Research Article Open Access

Exploring the Adoption of Building Information Modeling (BIM) in the Jordanian Construction Industry

Rana T Matarneh1* and Sadeq A Hamed21Architecture Engineering Department, Faculty of Architecture & Design, Al-Ahliyya Amman University, 19328 Amman, Jordan

2Electrical Engineering Department, Faculty of Engineering, Al-Ahliyya Amman University, 19328 Amman, Jordan

- *Corresponding Author:

- Matarneh RT

Architecture Engineering Department

Faculty of Architecture and Design

Al-Ahliyya Amman University

19328 Amman, Jordan

Tel: 0096253500211-17

E-mail: r.almatarneh@ammanu.edu.jo

Received Date: March 10, 2017; Accepted Date: March 15, 2017; Published Date: March 21, 2017

Citation: Matarneh RT, Hamed SA (2017) Exploring the Adoption of Building Information Modeling (BIM) in the Jordanian Construction Industry. J Archit Eng Tech 6: 189. doi: 10.4172/2168-9717.1000189

Copyright: © 2017 Matarneh RT, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Visit for more related articles at Journal of Architectural Engineering Technology

Abstract

In the last decade, construction industry has witnessed a huge transformation in term of the use of digital technologies, and particularly Building Information Modelling (BIM). BIM is a revolutionary digital technology and process that is reshaping the Architecture, Engineering and Construction (AEC) industry. Though, internationally, BIM has gained a great reputation for boosting productivity in AEC industry, but it holds undeveloped possibilities for providing and supporting AEC industry in Jordan. This study aims at assessing adoption of BIM within the construction industry in Jordan. To achieve this objective, the research commenced by carrying out an intensive literature reviews on the implementation of BIM world-wide, which was utilised to identify the benefits, and challenges of BIM in construction industry. An exploratory study was then conducted using an on-line survey to identify the current level of BIM experience, and to define the perceived value, benefits and challenges facing BIM implementation. Findings reveal that the adoption and implementation of BIM in Jordan is still in a very primitive phase and it faces number of critical barriers such as, but not restricted to, the absence of government incentives, the lack of BIM standards, lack of BIM awareness, lack of BIM training, cost and resistance to change. It concludes recommendations for how the industry shall adopt BIM and integrate it within construction industry's all processes. Highlighting the synergy between the two, this paper can help AEC practitioners in Jordan recognize potential areas in which BIM can be useful in AEC practise.

Keywords

BIM; Construction industry; Jordan

Introduction

Although the construction industry is considered one of the biggest industries worldwide [1]; but it is still lagging behind other industries in terms productivity, efficiency, quality and sustainability. For industries other than construction, improved productivity could be attributed to advances in and increased usage of information technologies, increased competition due to globalization, and changes in workplace practices and organizational structures.

Since the traditional industry model has no significant changes accompany the introduction of new digital tools and technologies; therefore, it still exhibits a low maturity in the use of IT that has negative reflection on its productivity level. Many studies [2,3] were conducted to address this gap between building industry and IT, one of the most important studies was conducted in 2004 by the National Research Council (NRC) that focused on providing strategy for advancing the competitiveness, efficiency and productivity of the U.S. construction industry. Findings of this study identified that interoperable technology application, also called Building Information Modelling (BIM) is not just the key solution, but also the most promising in terms of improving the quality, timeliness, cost-effectiveness and sustainability of construction projects.

BIM is an improved process and a tool that involves applying and maintaining an integrated digital representation of different information across various phases of a building construction project [1,3-6]. This technology, covering the entire life cycle of the building, can create, coordinate, document, manage and update information about a particular facility as well as its components. This collaborative and integrated process, based on a powerful data modelling capability, is a major change in the process of transforming the construction industry worldwide [7]. Accordingly, the implementation of BIM supports the concept of Integrated Project Delivery (IPD) which is a novel project delivery approach to integrate people, systems, business structures and practices into a collaborative process to reduce waste (of time, sources, money) and optimize efficiency through all phases of the project life cycle [8].

Many governments have set implementations strategies for the use of BIM on construction projects that has resulted in the wide spread of the adoption of BIM for instance, the UK [9], USA [10] and Australia [11].

