Short Communication Open Access

Potential and Challenges for Start-Ups in Japans Biotech Industry

Takao Fujiwara*Institute of Liberal Arts and Sciences, Toyohashi University of Technology, Japan

- Corresponding Author:

- Takao Fujiwara

Institute of Liberal Arts and Sciences, Toyohashi University of Technology

1-1 Hibarigaoka, Tenpaku, Toyohashi, Aichi 441-8580, Japan

Tel: 81-532-44-6946

E-mail: fujiwara@las.tut.ac.jp

Received date: September 22, 2015; Accepted date: October 12, 2015; Published date: October 19, 2015

Citation: Fujiwara T (2015) Potential and Challenges for Start-Ups in Japan’s Biotech Industry. J Biotechnol Biomater 5:204. doi:10.4172/2155-952X.1000204

Copyright: © 2015 Fujiwara T. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Visit for more related articles at Journal of Biotechnology & Biomaterials

Abstract

Although Japan has both a globally rare national M&Ated healthcare program and one of the most extensive life science research capabilities in the world, there is a risk of their divergence due to Japan’s aging citizenry and the domestic pharmaceutical industry. In order to bridge the gap between the research findings and the healthcare welfare with innovative new drugs under a prolonged drug development period and the diminishing grace period before generic drug introduction, we will examine the potential of risk management methods in biotech start-ups from real options, game theory, and start-up ecosystems perspectives. One of the reasons of this article’s focus on the biotech start-ups reflects the trend of the government 2015 policy as ‘Comprehensive reform of social security and tax’ for global drug discovery and start-up founding and the government policy and the economy trend.

Keywords

Biotech start-ups; Real options; Game theory; Bayesian method

Introduction

Almost every Japanese citizen is able to access medical treatment through the national M&Ated healthcare program, and life sciences research in Japan is also internationally renown. However, the national government is planning to raise the rate of generic drug use to 80% (similar to usage rates in the USA) within next 3 years in order to achieve greatest balance between government bonds and Japan’s aging population. On the other hand, the expenditures on imported medical and drug patents are very high since there are few pharmaceutical mega-firms (aside from Takeda Pharmaceutical, etc.) in Japan. Thus, a risk of divergence exists between the nation’s high standard of life science research and the sustainability of the present level of healthcare welfare available to taxpayers.

In such a situation, what is the most accurate risk management method for bridging life science research findings and the production of innovative new drugs under a prolonged drug development period and diminished grace period preceding generic drug introduction? More specifically, how can biotech start-ups-which are superior in terms of cost, speed, and risk control at combining innovative technology and niche markets with large market-oriented big pharmaceutical firmssurvive under resource limitations? And what ought to constitute the fluid biotech start-up ecosystem when many investors have exit plans such as partnerships or merger and acquisition (M&A) rather than supporting initial public offerings (IPOs), which renders it almost impossible for biotech start-ups to independently develop a drug before its point of market introduction?

Among previous research efforts, there are cornerstone studies [1,2] indicating the strong relationship between basic research and the biotech industry and the ‘valley of death’ tendency toward an initial period of negative profit. However, while they did not offer solutions for this ‘valley of death’, theories such as industrial clustering [3], open innovation [4], and open science [5] respectively suggest that it is possible to overcome the ‘valley of death’ by shifting from the Prisoner’s Dilemma to Pareto Optimization through resource-sharing during the commercialization process of scientific research. Nevertheless, they are still not focusing on the start-up’s trigger function of microscopic change as a means for enacting macroscopic change of the entire pharmaceutical industry. And although one study focuses on the role start-ups in the development potential of Japan’s biotech industry [6], its content is consistent within broader qualitative analysis regarding culture and government policy

As a main concept in this article, a biotech start-up is defined as a portfolio of real options constituting an investment opportunity in the life sciences. As the perspective or methodology for addressing the above research questions, this article applies option-games by integrating real options and game theory.

The first original objective of this article is to examine the potential of risk management methods regarding start-ups as a call option for keeping drug development value and for overcoming the deepening ‘valley of death’ resultant of generic drug introduction. The second objective is to consider the effectiveness of the application of option-games by integrating real options and game theory for optimizing the trade-off between flexibility and commitment, which addresses irreversible development investments under uncertainty for constructing biopharmaceutical open innovation created by start-ups. And thirdly, we shall discuss the implications of the Bayesian method for identifying Nash equilibrium in the information asymmetric game, with regard to whether the majority of biotech start-ups should repeat founding cycles within their ecosystem— including failure, partnership, Initial Public Offering (IPO), or M&A between university research and pharmaceutical manufacturing. One of the reasons of this article’s focus on the biotech start-ups reflects the trend of the government 2015 policy as ‘Comprehensive reform of social security and tax’ for global drug discovery and start-up founding and the government policy and the economy trend.

