Research Article Open Access

Effects of the Airline Deregulation Act on Aeronautical Industry

Bento Mattos1* and José Alexandre Guerreiro Fregnani21Aircraft Design, Instituto Tecnologico de Aeronautica, Sao Paulo, Brazil

2Instituto Tecnológico de Aeronáutica, São José dos Campos, Brazil

- *Corresponding Author:

-

Bento Mattos

Instituto Tecnologico de Aeronautica

Aircraft Design, Sao Paulo, Brazil

E-mail: baviator@gmail.com

Received date: October 13, 2015; Accepted date: February 15, 2016; Published date: February 17, 2016

Citation: Mattos B, Fregnani JAG (2016) Effects of the Airline Deregulation Act on Aeronautical Industry. Int J Adv Innovat Thoughts Ideas 3:161. doi:10.4172/2277-1891.1000161

Copyright: © 2016 Mattos B, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited

Visit for more related articles at International Journal of Advance Innovations, Thoughts & Ideas

Abstract

The present work provides a unique and creative overview that illustrates the economic and social impact of the 1978 North American Deregulation Act on the aeronautical industry. The Deregulation has had especially profound impact on regional aviation, which is now facing increasing competition from other types of low-cost carriers in hub feed flights. The Deregulation triggered an immense competition among airlines and among aircraft manufacturers of regional airplanes, which needed to bring technology of bigger airplanes to their products. Airplanes with lower operation costs enabled a new era in aviation, with more passengers and communities gaining access to flight services. The Deregulation Act is deeply related to the success of the Brazilian aircraft manufacturer EMBRAER, the third- largest airplane manufacturer in the world.

Keywords

Commercial aviation; Aircraft design; Economic policy; Airline deregulation; Air transportation; Aircraft industry; Airline; Airliner; Regional airplanes; Airline network

Introduction

Most studies concerning the Aviation Deregulation of the airline industry deal only with its effects on aviation, few of them address its impacts on the aircraft industry. The present work addresses this issue by providing a whole picture of the aeronautical industry before and after the 1978 Airline Deregulation Act [1]. The Deregulation triggered a strong competition among several airplane manufacturers of regional airplanes, most of them already well-established on the market with larger airplanes and strongly supported by their respective governments. However, this picture changed dramatically because new entrants appeared on the scene and the lack or withdrawal of public money after the fall of the Soviet Union. Thanks to the Deregulation, the regional aviation market soared and the Brazilian aircraft manufacturer EMBRAER and the Canadian manufacturer Bombardier were the biggest winners of the new aviation that emerged thereafter.

Before 1978, airlines obeyed an intricate network of rules elaborated by the North American federal government, which determined whether a new airline could fly to a particular city and even specified the airfare. With limited competition, airlines had high profit margins, issued brochures that offered expensive services covered by high airfare. Aviation was a means of transportation for few as air traveling at that time was very expensive. In the 1950s and 1960s, most people would never have dreamed of flying. At that time, over 80% of North American citizens had never had the opportunity to travel by air. Governmental regulation was responsible for expensive flights.

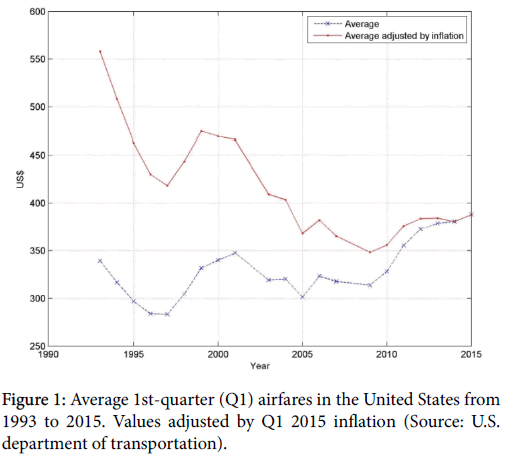

In the face of increased operating costs and high ticket prices due to the oil crisis of the 1970s, a commission composed of senators and economists decided that Washington should promote competition among airlines to lower airfares and improve services. Their work resulted in the Airline Deregulation Act, which came into force in 1978. Deregulation was therefore conceived to end government control over fares, routes and stimulate the entry of new airlines. In addition, civil aviation council regulation powers were eliminated, benefiting passengers through market forces in the airline industry. The law, however, did not remove or decrease the FAA's regulatory powers over all aspects of aviation safety. After the deregulation of air transportation in the United States, a remarkable plunge in the price of air tickets was brought about (Figure 1). There are also aspects criticized by many analysts of the airline industry about the effects of the deregulation. Reviewers state that in the twenty seven years prior to deregulation, no airline went bankrupt. On the other hand, 160 airlines have ceased activities in the United States since 1978. In the last 25 years, the lack of success has been ten times higher than in the general business community. In 2005, almost all major North American airlines filed for bankruptcy. There is also much criticism about the quality of services provided by airlines. At any rate, the allegation that there was no bankruptcy prior to deregulation is questionable because corporate deficits of airlines worldwide were topped with subsidies and other governmental support.

Thanks to their highly aggressive business model, low-cost carriers firmly established themselves in the aviation market as consequence of the widespread deregulation that took place worldwide. The fall of the Soviet Union contributed to boost the airline deregulation because it led to subsidy cuts in the aviation and the aeronautical industry worldwide.

Low-cost carriers specialized in point-to-point flights, while regional ones dedicated to hub feeding flights and low-to-moderate density point-to-point routes. However, regional aviation is facing increasing competition from low-cost carriers. In a new mode, one of biggest low- cost carrier in Europe, Ryanair is preparing its next step in the development of its business model, which would have been unthinkable only a few years ago. Ryanair is talking to IAG Group (owner of British Airways and Iberia), TAP Portugal, Virgin Atlantic Airways and Norwegian Air Shuttle about providing feeder traffic to their long-haul flights. Soon, Ryanair may be providing short-haul passengers for Aer Lingus transatlantic flights. This would be a considerable departure from the Ryanair service so far. This approach for the company’s growth, that is a direct competition with regional carriers, makes sense because another approach would be facing the long-haul transatlantic flights, which would demand a total reshape of the airline, including new types of larger airplanes.