Although, BIM has been on the global construction industry market for a number of years, BIM related technologies are just emerging in Jordan. Yet, there is no study that investigated the current situation of BIM adoption within the construction industry in Jordan. This study investigates the current Jordanian construction industry practices and uses of BIM:

• Assess the level of BIM adoption;

• Identify the benefits and challenges of BIM adoption; and

It is expected that this study is necessary to help practitioners in the construction industry to understand the value of BIM for their organizations and projects.

BIM Global Adoption

BIM usage is accelerating powerfully, for instance, looking at the statistics from 2007 to 2015), it can be seen that major private and government owners were driven to institutionalize its benefit faster, more certain delivery, and more reliable quality and cost. It can be seen that many countries have realised the potentials of such technological and procedural evolution within the construction industry [12]. According to Lee et al. [13], BIM technologies were mandated by US, UK government entities to empower design and construction and to meet and exceed enlightened owners targets. In US, since 2006, the general services administration (GSA) has included spatial programme BIMs as part of the minimum requirements for submissions to the Office of Chief Architect for final concept approvals. Thus, the country has become a mature BIM market and led BIM best practice. Resulting BIM adoption in North America rise steeply from 28% to 71% between 2007 and 2012, and the UK and other regions are poised for similar dramatic expansions. Adoption by contractors (74%) recently exceeded architects (70%) in North America. UK aims to become the BIM leader in Europe (McGraw Hill, 2014).

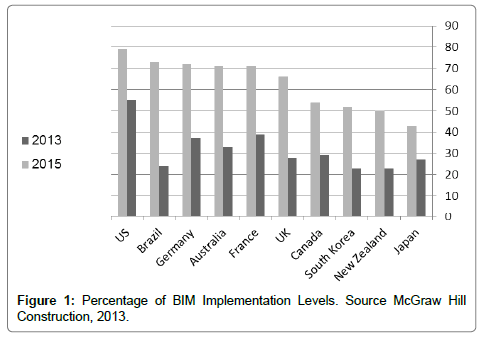

From 2016 onwards, the government of UK mandated the use of BIM in public sector projects; as the country aims to become the BIM leader in Europe. Although BIM is rapidly expanding around the globe, there is significant difference between construction companies' experience with the business benefits from BIM in various regions. Further research in many European countries such as Germany, France, Brazil, Austria, Finland, Denmark, Norway and Sweden revealed that BIM is gaining wide industry awareness and adoption. A little over one third of the industry in Western Europe (36%) has adopted BIM. BIM is becoming established with contractors in other regions such as Japan, South Korea and Austria/New Zealand represent the next tier of maturity, with a tree to five experience tier. This shows how rapidly BIM is advancing (Figure 1). For example, South Korea contractors show a 65% BIM adoption rate in 2012.

In south Asia, for instance, Singapore has been promoting BIM since 1997 [14]. In 2011 the country issued its nationwide BIM implementation roadmap so that BIM started to be used for various aspects in construction such as building plan approvals and fire safety certifications and as part of the public sector building project procurement process. From 2015 onwards, the government mandated the use of BIM in public sector projects for new building projects over 5,000 m2. In China, the government sat a five year plan (2011-2015) to formulate a BIM framework. In Hong Kong, BIM implementation is moving rapidly [15]. This is because clients have started to realise various BIM benefits such as the ability to generate various design solutions and to check designs integration and to eliminate errors that would create changes and to maximize productivity. BIM implementation in Africa varies from country to another; for example, meanwhile the level of BIM awareness is high in Nigeria, it is facing huge challenges in South Africa, such as contractual issues, personnel inadequacies in terms of education, training, and skills development; population growth, etc. [16,17]. Looking at the current global status of BIM, it can be argued that BIM adoption and implementation varies from developed to developing countries and this is due to the lack of clear practical mechanism, frameworks or strategies to adopt it. Some countries have set up agencies to manage nationwide implementation and introduce best practices and standards [1,3,18-20]. In Middle East region, the use of BIM is still not mandatory. Yet, Dubai was the first public authority in the Middle East to mandate the use of BIM for most large-scale projects in the Emirate [21].