Biotech Start-up as Call Option in Drug Development Value Chain

Japan’s level of prestige in life science research is very high-comparable to the USA and Europe. And as Japan operates a national M&Ated healthcare program, nearly all citizens can access medial treatment; and the average level of medical welfare is also the highest in the world.

However, in the middle of the drug development value-chain that connects these superior ‘seeds and needs’, the domestic system for developing a breakthrough biotech drugs in Japan fails to address both the deepening of the ‘valley of death’ due to the decline in development productivity and intensified competition with generic drugs following market introduction. With the exception of a few domestic companies, Japan has not yet seen great bio-pharmaceutical achievement. Thus, more accurate risk management is necessary within the pharmaceutical development value-chain.

Since the technology transfer divergence has progressed between research in universities and pharmaceutical manufacturing and sales, the biotech start-ups’ excellence (in terms of speed, cost, and risk management) in combining the innovative technological ideas and niche market justify the expectation of their prominence in the commercialization of research findings. However, drug discovery biotech start-ups are especially necessary for withstanding the ‘valley of death’ long-term deficit period in the face of resource constraints.

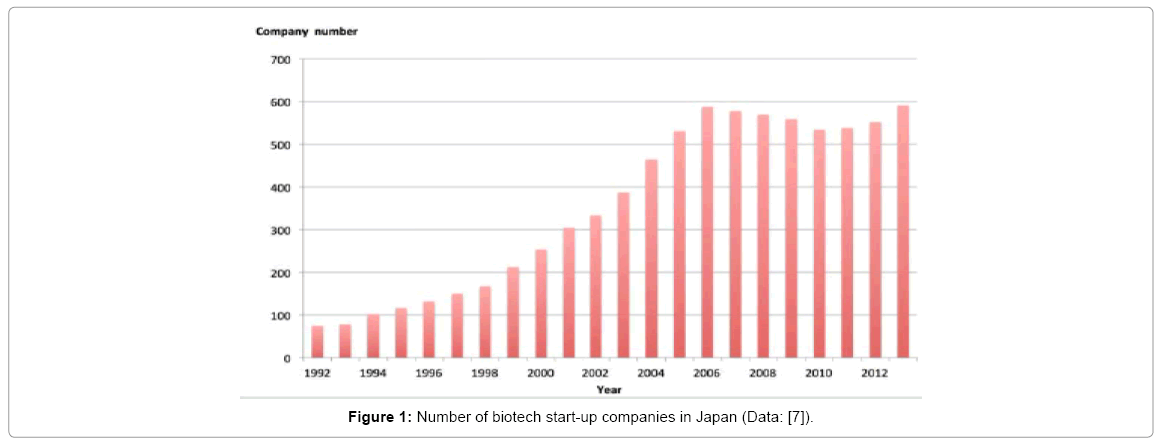

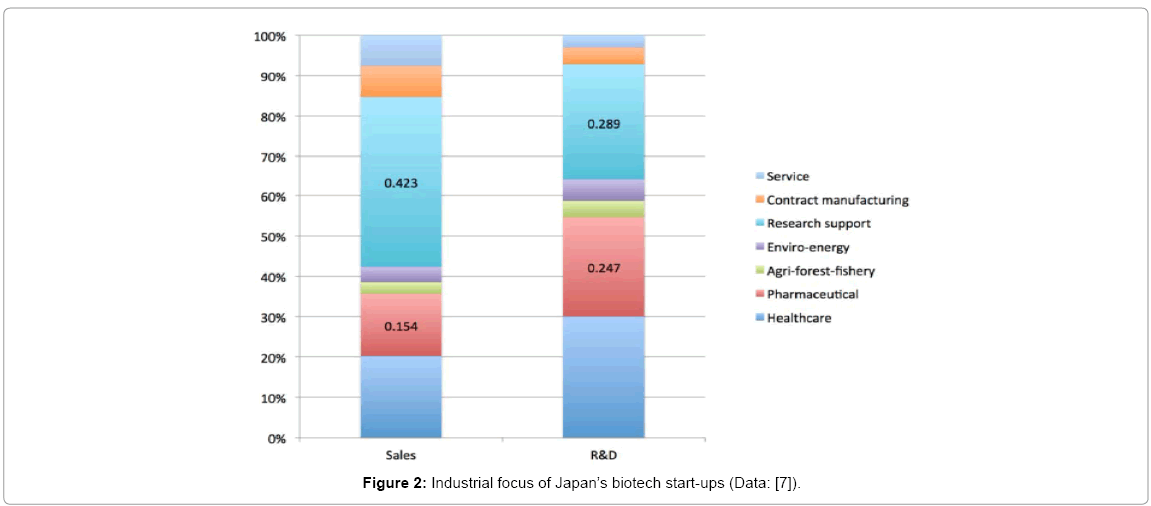

Japan’s biotech start-ups (total company number of 591) have the following averaged characteristics: a capital of 445.8 million Japanese Yen (JYN), 16.1 employees, an operating income of -47.6 million JYN, research and development (R&D) expenses of 80.9 million JYN, and sales of 668.0 million JYN in 2013 [7]. The change in the company number reflects a recovery from the collapse of Lehman Brothers in 2011, seen in Figure 1. Their industrial focus is very narrowly ‘pharmaceutical’ in R&D but is at ‘research support’ in sales due to the influence of the ‘valley of death,’ as in Figure 2.

As most of Japan’s drug discovery biotech start-ups have negative profits, like the in the USA, it is necessary to make investment timing decisions for operational continuity against development risk by keeping the fluctuations of the future underlying asset in mind, in addition to the potential of partnership and investment exit strategies such as IPO market and M&A. The risk-hedging function is understandable, if assuming the role of a start-up as a sequential compound option for additional investment according to the outcome at each end point for the high-risk development projects. However, option value for the domestic biotech start-ups has been quite limited, from the following state as the downturn in the IPO market and the out-of-range of international M&A or alliance have continued except some active companies.