The article analyses the evolution of the airline networks caused by the 1978 Deregulation Act. The technological and configuration evolution of regional airplanes, from turboprop to regional jets, is also mapped and analysed in the present work. Specially, the history of EMBRAER and its products were considered as a reference to establish and delineate the effects of Airline Deregulation in the aeronautical industry.

Aviation and Economy

Aviation in numbers

Since the aviation pioneer flights in the early decade of the XX century, aviation has grown enormously and today it accounts for huge economic and social benefits. Aviation unites countries, people and cultures; it also provides access to global markets; it generates and promotes tourism and business. In addition, aviation forges relations between countries with different levels of development. According to the Australian tourism agency, 99% of tourists visiting Australia are transported by air. This shows the importance of aviation to the economy of that continental country.

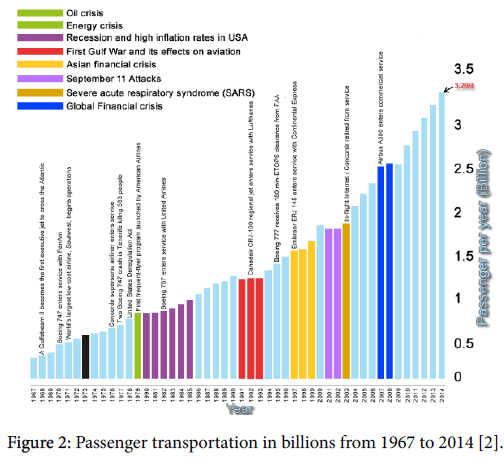

In fact, aviation provides the only worldwide rapid transportation system, which makes it essential for global business and tourism. In 2014, according to the International Air Transport Association (IATA) [2], aviation’s total global economic impact was US$ 2.4 trillion including direct, indirect, induced and catalytic effects of tourism, generating US$ 745 billion in revenues. In addition, IATA estimates that currently 58.1 million jobs worldwide are generated by aviation (from which 8.7 million are direct jobs) and in 2014 airlines carried over 51.7 million tons of freight and approximately 3.3 billion passengers. Figure 2 shows the evolution of carried passengers from 1967 to 2014 [3].

Not considering world scale economic turmoil’s, which may provide unpredictable impact on the air transport activity, IATA’s 20-year passenger growth forecast [2] projects that passenger numbers are expected to reach the impressive mark of 7.3 billion by 2034. That represents a 4.1% average annual growth in demand from now for air connectivity that resulted in more than double of the 3.3 billion passengers who travelled in 2014. By 2034, the five fastest-increasing markets in terms of additional passengers per year will be China (856 million new passengers), the U.S. (559 million), India (266 million), Indonesia (183 million) and Brazil (170 million) and eight of the ten fastest-growing markets in terms of percentage will be in Africa with Central African Republic, Madagascar, Tanzania, Burundi and Kuwait making up the five fastest-growing markets [2]. The Indian and Brazilian domestic markets will grow at 6.9% and 5.4% respectively [2]. In terms of country-pairs, Asian and South American destinations will see the fastest growth, reflecting economic and demographic growth in those markets. For intra-Pakistan, Kuwait-Thailand, the United Arab Emirates (UAE)-Ethiopia, Colombia-Ecuador and intra-Honduras travel will grow by at least 9.5% on average for the next 20 years, while Indonesia-East Timor will be the fastest growing pair of all, at 14.9%. The European airspace is a significant example of the current impressive volume of air traffic. The British air navigation service provider NATS (National Air Traffic Services) offers a significant amount of data related to the movement of aircraft in the European airspace, available at its Website (www.nats.aero). According to this database, on a typical day in July, there are about 30,000 flights in European skies. The impressive total distance covered by such aircraft is 25 million nautical miles. That is equivalent to 998 trips around the earth, or 104 trips to the moon.

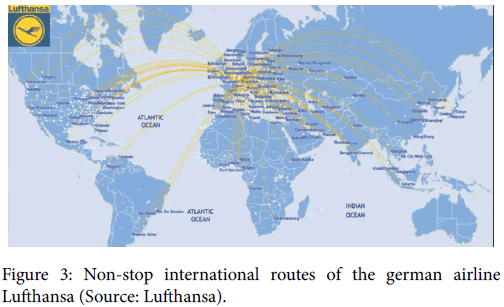

Lufthansa is one of the largest world airlines. For this reason, this German airline was selected to illustrate the importance and dimension of commercial aviation. Figure 3 shows the routes of Lufthansa starting from the city of Frankfurt. They are only international non-stop routes. Figure 2 provides a good picture of the global dimension that an airline can reach thanks to the impressive range of many modern airliners. The Lufthansa Group operated in the year 2014 more than 620 airplanes. Its subsidiaries, and joint ventures total up to at least 10 airlines, among them (to name only four) are Lufthansa Cargo; Swiss International Air Lines (former Swissair); Sun Express; and Lufthansa City Line. Some of the Lufthansa airplanes can be seen in figure 4. Lufthansa operates the Airbus A380, the largest airliner that ever entered serial production, as well as the Boeing 747-8, the latter a version of the double deck Boeing 747 that incorporated Boeing 787 technology.