Research Methodology and Strategy

This study aims at investigating the current situation of BIM within the construction industry in Jordan. To achieve this objective, the research commenced by carrying out an intensive literature reviews on the implementation of BIM world-wide. The literature is utilised to identify the benefits, and challenges of BIM in construction industry. An exploratory study was then conducted using a structured, on-line survey that was designed based on the literature review to identify the current level of BIM experience, and to define the perceived value, benefits and challenges facing BIM implementation. The questionnaire was designed to be simple and direct yet specific to capture the current state of practice in Jordan as to the use and implementation of BIM (see Annex A).

Results and Analysis

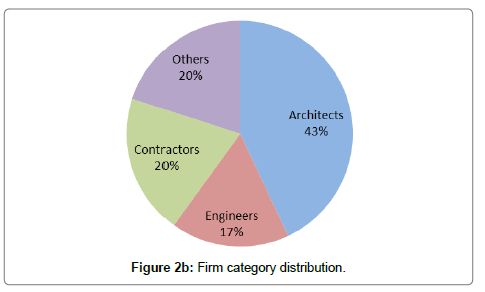

This survey was conducted through an internet survey of industry professionals between November 27, 2016 to January 21, 2017. The survey had 180 complete responses (Table 1). The “total” category displayed throughout the study includes 77 architects (43%), 31 engineers (17%), 36 contractors (20%) and 36 other industry respondents (20%) including owners, planners, building product manufacturers, government agencies, various integrated firms and consultants.

| Number of distributed questionnaire | 300 |

| Number of respondents | 215 |

| Number of valid questionnaire | 180 |

| Response rate | 83.7% |

| Time taken to collect data | 53 days |

Table 1: Questionnaire statistics.

Respondents’ profiles

The sample for this study consists of architects, civil engineers, MEP engineers, consultants and contractors. Out of 300 questionnaires sent out to respondents, 180 were valid to be analysed. Table 2 presents respondents profiles, in which we can see diversity in their age, educational level, the nature of activity and experience in construction Industry.

| Respondent information | Categories | Frequency | Percentage |

|---|---|---|---|

| Age | 25-30 | 27 | 15% |

| 31-40 | 70 | 39% | |

| 41-50 | 52 | 29% | |

| >50 | 31 | 17% | |

| Educational level | Bachelor's Degree | 148 | 82.2% |

| Master's degree | 26 | 14.5% | |

| PhD degree | 6 | 3.3% | |

| Firm Sizes by Number of Employees | 1-49 | 13 | 7% |

| 50-199 | 113 | 63% | |

| 200-999 | 38 | 21% | |

| >1000 | 16 | 9% | |

| Discipline | Developer | 18 | 1% |

| Facility Manager | 3 | 1.7% | |

| Design Consultant | 6 | 3.1% | |

| Owner | 4 | 2.3% | |

| BIM Consultant | 13 | 7% | |

| Construction Manger | 21 | 11.4% | |

| Contractors | 22 | 12.3% | |

| Architecture/Engineering | 20 | 11% | |

| Engineering | 22 | 12 | |

| Architecture | 60 | 33.2 | |

| Specialist | Architect | 77 | 43% |

| Engineer | 31 | 17% | |

| Contractor | 36 | 20% | |

| Other | 36 | 20% | |

| Experience in Construction Industry | 1-10 Year | 79 | 44% |

| 11-20 Year | 56 | 31% | |

| 21-30 Year | 40 | 22% | |

| >30 Year | 5 | 3% |

Total no. of valid questionnaire=180

Table 2: Respondents' profile.

