed the failure of large organizations, the case of the collapse of ENRON is an example of winding up due to unethical practices by an audit firm which was headed by Arthur Anderson in the United States of America. However, each time a professional accountant is fund gently of misconduct, any kind of sanction meted out to him has ripple effects on his immediate family business, government the economy, etc. A misconduct of a professional that affects the going concern status of his firm affects the various stakeholders in that firm. The economy also suffers from this type of scenario, the loss of income to government either on the employees’ personal income tax or partners’ income tax. Any or the entire above situation will have adverse effect on the particular profession of the affected individuals.

Professional Ethics Compliance in Achieving the Financial Management Objectives

A country as a reporting entity may set for itself high ethical standards. Such standards are expected to cover the local needs of the entities within the country. The present reality is that countries are connected so closely in an increasingly global economy. The best standard and process are therefore collaboration efforts that take into consideration worldwide international needs and requirements. Changes aimed at improving the credibility of financial reporting did not start after the collapse of ENRON, there have been on-going efforts which are intensive in nature in a number of developed countries to review and address issues such as corporate governance, accounting standard, etc. in order to create a harmonization in the financial reporting requirement across the whole country. In view of the determination of federal government of Nigeria to eradicate corruption and misappropriation of funds in public sectors, the corrupt practices and other related offence Act 2000 (ICPC) was enacted and the independent corrupt practice and other related offences commission was established. In 2003 the federal government established another anti-corruption agency, the Economic and Financial Crimes Commission followed by the enactment of the EFCC Act in 2004. within the current development at hand, all states will not only implemented the sue of professional ethics in their operations but they will also see to it that such are instrumental towards effective and efficient management of the funds entrusted in their care, Mbat (2001), Cola (2004) and Nwachukwu (2002).

Public Sector Financial Management

Public sector financial management is a vast field of endeavour which encompasses the whole process of formulating and implementing decisions made on government service, expenditure, takes public debt and other revenues for the Federal, State or Local Government, (Mbat, 2001). Public sector financial management is vital in the government than other matters since money (fund) is the hub of the wheel of every government activity. Behind the formulation and execution of financial decisions lie many questions ranging from what fiscal measures are to be put in place to ensure high standard of living, satisfactory income distribution, resource allocation and public accountability. Government finance is bound to have remarkable influence on the activities of both the money and real economic sectors (Mbat, 2001). For instance, investment activities of government are bound to create employment opportunities, make good services available to the citizens and lead to the development of sub-sectors which have linkages with such specific investment activities (Abianga, 2001).

Quality Control and Peer Reviews of Professional Ethics And Conduct

Cole (1986) defines “quality control as a system for setting quality standards and taking appropriate action to deal deviations outside permitted tolerances.” This therefore means that the role of quality control is to make sure that standards of quality are set so that adverse deviations may be spotlighted for corrective measures. The quality control requirements are clearly spelt out in the code of conduct of ethics for professional accountant released by the International Federation of Accountants (IFAC) and rules of professional conduct for members issued by the Institute of Chartered Accountant of Nigeria.

Peer review on the other hand is dedicated to enhancing the quality of auditing, accounting and attestation services. These peer review activities are handled by the professional practice monitoring committee on behalf of ICAN. Peer review activities issue out reports which provide insight into the individual firms implementation of the quality standards set in the course of auditing, accounting and attestation services contracted and executed. Peer review activities increase the efficiency and effectiveness of firm in public service and boost the level of trust in the profession.

Research Methodology

The study adopted the survey research method. A structured questionnaire made up of twenty relevant questions was developed and administered to selected public sector establishments in Cross River State. The responses received were analysed using appropriate statistical tools. In order to ensure the reliability and validity of the data instrument, a pre-test was carried out of which questionnaires were administered to a small number of the sampled population and the responses were carefully studied criticized and modified before the final questionnaires meant for the study were sent out.