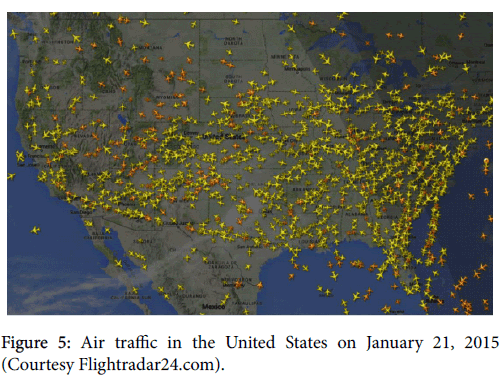

The United States possesses the world's largest economy and registers the most voluminous air traffic in the world over a single national airspace. Table 1 contains information about the air traffic in the United States in December 2013 [4]. The data were made available by the US Department of Transportation and confirm the strength of the US airline industry. Figure 5 shows air traffic on the morning of January 21, 2015 over the United States. The image is a courtesy of Flightradar24.com free service. Figure 5 testifies to the impressive daily volume of airplanes airborne in that country.

| Passengers (domestic and international) | 824,836,391 |

| Revenue passenger miles (000) | 1,166,237,445 |

| Available seat- miles (000) | 1,408,907,561 |

| Load factor | 82.78 |

| Net income (000) | 12,706,078 |

Table 1: Data on air traffic in the United States of America in 2013 [4].

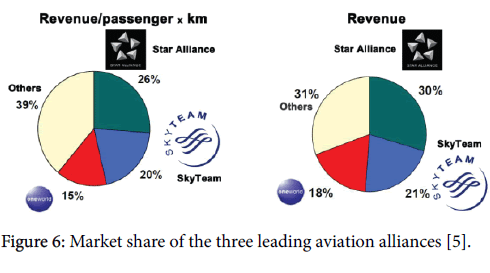

In 2015, many airlines were organized into three major global alliances: Star Alliance, Sky Team, and One world [5]. The airlines belonging to these three alliances account for 61% of revenue per passenger km (RPK) worldwide and 69% of total operating revenue (Figure 6) [5]. Sometimes, airlines within an alliance forge joint efforts to obtain bigger discounts when buying airplanes.

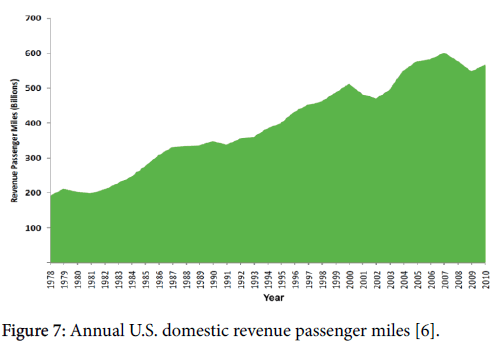

U.S. domestic passenger air traffic, measured in revenue passenger miles (RPM), has almost tripled during the period 1978-2009, as shown in figure 7 [6]. The annual growth of domestic passenger air traffic has been consistently positive, with only a few disruptions:

• Traffic declined in 1980-1981 due to the economic recession;

• In 1991, fuel and market crisis caused by the first Gulf War;

• Again in 2001-2002 after the September 11th terrorist attacks;

• After the economic recession that followed the 2008 world financial crisis.

Federal Aviation Administration (FAA) elaborated table 2 that summarizes the total importance of North American civil aviation on output, earnings, and jobs. In 2012, economic activity attributed to civil aviation-related goods and services totaled US $ 1.5 trillion, generating 11.8 million jobs with US $ 459.4 billion in earnings [6]. In 2012, aviation contributed 5.4 percent to gross domestic product (GDP), the value-added measure of overall U.S. economic activity [6].

| Year | Output (US$ Billions) | Earnings (US$ Billions) | Jobs (Thousands) | Percent ofGDP |

|---|---|---|---|---|

| 2012 | 1,533.8 | 459.4 | 11,790 | 5.4 |

| 2011 | 1,455.0 | 437.2 | 11,238 | 5.3 |

| 2010 | 1,354.8 | 407.8 | 10,496 | 5.2 |

| 2009 | 1,309.4 | 393.2 | 10,118 | 5.2 |

| 2008 | 1,453.5 | 436.9 | 11,237 | 5.6 |

| 2007 | 1,421.6 | 426.7 | 10,960 | 5.6 |

| 2006 | 1,315.2 | 395.4 | 10,185 | 5.4 |

Table 2: Summary-Civil Aviation Economic Impact on the U.S. Economy 2006-2012 (2014 Dollars) [6].

Reshape of the airline networks

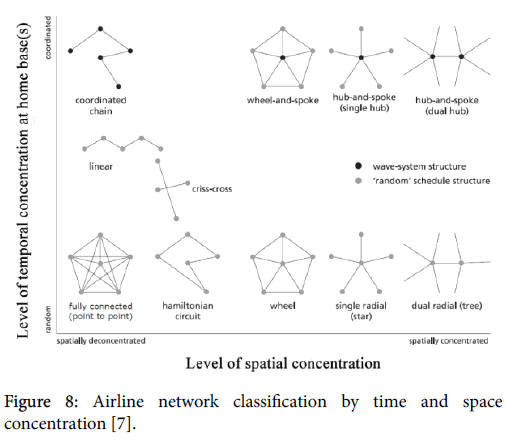

A characteristic that makes the air transportation system singular when compared with other means of transportation is its topological network reconfiguration. Burghouwt [7] defines network as a set of interconnected nodes and states that interconnectedness should not only be considered from a spatial, but also from a temporal point-ofview [7]. To capture this two- dimensional framework, an airline network configuration is categorized by its level of spatial and temporal concentration [7]. In other words, airline networks vary on a two-dimensional continuum of spatial concentration and temporal concentration. In fact, figure 8 reveals that one may think of many intermediate network configurations. The prototype hub-and-spoke and point-to-point networks so frequently mentioned in air transportation literature are just two network configurations among the many types possible.