Thus, the role of the biotech start-up, even facing a long-term and deep ‘valley of death’, can be expected to push the rapid translational research aimed at the commercialized promotion of research results by converting a negative Net Present Value (NPV) to a positive Expanded Net Present Value (ENPV) against the background of the technical possibility expected by investors, if enough efforts are made to ensure that the growth option value of biotech start-up can be fairly evaluated based on the investment recovery plans (such as Investment Exit, etc.).

Alliance Potential as Pareto Optimization in Open Innovation

It was determined in the previous section that a biotech start-up may overcome the ‘valley of death’ through option valuation, since it has a call option function which leads to an asymmetric revenue with respect to the technology transfer investment at success and the risk avoidance of additional investment at failure, functioning as a linking pin in the pharmaceutical development value-chain.

In terms of opportunities for additional investment in technology transfer, which corresponds to the call option exercise, IPOs and M&A constitute representative investment exit strategies. Although the actual number of IPOs is low in comparison with the USA, the downturn in the value of the publicly traded companies has continued, reflecting the grace period trends of the market introduction of pharmaceutical products after the IPOs. Additionally, with regard to the sale of itself to major companies, the M&A of domestic biotech start-ups is not particularly active, with the exception of a few examples among domestic companies, compared to the acquisition of overseas biotech start-ups by large domestic pharmaceutical companies. As M&A is the only alternative to seeking IPO support other than liquidation, the idea of promoting the technology transfer or its commercialization through the sale of domestic biotech start-up itself in the M&A is not a mainstream management philosophy in Japan. Such patience has, in a sense, caused the preservation of its inefficient state as a method of investment decision-making concerning management resources. According to a common philosophy of start-up entrepreneurs, start-up foundation is easy, but the survival of the start-up presents difficulties. However, start-up founders should seek total optimization of the effective use of input resources by selling their companies in order to transfer their own ideas to other managers and companies with superior aptitude, rather than maintaining the present dependence upon success at each stage of the unstable growth process, even if there is a fondness for struggling through the difficulties of foundation. Domestic pharmaceutical companies, as shown in Table 1, are attempting to follow the market shift from the chemical synthesis drugs to biopharmaceuticals, generic drugs, and globalization through major M&As to acquire businesses— such as overseas biotech, pharmaceutical, and generic companies. Additionally, there are also some start-ups, as illustrated by Table 2, which singed contracts of out-licensing or cooperative development with large overseas pharmaceutical companies.