Results

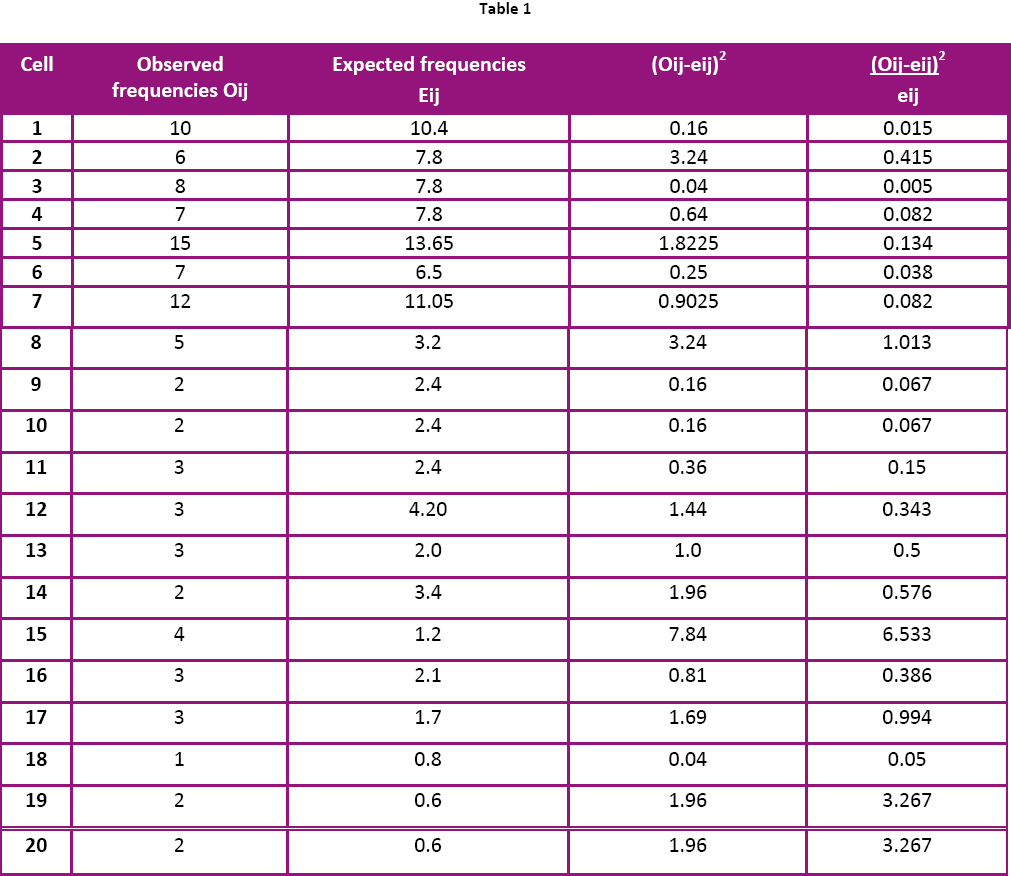

A test was carried out to determine whether there is no significant relationship between the use of professional ethics and proper financial management of government funds, thus:

Then using one tailed test at 5% significant level, the critical value with 18 degrees of freedom (i.e. X2 tabulated) is 28.869, showing that the calculated X2 is less than the critical value, hence we accept the null hypothesis and concluded that there is no significant relationship between the use of professional ethics and proper financial management of government funds.

Discussion

Most of the respondents in this study were not too familiar with the concept of professional ethics in the public sector governance. They claimed that the management of government establishments in Cross River State are not involved in setting policies concerning the use of professional ethics in government organizations hence lack of compliance. The above claims confirmed the result of our test which showed that there is no significant relationship between the use of professional ethics and proper management of government funds. Further findings revealed that proper financial management in government establishments in Cross River State depends largely on internal factors such as policies, rules and regulations, and internal control systems.

Conclusions

It could be concluded from the findings of the study that laws are general rules which are made to guide human activities whereas ethics are specific rules to specific groups for purpose of carrying out their specialized functions. Professionals in various fields of human endeavour develop ethics and code of conduct to emphasize their significance in dealing with their clients and society at large. Thus, the ethical standards established by accounting professional bodies in Nigeria and the Nigerian Accounting Standard Board are not instrumental in ensuring that funds are adequately managed in the public sectors.

Recommendations

In consideration of the research findings, the following recommendations were made:

• The management of public organizations in Cross River State should be actively involved in the planning and implementation process of laws regarding professional ethics in public sectors.

• More individuals with professional qualifications should be duly employed in Cross River State Public Sectors.

• The organization structures policies and plans should be made such that they would provide enabling environment for successful application of professional ethics systems.

• The acquisition and utilization of resources by government should be handled on trust for citizens, respecting their yearnings and aspirations.

References

- Ahakiri, F. D. (2010). Corporate Governance and Organizational Compliance; Unpublished Research Work, pp. 24 – 40.

- Abianga, E.U. (2008). Course Development Public Financial Management National Open University of Nigeria – Unpublished Lecture Notes, pp. 3-10.

- Adams, R A. (2006). Public Sector Accounting and Finance made Simple (5th ed) Lagos. Corporate Publishers Ventures, pp. 240-250.

- Cola, G.A. (2004). Management Theory and Practice, 6th ed. London, Book Power, pp. 205 – 300.

- Effa, L. R. (2010). Assessment of Compliance to Professional ethics in discharging of duties by Professional. Unpublished Research Work pp. 20-22.

- Government of Cross River State: The Economic Blue Print (2007-2011) Cross River: Economic Management Team, pp. 15-20.

- ICAN: Code of Professional Ethnics; Lagos: V/I Publishers.

- ICAN Study Pack (2009). Advanced Audit and Assurance: Lagos: V/I Publishers.

- ICAN Study Pack (2009).

- Public Sector Accounting and Finance (2nd ed). Lagos: V/I Publishers.

- Kaliski, B. (2001). Social Responsibility and Organizational Ethics, New York, Macmillan Reference, pp. 140-150.

- Nwachuku, C. C. (2002). Comparative Management and Introduction, Owerri, Springfield Publishers, pp. 112 – 115.

- Scott, K. (1998). “The role of corporate governance in South Korean economic reforms; Journal of Applied Corporate Finance, vol. 10 No. 4, pp. 8-15.

- Smith, D. (2002). “Challenges in Corporate governance.” www.camagazine com.

Relevant Topics

- Advance Techniques in cancer treatments

- Advanced Techniques in Rehabilitation

- Artificial Intelligence

- Blockchain Technology

- Diabetes care

- Digital Transformation

- Innovations & Tends in Pharma

- Innovations in Diagnosis & Treatment

- Innovations in Immunology

- Innovations in Neuroscience

- Innovations in ophthalmology

- Life Science and Brain research

- Machine Learning

- New inventions & Patents

- Quantum Computing

Recommended Journals

Article Tools

Article Usage

- Total views: 15346

- [From(publication date):

November-2012 - Apr 02, 2025] - Breakdown by view type

- HTML page views : 10618

- PDF downloads : 4728