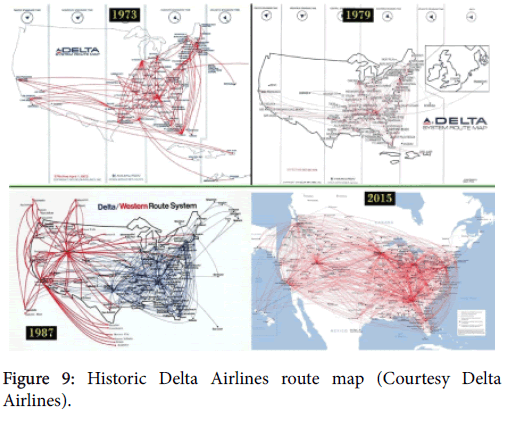

In 1978, the U.S. Congress issued an Act deregulating the aviation sector in that country. This apparently isolated move caused profound changes in aviation and the aeronautical industry. Airline networks also suffered a deep reshape. As example, the evolution of the Delta Airlines network is analysed here. Figure 9 shows the route maps of Delta Airlines over time. There are no significant changes in the network of 1979 when compared with that of 1973. In 1975, new entrance restriction was eased by the Civil Aeronautics Board. The 1978 Airline Deregulation act (ADA) led to no control being enforced in 1983. However, the big difference that can be observed by comparing the network of 1979 with that of 1987 can be largely credited to the ADA. For instance, Western entered an operating agreement with regional airline SkyWest, to add feeder lines between Salt Lake City and smaller cities, many formerly served by Western. The joint service was named Western Express. Western and Delta Air Lines announced a merger agreement that led to Delta's acquisition of Western on September 9, 1987. Western became a wholly-owned subsidiary of Delta on December 19, 1987. The 1987 route map displayed in figure 9 reveals the huge expansion of the Delta network arising from the merger with Western. Air carriers, in an attempt to maximize their profit or simply just survive, adopted the hub-andspoke system after deregulation [8]. Relatively low demands at spoke airports are aggregated at hubs and bigger airplanes are used at higher frequency between big hub airports [8]. Major air carriers generally service larger cities where demand is high, utilizing large commercial aircraft. Major carriers have been operating with regional carriers to open the small community markets that could not be operated before with larger aircraft. The technical and financial support from major carriers helped the growth of regional airlines, widening the air transportation network coverage. In many cases, regional airlines partnered with major carriers, called code-sharing, taking care of the smaller demand of hub- to-spoke connections.

Continental Express (CoEx) offers a good example to measure the Deregulation effects on the regional aviation growth. This regional air transporter was founded in 1987. Since the 1978 deregulation of the U.S. airline industry, U.S. carriers have increasingly sub-contracted small regional carriers to perform flights to small city destinations. The motivation for the creation of CoeEx from a business standpoint was administrative: having just one subsidiary airline for Continental was preferable to the previous scenario of numerous agreements with various small carriers. Many of these commuter carriers were purchased by the major airlines, which they served. However, some independent carriers flying under the Continental Express brand name were never incorporated. Pioneer, Royale Airways, and Presidential Airways are among them. Using the quadrijet BAe 146, Presidential Airways was the first carrier to fly jet aircraft under the Continental Express flag. The first company to use Continental Express livery on its aircraft was Air New Orleans using the Beechcraft Model 99.

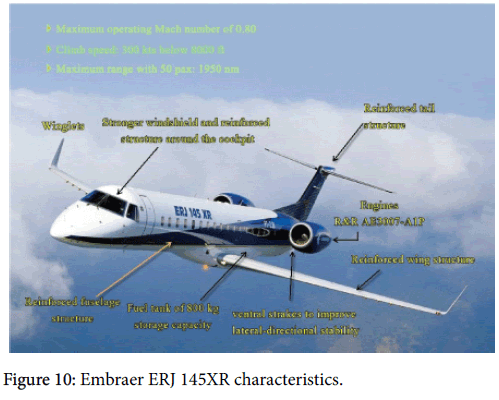

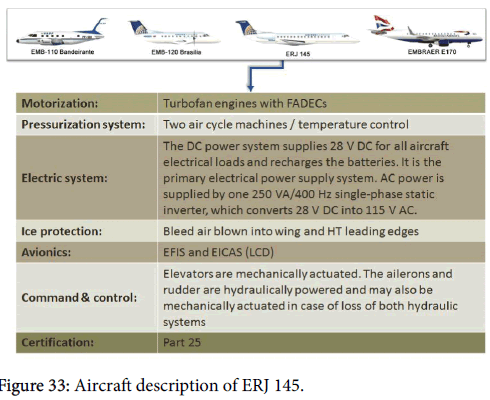

Continental Express finally became a single corporation operating under the Britt Airways certificate in April, 1993. In May, 1996, Continental Express was an all-turboprop fleet consisting of Beechcraft 1900D, EMB-120, and ATR 42/72. The route structure consisted mainly of turn around flights from the hubs to destinations distant 500 miles. In September 1996, Continental Express placed the first orders for 200 EMBRAER ERJ 145ER. The first revenue service flight took place in April 1997 from Cleveland. Originally, these jets were portrayed as replacements for the turboprop fleet. It has become very obvious, however, that the ERJ-135/145ER have been used to expand the fleet at an unprecedented rate. With a plus 1,000-nm range, the ERJ-135/145s are not only being used on new destinations (long and short routes), but also to supplement and even assume what were once Continental routes. The ERJ 145XR is a later version of the best-selling ERJ 145. The ERJ 145 XR climbs faster (at 300 kts) and burns less fuel than the ERJ 145ER/LR. Figure 10 shows some characteristics of the EMBRAER ERJ 145XR.