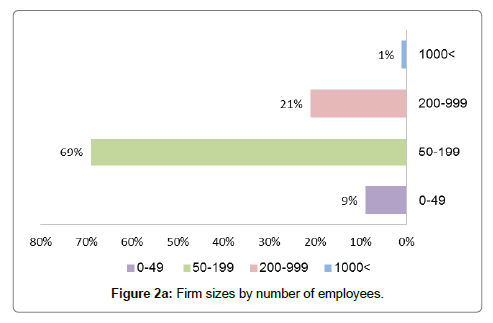

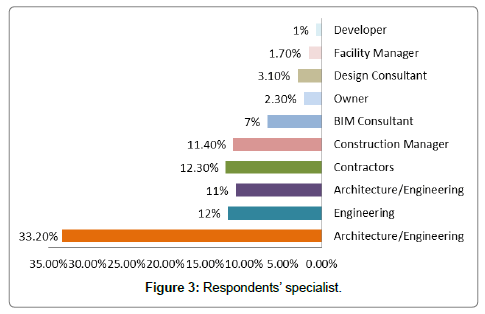

Table 2 shows distribution among respondents'' according to their age, around 39% of the respondents were within the category of 31 years to 40 years followed by respondents of 41 to 50 years and the least category was respondents older than 50 years (15%). The respondents' education level was varied from 82.2% for Bachelor's Degree holders, followed by 14.5% for Master's degree holders, and only 3% of PhD degree holders. Survey was carried out in small, medium and large- sized companies. Figure 1 presents the percentage of the respondents based on the size of the firm. It shows that 69% of the companies are medium companies (with 50 to 199 employees) followed by large companies (21%) of 200-999 employees, the least respondents were found in two categories: the very large companies with more than 1000 employees (1%) and the small companies with fewer than 50 employees (9%) (Figure 2a). Respondents’ profiles were classified according to the market segment they serve, as shown in Figure 2b the highest response rate was from architects (large architecture, engineering, and construction (AEC) firms) with 43% of the total responses followed by 36 contractors (20%) and 36 other industry's respondents (20%)-including owners, planners, building product manufacturers, government agencies, various integrated firms and consultants. So the distribution of the respondents in the survey was not a normal distribution and it shows that the architects have the most interest among others to participate in surveys and knowledge about BIM (Figure 3).

As observed in Figure 4, the survey was distributed to all types of specialist, most of the respondents were specialized in architecture and engineering, of 33.2% and 12% respectively, followed by contractors with 12.3% respondents and the least of respondents were developers of 1%. 60% of respondents were working in top management positions (presidents, vice presidents, directors, coordinators, and managers).

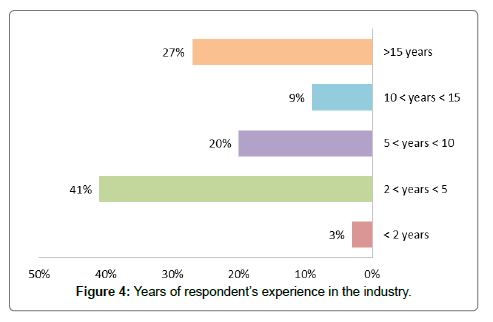

In terms of years of experience in the AEC construction industry, respondents were having varied experiences. About 41% of respondents had experience between 2 to 5 years followed by 27% of respondents had more than 15 years' experience, 29% respondents have from 5 to 10 years working in this industry. Only 3% had less than 2-year experience in the industry, while 87% had over 5 years of experience. 9% of respondents had between 10 to 15 years’ experience Figure 5.

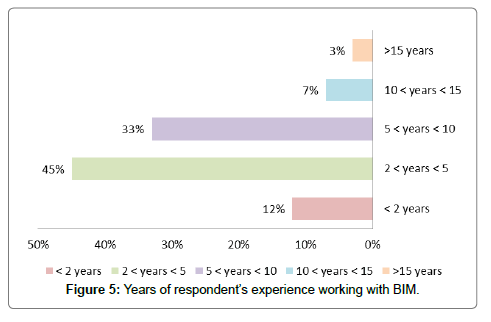

Figure 6 shows that the current experience of BIM is still low as the majority of respondents had 2 to 5 years’ experience working with BIM (45%). These were followed by respondents had 5 to 10 years’ experience working with BIM (33%). And the lowest response rate was from respondents had more than 15 years’ experience (3%). Obviously, implementation of BIM in Jordan is still in a very early stage.

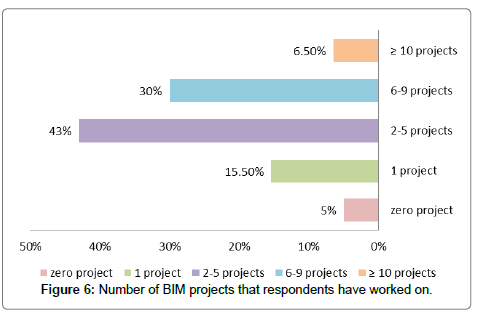

Figure 7 shows the number of BIM projects that respondents had worked on within their years of experience. The majority of respondents had worked on a maximum of 5 BIM projects (43%), followed 30% who worked on 6 to 9 projects, only 15.5% had worked on one project. Only 5% had not worked on projects, where only about 6.5% worked on more than 10 projects.