| Pharmaceutical firm | Acquired biotech or pharmaceutical firm | Year | Financial amount |

| Takeda Pharmaceutical | Millennium Pharmaceuticals | 2008 | 880 billion JYN |

| Nycomed International Management | 2011 | 1100 billion JYN | |

| Eisai | MGI Pharma | 2008 | 410 billion JYN |

| AstellasPharma | OSI Pharmaceuticals | 2010 | 370 billion JYN |

| Daiichi Sankyo | Ranbaxy Laboratories | 2008 | 480 billion JYN |

| Plexxikon | 2011 | 66 billion JYN | |

| Shionogi | ScielePharma | 2008 | 150 billion JYN |

| Sumitomo Dainippon Pharma | Sepracor | 2009 | 250 billion JYN |

Table 1: Selected examples of Japan’s pharmaceutical firms’ M&As (Data: selected from [8]).

| Japan’s biotech start-up | Foreign partner of pharmaceutical firm etc. |

| PeptiDream | Novartis, GlaxoSmithKline, AstraZeneca, Bristol-Myers Squibb, Amgen, Ipsen, Eli Lilly, Merck, Sanofi, |

| ID Pharma | International AIDS Vaccine Initiative, Beijing Pharmaceutical Group |

| Chiome Bioscience | Five Prime Therapeutics, Glaxo Group, Biotecnol |

| Precision System Science (medical device) | F. Hoffmann-La Roche, Boehringer Mannheim, GenoVision, Magnetic Biosolution Sweden |

Table 2: Selected examples of international alliance (Data: [9-12]).

Considering the long period of drug development and the ‘valley of death’, a daily income is necessary to overcome periods of negative profits through the out-licensing and cooperative development of a start-up’s own projects, to be implemented before the investment exit strategies such as IPO and M&A. For the valuation of intellectual property in licensing or co-development at partnerships, the real options method is expected to apply from the feature of intellectual property as a call option, instead of the market value assessment with similar technology or the cost mark-up method.

As the exclusivity of intellectual property is limited by technical detour patents and patent litigation, for example, there is a need to consider the Pareto optimal partnerships over prisoner's dilemma, even with the competitive players. In a strategic alliance under such uncertainty, it is necessary to optimize the NPV from each other's synergies through game theory, in addition to the real options method. In particular, it is necessary to optimize the trade-off between the flexibility value of real options under uncertainty and the commitment value relating to competition or alliance. That is to say, in terms of the start-up-mediated open innovation that connects both ends of the basic research and pharmaceutical large companies, the methodology of option-games that integrates real options and game theory is successful. Thus, in order to solve the dilemma of choosing between warning against such high-risk development project and promoting the alliance rather than the competition, the start-up ecosystem is a realm where people can share subjective information that is difficult to transfer-in addition to making the objective information more useful.

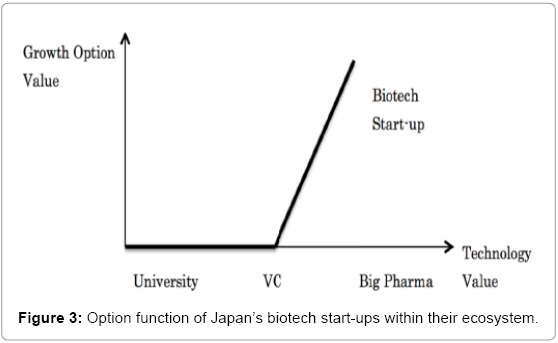

Technology Valuation and Bayesian Method for Smooth Re-Founding in a Start-Up Ecosystem

Biotech clusters in Japan, Kanto (Tokyo area), Kansai (Kyoto Area), and Hokkaido (Northern island) are attracting attention, as well as those in the Bay Area, Boston, and La Jolla in the USA, or Cambridge and Heidelberg in Europe. Biotech clusters should be considered as biotech start-up ecosystems, rather than mere R and D-type industrial accumulations. In other words, drug discovery biotech start-ups have not only generally negative-profit financial conditions (a long period of the ‘valley of death’), but also a high bankruptcy rate; M&A is regarded as major investment exit, especially in the USA. Therefore, with the exception of some highly successful biotech start-ups, the field of regional resources circulation necessitates a re-founding through a bankruptcy or M&A from its inception. In terms of a thriving metabolism of industry, the Bay Area is preferable to Chicago, without any great difference in infrastructure such as universities and financial institutions; it is believed that the Bay Area and Boston were able to build the autonomous mechanism allowing the momentum of sustained growth of the virtuous cycle to be maintained—in particular, the steps of founding and refounding. Additionally, for a virtuous cycle that will lead to sustained growth within the biotech’s start-up ecosystem, the risk-hedging function becomes key through its consideration of the options for startups, as shown in Figure 3. That is to say, biotech start-ups can survive even the ‘valley of death’ if they practice asymmetric risk management, cooperating, out-licensing, or selling the patents or companies to big pharmaceutical firms if they succeeded in VC-funded projects based on university technology, and halting development otherwise. In rare cases, a few start-ups independently grow into large companies.