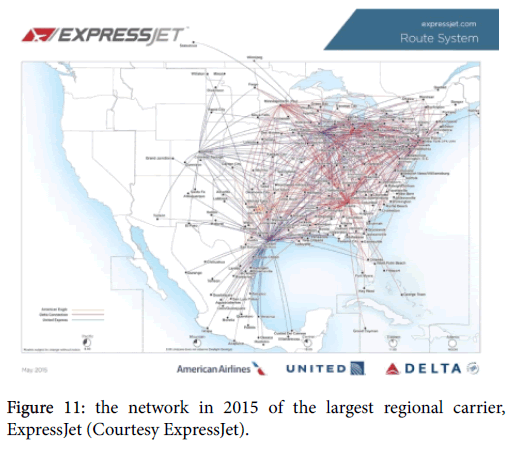

SkyWest Inc. purchased CoEx in 2010. On November 22, 2011, both ExpressJet and Atlantic Southeast Airlines, a subsidiary of SkyWest, achieved a single operating certificate that allowed them to operate as one carrier. Effective from December 31, 2011, all flights began operating under the name ExpressJet making it the largest regional airline in the world at that time with more than 400 aircraft in its fleet. Headquartered in Atlanta, ExpressJet was in 2015 the world’s largest regional airline with 9,000 aviation professionals, an average of 2,200 daily flights and an all-jet fleet of 388 aircraft. ExpressJet operates as American Eagle, Delta Connection and United Express to serve more than 190 airports in the U.S., Bahamas, Canada and Mexico (Figure 11).

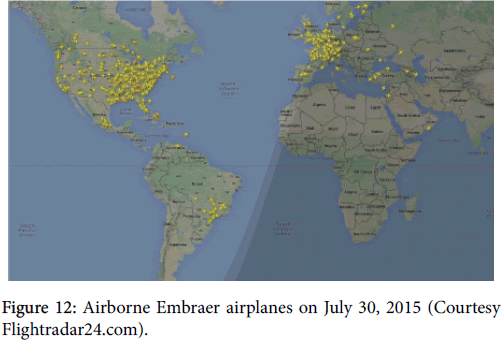

EMBRAER is one of the biggest players in the aviation market. Their airplanes compose the fleet of major airlines in the United States, Europa and South America. Figure 12 was obtained from the Flightradar24.com Website. On July 30, 2015 at 16:30 Brasilia Time, this Website registered that 442 EMBRAER jet airplanes were airborne.

The numbers and data disclosed in the preceding paragraphs certainly support the allegation that aviation is essential for the competitiveness of various countries and regions. Aviation is also an important vector for regional economic growth. People living in distant locations from each other are quickly connected and many products are easily transported to meet diverse needs. The combined importance of speed, agility and connectivity in an increasingly faster pace has changed the world economy. The network of commercial air transport is creating a new economic geography. The commercial aviation has boosted economic development in the XXI century in a very similar fashion as highways did in the XX century, railways in the XIX, and the rivers and seaports in the XVIII century. The development of routes and business opportunities are directly linked.

Table 3 shows air traffic data for the overall system (international, domestic and cargo) in the United States from 1978 to 2014. Number of enplaned passengers soared; load factor increased substantially and number of departures doubled in the period.

| 1978 | 1985 | 1990 | 1995 | 2000 | 2010 | 2012 | 2014 | |

|---|---|---|---|---|---|---|---|---|

| Departures | 5,016 | 5,835 | 6,924 | 8,062 | 9,035 | 10,095 | 9,864 | 9,536 |

| Pax enplaned (millions) | 274.7 | 382 | 465.6 | 547.8 | 666.1 | 720.5 | 736.7 | 762.1 |

| Load factor | 61.50% | 61.40 % | 62.40% | 67.00% | 72.40% | 82.10% | 82.80% | 83.40% |

Table 3: Air traffic data in the U.S. from 1978 to 2014 (Source: Airlines for America).

Are regional airlines low-cost?

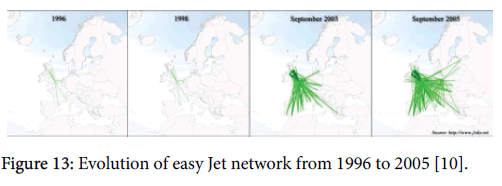

A Low-cost carrier (LCC), also known as no-frill airlines, a discount or budget carrier is an airline that practices low airfares, presents a low-cost structure and offers few or no amenities like seat allocation, meals, and on board entertainment. Most LCC allow for only one carry-on baggage. The business model of low-cost carriers includes charging for extras like food, priority boarding, seat allocation, and overweight baggage [9]. Table 4 summarizes the main differences between LCCs and legacy carriers. A legacy or full service network carrier (FSNC) is an airline that provides a wide range of pre-flight and on board services, including different service classes, and connecting flights. Since most FSNCs operate a hub-and-spoke model, this group of airlines is usually also referred to as hub-and-spoke airlines. Currently the world's largest low-cost carrier is Southwest Airlines, which operates in the United States. Ryanair and easy Jet are the two largest low-cost airlines in Europe. Figure 13 shows the evolution of the easy Jet network from 1994 to 2005 [10].

| Low-cost carrier | Legacy carrier | |

|---|---|---|

| Airplane usage | Higher than 10 h/day | 8-10 h/day |

| Pricing structure | Simple | Complex |

| Network | Point-to-point | Hub-and-spoke |

| Class | single | Multiple classes |

| Partnership | No code sharing or interlining | Some use of code sharing or interlining |

| Aircraft fleet | Single type | Mixed airplanes |

| Turnaround time | Shorter than 19 min | 25 min |

| Operational activities | Outsourcing | Extended (maintenance and cargo) |

| Flight service | No amenities | Onboard entertainment, meals, and seat allocation |

| Baggage | One carry-on baggage | Carry-on baggage and an additional unit placed in cargo compartments |

Table 4: Differences between low-cost and full-service carriers, Adapted from [9].