Respondents’ BIM experience level was investigated through asking them about the consumed time on tasks that require hands-on BIM experience. About 43.5% of respondents spent less than 20% of their time on BIM tasks. And only 5.6% of respondents spent from 80% to 100% of their time on BIM tasks. This finding in line with what found of majority numbers of respondents worked on few projects from 2 to 5. Interestingly, when different firm types are analysed, general contractors have the least hands-on experience; 73% of respondents spent less than 20% of their time using BIM, followed by 42% of construction managers. Again, architects have more hands-on experience with BIM than the other disciplines (Figure 8).

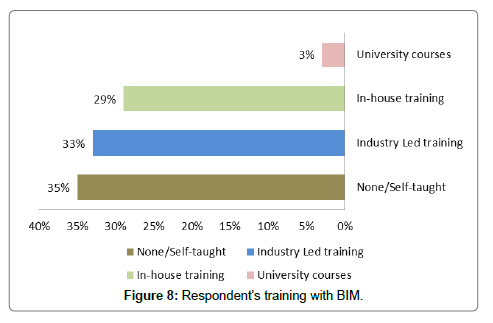

Next, respondents were asked to determine the way they taught BIM. As observed in Figure 9, 35% of the respondents were selftaught on BIM, where the majority could know the tools of BIM but not the process. “Industry training” was followed with 60 respondents (33%) indicated that their organizations and companies had provided training for employees to learn the process and its tools followed by “in-house training” with 29% and it was only with 3% of respondents who got their training from colleges and universities. Usually university training courses on BIM is very basic and it’s more on the use of the software rather than the process of BIM.

This finding confirmed Rita Awwad's (2014) findings in her research on BIM in Middle East, where she found that universities in Middle East include BIM within their programs' curricula as a course at the graduate level or as a part of a scheduling course at the undergraduate level. None of these colleges have BIM as a requirement for engineering students. In Jordan, its only three universities out of 19 surveyed universities offer BIM as an elective course to their students. These findings show further the lack of BIM awareness in the market. Results presented in Figure 10 shows different BIM tools available widely in the Jordanian construction industry market. Based on the survey results the most common BIM tool was Autodesk programs, that are Revit, Sketchup, Archicad and Bentley with 90%, 70%, 60% and 55% respectively. Navisworks was in the second place with 90 responses (50%), where it was mainly used for construction schedule simulation. However, 35% and 15% of the respondents selected Tekla and other software respectively. This corresponds to ‘most of the respondents indicating that they use BIM in the design stage. Responses to this part of the survey show that traditional CAD vendors such as Autodesk, Bentley and Archicad are most popular ones amongst the users. It can be said that these CAD vendors have taken the lead to introduce BIM to their current users in construction.

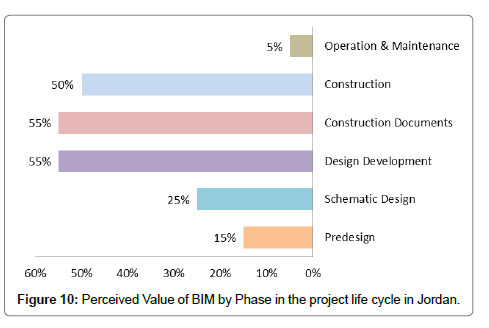

Next, respondents were asked to determine the phase of the construction project BIM was implemented. Majority of respondents indicated that BIM was utilized in more than one stage, particularly in large-scale projects. Figure 10 indicates that the design and construction-related phases have been perceived having very high value. 55% of the respondents used BIM in the design and construction documentation followed by construction 50%. Only 5% indicated that BIM was used in the operation and maintenance. The illustrated results in Figure 11 indicate that interest in implementing BIM was mainly in the design stage for design-related functions such as building design, visualization, programming and massing studies. On the other hand, 15% of respondents indicated that BIM was utilized during predesign and 25% stated that BIM was used during schematic design. However, data shows that the design phase seems to be the most important phase and this can be explained due to the general understanding, on the part of our participants, is that “BIM is primarily a modeling tool”.