In Japan, with the exception of a few radical companies, there is a tendency of the founders to maintain managerial initiative with a strong patience following a company’s inception. The notion that technology transfer through selling a start-up to a large company leads to resource efficiency of the entire system is not so popular. Rather, if the development complexity is unruly, there is a tendency to attempt to continue the start-up founder’s initiative even by lowering the scale of and reducing challenges to the company or project. By recognizing the limits of their own abilities, it may be necessary to accept the paradigm shift dictating that a company’s selling in high value is a success from their capability boundary.

Decision-making under information asymmetry is mainly necessary due to company-scale difference in such an alliance or in M&A. Information searches leading to the Pareto optimal strategy equilibrium seem to be effective according to the Bayesian approach, the real options, and the game theory (Figure 4 and 5). More precise valuation of biotech start-ups can lead to sustainable growth of Japan’s biotech start-up ecosystem through the application of Real Options, Game Theory, and Bayesian analysis.

Conclusion

Japan has an over-concentrated manufacturing industry that depends only upon Aichi Prefecture’s automotive industry. The development of the biotechnology industry as one of the candidates for the next generation to Aichi’s automotive industry has been advocated over the past few decades through the cooperation of government, universities, industry, and financial institutions in order to correct this vulnerable condition of Japan’s economy. However, the sustainable growth type of biotech industry, such as the Bay Area, or Boston, has not yet materialized in Japan.

In order to build the development value-chain of innovative drugs by connecting both ends as the university research and the pharmaceutical company manufacturing; while both constraints grow (the deepening ‘valley of death’ from the development difficulty and the generic drug diffusion for medical cost saving), it is necessary to accumulate knowledge and experience regarding highly accurate risk management concerning cooperation between various levels of business decision-makers under unstable conditions, in addition to the macroeconomic system design. It is necessary to build an idea-sharing network for optimal local or global technology transfer-not only to make money, but also to save lives by regarding these management techniques as a benchmark. Thus the management methods discussed above are expected to contribute to present Japan’s trade-off between healthcare burden and economic recovery.

References

- Kenney M (1988) Biotechnology: The University Industrial Complex.Yale University Press, New Haven: CT.

- Pisano GP (2006) Science Business: The Promise, the Reality, and the Future of Biotech.Harvard Business School Press, Boston: MA.

- Porter ME (2000) Location, Competition, and Economic Development: Local Clusters in a Global Economy.Economic Development Quarterly 14: 15-34.

- Chesbrough H (2003) Open Innovation: The New Imperative for Creating Profiting from Technology.Harvard Business School Press, Boston: MA.

- Nielsen M (2011) Reinventing Discovery: The New Era of Networked Science. Princeton University Press, Princeton, NJ.

- Müller C, Fujiwara T (2002) The Commercialization of Biotechnology in Japan. DDT 7: 699-704.

- Japan Bio-industry Association (2014) 2014 Statistical report of Japan’s biotech start-ups.

- Development Bank of Japan (2012) Report on Pharmaceutical Industry and Biotech Start-up (in Japanese).

- PeptiDream (access date: Sep 1, 2015).

- ID Pharma (access date: Sep 1, 2015).

- Chiome Bioscience (access date: Sep 1, 2015).

- Precision System Science (access date: Sep 1, 2015).

Relevant Topics

- Agricultural biotechnology

- Animal biotechnology

- Applied Biotechnology

- Biocatalysis

- Biofabrication

- Biomaterial implants

- Biomaterial-Based Drug Delivery Systems

- Bioprinting of Tissue Constructs

- Biotechnology applications

- Cardiovascular biomaterials

- CRISPR-Cas9 in Biotechnology

- Nano biotechnology

- Smart Biomaterials

- White/industrial biotechnology

Recommended Journals

Article Tools

Article Usage

- Total views: 16042

- [From(publication date):

December-2015 - Mar 31, 2025] - Breakdown by view type

- HTML page views : 15151

- PDF downloads : 891