The term low-cost carrier originated within the airline industry referring to airlines with a low-cost structure. Theoretically, it should be possible to categorize an airline as a low-cost carrier based on the characteristics contained in table 4. In fact, it is very difficult to raise the appropriate information related to all these characteristics and it would also be a time- consuming task. However, there is an alternative method to determine whether a carrier is low-cost or not. To do this, it is necessary to look at the essence of the low-cost carrier model and to evaluate its operation against the lowest possible costs [10]. Cost reductions should result in low airfare prices, which will in turn benefit the passengers. The criterion as used by the European Travel Network states the most important condition which labels an airline company as a low-cost carrier is if “at least 75% of the sold seats are sold for the lowest advertised price [11]. The resulting list of low-cost carriers complies with most of the characteristics from table 4. For the year 2005, the list contained 58 European low-cost carriers [10, 11]. Furthermore, an OAG’s report [12] affirms that from 916 airlines in their database, 113 were considered as low-cost carriers by July 2015 [12].

The low-cost carriers may be classified into four groups. They are distinguished among the LCC charter type, the LCC full-service type, the LCC original type, and the LCC regional type [10]. Especially in the case of the LCC full-service type and the LCC charter type it appears that the low-cost carriers have multiple relations with other carriers. The larger full- service carriers and large travel organizations own shares of some smaller airline companies, travel organizations and other companies [10].

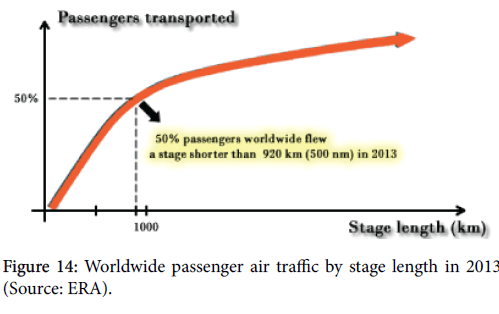

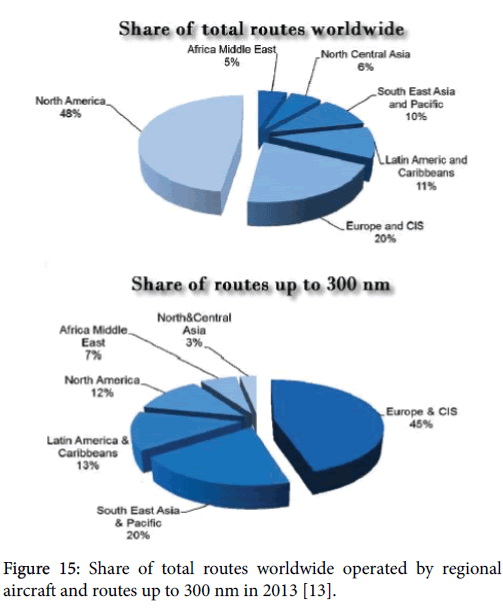

The definition of regional aviation has become fuzzy in recent years so that the traditional approach of short routes with predominantly turboprop airplanes or small-capacity jets is no longer a proper description of this aviation sector [13]. The intensive adoption of 50- seat regional jets in the second half of 1990s enabled a much wider threshold of distances on which regional aircraft could operate. Thus, the size of the market for regional operators was considerably increased. Larger aircraft are now being operated, with 75-seat twinjets being in high-demand in the United States in recent years thanks to relaxation of scope clauses. At the same time, there is the explosive growth of the other LCC types that encroached on markets which had previously been served by regional airlines. Despite these changes, the market for regional aviation remains strong [13]. From a market size perspective, short-haul travel remains the largest portion of the world’s aviation system. Half of the passengers, circa 1.5 billion people, flew sectors below 500 nm (920 km) in 2013; and 30% of them flew sectors below 300 nm (550 km), as shown in figure 14 [13]. All such routes are suitable for regional aircraft.

Besides stage length, the density of traffic volumes between any routes is also a very important factor for the determination of suitability of a regional aircraft. If a given route has a large traffic volume, it is likely to be served by narrow-body aircraft even if the sector length is below 300 nm [13]. Relatively high density short shuttle routes, such as New York to Washington would be typically served by narrow-body airplanes like Boeing 737 and Airbus A320. At the lower end of the density spectrum, turboprops might seem the obvious choice, but this can also be over-simplistic in that some airlines wish to provide a jet service when feeding hubs although this is primarily distance-related. However, in some such cases airlines may offer a regional jet service on short sectors below 300 nm [13].

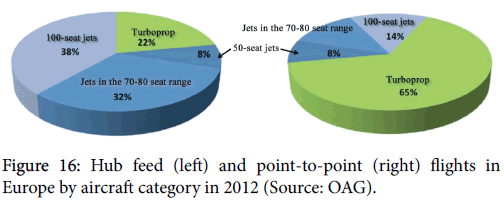

Aircraft categories operating on hub-feeding and point-to-point service networks are shown in figure 16. These are all routes where traffic volumes do not justify the operation of larger narrow body aircraft or where frequency is important. In a typical week during June 2012, 18,780 hub feed flights were operated by regional aircraft in Europe [13]. Of these, 78% were operated by regional jets up to 100 seats while turboprops accounted for 22% [12]. By contrast, for pointto- point only services where 17,720 weekly services operated in June 2012, the proportion is almost reversed with 65 per cent operated by turboprop aircraft and 35 per cent by jets up to 100 seats [13].

Mainline or legacy are becoming indistinguishable from their lowcost competition in terms of the airfares they charge and the service they offer, according to research published by KPMG, a consultancy company [14]. The cost gap between traditional and discount airlines has fallen by an average of 30% in six years before 2013, partly because legacy airlines have abandoned old differentiators like free baggage and in-flight catering on short-haul flights [14]. The service offered by low-cost and legacy carriers is now more or less the same.

Throughout the 2009 financial crisis, traditional airlines trimmed costs, but came unstuck when confronted by their unionized workforces: Iberia is the latest to have had services disrupted by prolonged strikes. Older, airplanes burning considerably amounts of fuel also caused costs to skyrocket when fuel prices rose. Thus, management opted for airplanes presenting low direct operating costs, cutting on-board perks and ditching inclusive extras. KLM and British Airways introduced checked-baggage fees on European routes, fees that normally budget airlines like easyJet and Ryanair usually apply.