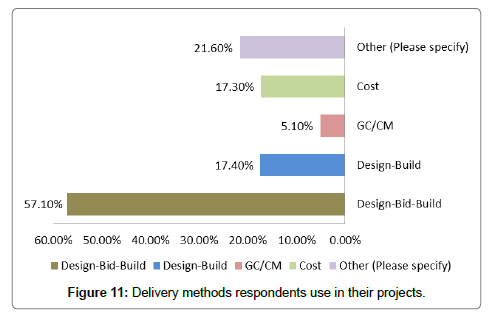

Respondents were also asked on the project delivery method that was used in their projects. Figure 12 shows that Design-Bid-Build was the most common used delivery method for construction projects in Jordan with 103 respondents (57.1%) followed by Design-Build with 31 responses (17.40%). Design-Build and cost-plus methods have almost the same number of respondents (31). 39 respondents indicated other methods such as Design-Build-Operate. Again, the respondents also had the option to choosing more than one answer for this question.

Benefits of BIM Adoption in Jordan

Another objective of the survey was to determine the different views of respondents about the major benefits realized through adopting and implementing BIM in AEC construction in Jordan. Table 3 shows that respondents believe that BIM provides multiple benefits. Table 3 shows respondents classification according to their experience in working projects with BIM. Benefits were almost consistent across most of respondents. Namely, those key benefits were shown in Table 3.

| Advantages | Percentage |

|---|---|

| 1. Reduce Rework During Construction | 95% |

| 2. Maximizing productivity | 90% |

| 3. Reduce conflict/changes | 88% |

| 4. Clash detection | 88% |

| 5. Enhance collaboration & communication | 85% |

| 6. Improves visualization | 85% |

| 7. Improve project documentation | 85% |

| 8. Enhance design review | 80% |

| 9. Faster & more effective method | 85% |

| 10. Improve Quality | 84% |

| 11. Reduced Construction Time | 70% |

| 12. Reduce Contingencies | 65% |

| 13. Reduced Construction Cost | 70% |

Table 3: Benefits of BIM adoption.

Table 3 shows that about 95% of respondents agreed on BIM ability to reduce the rework and design errors, conflicts and changes during construction processes to a large extent; thus improve productivity. Moreover, 85% of respondents believed that BIM improves visualization, which resulted in enhancing design scheme options. Consequently, this results in time reduction, and minimizes the cost and maximizes profitability and productivity.

85% of respondents believed that BIM enhance collaboration and communication between the different project entities facilitating early engagement with the relevant disciplines. Moreover, BIM can also help with localised engineering solutions such as design review, project documentation, clash analysis, shadow analysis, cost analysis, etc. Arguably, BIM offers support to designers in enabling designs to be checked automatically against constraints. To summarize, most of the respondents were in agreement that BIM implementation is very important and beneficial, particularly in term of productivity. Accordingly, the productivity related benefits of using BIM can be identified as follows:

• Reduced rework is the highest rated benefit among respondents. Four in five experts say this aspect rates a high to very high value, compared to 23% of beginners.

• The potential of BIM technology to improve productivity is appreciated by all respondents.

• Reduced errors, conflicts and changes during construction are among the top rated ways engineers say BIM adds value to a project.

• Clash detection and avoiding rework are the top rated ways owners believe BIM saves time and money.

Barriers and obstacles of implementing BIM in Jordan

The implementation of every new technology faces some challenges before fully applied. The advantages provided by the new technology are the key to its full implementation. Another scope of this study was to investigate obstacles and barriers of implementing BIM within the construction industry in Jordan. Respondents were asked to identify challenges that inhibit the full use of BIM. Several challenges and issues related to BIM implementation, ranging from technical issues to the more human factors, which are critical for BIM adoption.

Table 4 shows four main obstacles that have the most influence on BIM implementation in Jordan, which are:

| Challenges | Percentage |

|---|---|

| 1. Lack of support and incentives from construction policy makers | 95% |

| 2. BIM industry standards and codes are not available | 95% |

| 3. Lack of awareness about BIM | 90% |

| 4. We don't know where to start | 90% |

| 5. No client demand | 88% |

| 6. Resistance of change | 88% |

| 7. Lack of a BIM specialist in Jordan | 85% |

| 8. Necessary training is not available | 85% |

| 9. Cost (software, hardware upgrade, training, and time) | 80% |

| 10. BIM requires radical changes in our workflow, practices and procedures | 65% |

Table 4: Key challenges faced BIM adoption and implementation process in AEC construction in Jordan.