Traditional airlines in North America long time ago dropped out complimentary in-flight food for economy-class travelers. That trend has spread its wings. Several flag carriers, Aer Lingus, Iberia, and American Airlines among them, now only sell drinks and snacks on short- haul routes. Some charge for seat reservations, and still more for a window berth. To save weight, in-flight magazines have been disappeared. According to KPMG, these kinds of initiatives reduce legacy carriers’ cost disadvantage against low-cost airlines by more than a third [14]. To displace one seat one kilometer through the air, a typical legacy carrier now spends 2.5 cents more than one of its lowcost rivals, down from a 3.6-cent premium in 2006.

Deregulation and Aeronautical Industry

Deregulation had profound impacts on immigration and airfares. However, there are other effects like the one on the fate of several airplane manufacturers. Since the 1980s, traditional manufacturers of small-to-medium size airplanes have disappeared, although those companies were very successful in the past. There are many and controversial reasons to explain what happened to those manufacturers. Wrong products or good products at the wrong time are some of the reasons which help to explain the shutdown of many manufacturers. Bombardier and EMBRAER practically share the market of airplanes seating between 50 and 130 passengers. There are new entrants to break that duopoly. How did EMBRAER - a company whose headquarters are in a country with no significant aircraft manufacturing until 1970 - become the third largest airplane manufacturer in the world? Airline Deregulation plays an important role in this story.

Poole and Butler [1] describe the deregulation effects in terms of four “waves of change” or periods of evolution. The first period was the expansion of the traditional and bigger airlines and the consolidation of the hub-and-spoke model. All this increased the load factor of flights and also offered people more and new destinations. The second period was a counterbalancing growth in point to point services, largely by new low-cost carriers, the most notable of which was Southwest Airlines. The third wave is characterized by the growth of regional services provided by regional carriers, filling gaps left by major carriers. The fourth period - which we are in at present - registers the unbundling of fares with many things that used to be included in a ticket price, but are now charged extra or are no longer offered at all. At the same time, there is a reduction in the number of airlines [1].

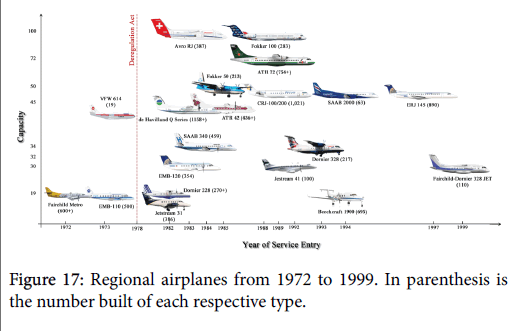

Regional carriers operate the so-called regional jets (RJs). These airplanes not only replaced turboprops on many routes but enabled the creation of new routes to more distant destinations. Another important aspect of RJs is their ability to provide airline service at additional airports in major metropolitan areas [1]. RJs are considerably less noisy than larger airliners such as Boeing 737, Airbus A320, and MD-80s. RJs off-airport noise signature is similar to that of a twin engine propeller general aviation aircraft. Thus, they provide jet service to relieve airports that are near congested big-city airports but are not serviced by airlines [1]. Regional carriers are intrinsically low-cost in nature. Regional pilot wages are considerably lower than those of pilots from major carriers; maintenance is provided by third parties; and airplanes are purchased in large orders with great discounts. Thus, lowcost operational nature is a reason of success of many regional carriers. Figure 17 shows the regional airplanes that entered service between 1972 and 1999. Before the 1978 Deregulation Act, only three types of regional airplanes saw service, the EMBRAER Bandeirante and the Fairchild Swearingen Metroliner, both unpressurized 19-seat airliners, and the VFW-614, whose production ended in 1977 after very few exemplars were manufactured. Bandeirante assembly line was closed down in 1990; the last Fairchild Metroliner left assembly line in 2001, having remained in production for 29 years. It is clear that the North American Deregulation promoted the emergence of several new aircraft types. EMBRAER profited from this scenario because it had the right product for this market, namely the Bandeirante twin turboprop. EMBRAER became soon aware that the regional market was demanding even more sophisticated airplanes and developed two new successful products: the EMB-120 Brasilia and the twinjet ERJ 145, the latter experienced a troubled program and entered service only in 1997. The liberalization of the aviation market led to the creation of new airlines.

Bandeirante encountered strong competition in Jetstream 31, a pressurized airplane. Because of this, EMBRAER started to develop a new 19-seat turboprop in the mid-1980s, the EMB-123, later renamed CBA-123. After no orders for this type came, EMBRAER cancelled the program in 1992. The void in this market segment was filled by the Beechcraft 1900, which was based on the general aviation Beechcraft King Air and has a pressurized cabin.

Despite the success of SAAB 340, the Swedish company went out of commercial aviation business because of the poor sales of its SAAB 2000. This twin turboprop presented a relatively higher cruise speed than other turboprops, but it cost almost the same (in 1991 dollar, US$ 12.4 million [15]) as a regional jet of similar capacity. SAAB considered

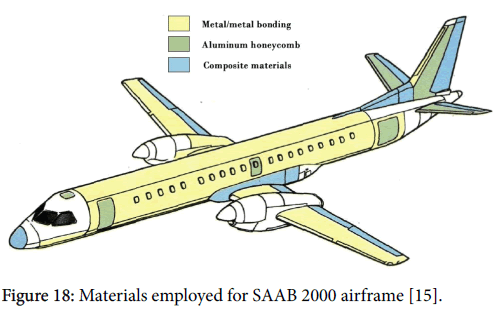

Seriously the incorporation of a full fly-by-wire flight-control system on the SAAB 2000, but dropped the idea in favour of conventional mechanical control to retain maintenance commonality with SAAB 340 [15]. In addition, the cost of such a system could not be justified [15]. An electrical control system would have been the most technologically advanced at that time because the first airliner below 100 seats to present a fly-by-wire control system was the EMBRAER 170, which entered service with an analog fly-by-wire system in 2004. SAAB 2000 has a high percentage of bonded metal in its airframe (Figure 18). Fuselage production at city of Malmö utilized a robot that virtually eliminated all manual riveting [15].