• Lack of support and incentives from construction policy makers (95% of respondents): the absence of government's support of any incentives or from mandating BIM implementation at least on public construction projects which scored 95% along with the absence of “BIM industry standards and codes are not available”.

• Lack of awareness about BIM (90% of respondents): People are still not aware of BIM benefits and potentials as a process; accordingly, they don’t know where to start” and

• Not enough demand for BIM from clients or others firms (88% of respondents).

Another two inter-related issues stated by respondents was “resistance of change” and “Lack of a BIM specialist in Jordan” that scored 88% and 85% respectively. Whilst the Government is in the process of enforcing BIM for its own public projects, as the case of Al Tafaieh Governmental hospital, south Jordan, but owners of smaller businesses usually don’t have such demands – and the smaller they are, the more likely to provide resistance to technological changes. Similarly, “contractors looking at BIM as additional cost” was also identified as a major barrier to BIM, with a response percentage of 90%. It can't be denied that the move towards implementing BIM requires costs on software, training, and time. But the costs need to be weighed against the potential benefits. That’s why BIM is regarded as a low return-on investment. To sum up, BIM requires radical changes in our workflow, practices and procedures in order to take the advantages of its implementation, as for the time being, lots of adopters thought BIM is regarded as a low return-on investment.

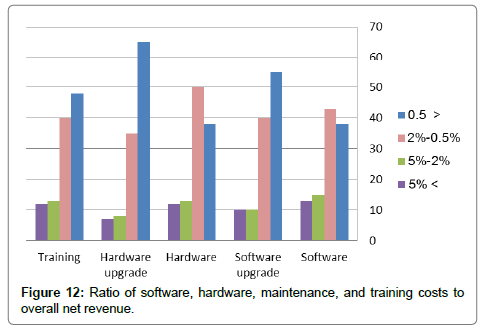

Table 4 shows that the majority of the respondents spent less than 2% of their income on software, software upgrades, hardware, hardware maintenance, or training. On one hand, software and hardware costs contributed the most to overall expenses. On the other hand, software upgrades and hardware maintenance costs are less than 0.5 of overall income of the firms. Other greatest obstacle on the path to BIM adoption is training, though it is a critical investment for successful BIM implementations (McGraw Hill, 2010). Based on the survey findings, respondents have recognized this issue and firms are providing training to their BIM users.

Conclusion

Based on the previous survey analyses and findings, it can be concluded that the adoption and implementation of BIM in the AEC industry in Jordan is still in a very primitive phase. However, the state of BIM adoption and implementation is not satisfactory only 5% of AEC companies and organizations are using BIM. However, only large AEC organizations and companies have prompted a serious move towards BIM as tools and processes whereas small companies are still resisting this transformation and, seemingly, they are not aware of BIM benefits and its reflections on AEC industry in terms of planning, design construction, operation and facility management. Another major issue discouraged construction players in Jordan to adopt BIM is the cost of BIM's software, hardware, training and the radical change that is needed to adopt this new technology.

Despite any reluctance to make the change, Jordanian government should take a serious step towards drawing up a roadmap for urgent adoption and strategic implementation of BIM in the construction industry aiming to enhance productivity and efficiency. For example, government should encourage BIM implementation at least on public construction projects with some incentives such as awards for BIMbased projects which have good post occupancy evaluation results. Moreover, government should set local standards and codes for BIM industry at both the organizational and project supply chain level. Good and accessible standards have a major role to play in the success of BIM as a growth factor. There is a need for holistic co-ordination among the industry's stakeholders including the government, industry, BIM vendors, clients and educational institutions.

To address the shortage of BIM practitioners, the industry and academic institutions should work together to develop syllabuses that are in line with developments in industry practice and procedures. There should also be a system within each firm to ensure that the practitioners retain, actually apply and also share the knowledge gained from such programmes. Yet, the findings of the study show that BIMā?related tools are considered the most promising technology to enhance construction productivity. However, to maximize the benefits of this technology, a variety of structural, legislative and technical issues should be addressed. BIM technologies, as processes and tools, should be combined with new processes that change the context and conditions in which construction projects are planned, designed, and constructed. This could be the first step to move forward to a higher level of maturity in terms of integrating BIM in construction. While this survey represents a first step towards understanding the current situation of BIM implementation in the Jordanian AEC construction industry and thus to provide a benchmark for future studies, there are several avenues that should be pursued further.

References

- Department of Commerce, Bureau of Economic Analysis (2007) Gross domestic product by industry accounts.

- FIATECH (2005) Emerging construction technologies_ a FIATECH catalogue.

- NSCSCā?ICI(2010) Functional Information Technology Phase 1: Detailed Analysis (FIT). Overview Report. Prepared for the NSCSCā?ICI by CEM, (Construction Engineering and Management Group).

- Eastman C, Teicholz P, Sacks R, Liston K (2011) BIM Handbook: A Guide to Building Information Modeling for Owners, Managers, Designers, Engineers and Contractors.(2ndedn), Hoboken,Wiley.

- Azhar S, Khalfan M, Maqsood T (2012) Building information modelling (BIM) now and beyond. Construction Economic and Building 12: 15-28.

- Barlish K, Sullivan K (2012) How to measure the benefits of BIM -A case study approach. Automation in Construction24: 149-159.

- Associated General Contractors of America (2005) The Contractor’s Guide to BIM.(1stedn), AGC Research Foundation, Las Vegas, NV.

- Glick S,Guggemos A (2009) IPD and BIM Benefits and Opportunities for Regulatory Agencies. Proceedings of the 45th ASC National Conference, Gainesville, Florida.

- Government H (2012) Building Information Modelling, Industrial Strategy-Government and Industry in Partnership.London HM Government.

- Wong A, Wong F, Nadeem A (2009) Comparative Roles of Major Stakeholders for the Implementation of BIM in Various Countries.Hong Kong Polytechnic University.

- BuildingSMART (2012) National Building Information Modelling Initiative. Strategy A strategy for the focussed adoption of building information modelling and related digital technologies and processes for the Australian built environment sector. Sydney Research and Tertiary Education.

- McGrawHill Construction (2014)SmartMarket Report The Busniess Value of BIM for Construction in Major Global Markets.McGraw Hill Construction.

- Lee S, Kim K, Yu J (2014) BIM and ontology-based approach for building cost estimation. Automation in Construction 41: 96-105.

- Chan C (2014) Barriers of Implementing BIM in Construction Industry from the Designers Perspective A Hong Kong Experience. Journal of System and Management Sciences 4: 24-40.

- Kekana TG (2014) Building Information Modelling (BIM) Barriers in Adoption and Implementation Strategies in the South Africa Construction Industry. International Conference on Emerging Trends in Computer and Image Processing pp: 15-16.

- Ogwueleka AC (2015) Upgrading from the use of 2D CAD systems to BIM technologies in the construction industry consequences and merits. International Journal of Engineering Trends and Technology (IJETT) 28: 403-411.

- Succar B (2009) Building information modelling framework A research and delivery foundation for industry stakeholders. Automation in Construction 18: 357-375.

- Arayici Y, Coates P, Koskela L, Kagioglu M, Usher C,et.al. (2011) Technology adoption in the BIM implementation for lean architectural practice. Automation in Construction 2: 189-195.

- Masood R, Kharal M, Nasir A (2014) Is BIM Adoption Advantageous for Construction Industry of Pakistan? Procedia Engineering 77: 229-238.

- Guidline for BIM Implementation 196 (2013)Dubai, UAE: Dubai Municipality.

- Awwad RA (2013) Surveying BIM in the Lebanese Construction Industry.

Relevant Topics

- Architect

- Architectural Drawing

- Architectural Engineering

- Building design

- Building Information Modeling (BIM)

- Concrete

- Construction

- Construction Engineering

- Construction Estimating Software

- Engineering Drawing

- Fabric Formwork

- Interior Design

- Interior Designing

- Landscape Architecture

- Smart Buildings

- Sociology of Architecture

- Structural Analysis

- Sustainable Design

- Urban Design

- Urban Planner

Recommended Journals

Article Tools

Article Usage

- Total views: 9914

- [From(publication date):

April-2017 - Apr 24, 2025] - Breakdown by view type

- HTML page views : 8600

- PDF downloads : 1314