Thanks to their characteristics, the regional jets offer a higher daily utilization rate than the one of turboprops, minimizing or overcoming their drawback of higher fuel consumption. The SAAB 2000 presented good performance and advanced manufacturing technology at that time. However, developing a product not welcomed by the market could cause many companies to go bankrupt. EMBRAER managed well to survive sales fiasco of its CBA-123 and offered the right product at the right time, thus becoming the third-largest aircraft manufacturer in the world. This can be credited to the growth of regional networks triggered by ADA. With the passage of time, the regional airline market became more sophisticated and EMBRAER was able to successively and quickly offer new airliners with increased comfort and performance.

The present market of aircraft below 120 seats is almost exclusively shared between EMBRAER and Bombardier. However, new entrants like Mitsubishi and Sukkoi are offering products in the 90-120 passenger range. EMBRAER and Bombardier are survivors of an intense competition in the regional aviation market. Many regional airplane manufacturers went bankrupt in the 1990s. Table 5 summarizes the fate of some regional airplane manufacturers that went out of business.

| Company | Airplanes for the regional market | Possible causes |

|---|---|---|

| McDonnell Douglas | MD-95 (Boeing 717) | Slow sales of the MD-10/11 and Boeing 717 airliners |

| Fokker | Fokker 50/70/100 | No profit selling its products. Due to losses sustained, the owner DASA did not invest any further money |

| Fairchild Dornier | Do 328/728 Jet | Low sales of the Do 328Jet associated with high costs and development troubles of the larger 728Jet |

| Jetstream | BAe 100/British ATP | Slow sales due to unsuited airplanes, which also presented high operational costs |

| SAAB | SAAB 340/2000 | Slow sales of the speedier SAAB 2000 |

| EMBRAER* | ERJ 145 E-Jets | Reconfigurations of the ERJ 145 twinjet and sales fiasco of the 19- seat CBA-123 turboprop |

| *Thanks to governmental support, EMBRAER was privatized in 1994 and recovered from the bankrupt situation |

Table 5: Regional airplane manufacturers that went bankrupt.

Above 150-seat airplane category, Boeing and Airbus dominate the market. These companies and others also disclose annually their air traffic volume forecasts and demand for aircraft (market outlook) in a time of a 20-year window. This type of prediction has several important practical applications. It helps aircraft manufacturers to shape strategies of their products, and provides guidelines for longterm business planning. The company Boeing, in particular, has shared its forecast with the public since 1964 in order to help airlines, suppliers and the financial community to make informed decisions. Table 6 shows the market forecast of the company Boeing Co. for several categories of airliners [16]. The largest share in terms of monetary value is for single-aisle airplanes, airplanes in the range 130-220 seats. The category with business monetary volume is the regional jet one, with US $ 80 billion.

| Airplanes in service | Market outlook | ||||

|---|---|---|---|---|---|

| 2012-2032 | 2013-2032 | ||||

| Configuration | 2012 | 2032 | Configuration | New airplanes | Value (US$B) |

| Two aisles and large cross section | 780 | 910 | Two aisles and large cross section | 760 | 280 |

| Two aisles and average-size cross section | 1.520 | 3.610 | Two aisles and average-size cross section | 3.300 | 1.090 |

| Two aisles and small cross section | 2.310 | 5.410 | Two aisles and small cross section | 4530 | 1.100 |

| Single aisle | 13.040 | 29.130 | Single aisle | 24.670 | 2.290 |

| Regional jets | 2.260 | 2.180 | Regional jets | 2.020 | 80 |

| Total | 20.310 | 41.240 | Total | 35.280 | 4.840 |

Table 6: Market outlook issued by Boeing Co. (Source: Boeing Co.).

Deregulation and Embraer’s Fortune

The Bandeirante EMB-110 era

The aircraft manufacturing industry in Brazil took a long time to put down roots. After several failed attempts to create a strong aeronautical industry in Brazil, a new attempt was undertaken with EMBRAER in the sixties. EMBRAER already had a competitive product, the twin-engine turboprop Bandeirante EMB-100 (Figure 19). Bandeirante was designed and built at Centro Técnico de Aeronáutica (CTA) in São José dos Campos, Brazil. CTA was a military research center of the Brazilian Air Ministry. Previous attempts to design and build aircraft in Brazil failed or had little success, primarily because only outdated aircraft were built, which had no possibility of exportation.

Exportation on a large scale is imperative for the success of any aircraft industry to develop and manufacture commercial aircraft, considering that domestic demand is not sufficient to keep a modern factory economically running, mainly in Brazil. For instance, in the beginning of 2015, there were 85 EMBRAER E-Jets in the Azul Linhas Aéreas fleet, according to the Website Airfleets.net. Azul is the single operator of the type in Brazil. Considering that EMBRAER delivered 1,090 E-jets by January 2015 [17], it can be noted that there is only a small fraction of the E-jets in the Brazilian market. Thus, it would be a commercial failure if that company depended only on the domestic market in Brazil to sell its E-jets. EMBRAER was founded with a competitive product in its portfolio: the Bandeirante turboprop that had been developed in Brazilian Airspace Technical Center (CTA). Would Bandeirante have any chance on the international market?

EMBRAER began operations in January 1970, having been founded in August of the previous year. While the prototype of the Bandeirante (EMB-100) was on flight trials, the design team was making necessary changes and adaptations that would affect the third prototype. Despite the good performance of the Bandeirante, the market had changed since the beginning of its development and some redesign was needed. For example, the cabin providing accommodation for only eight passengers proved to be insufficient for the Brazilian Air Force - Força Aérea Brasileira (FAB) – as well as for airlines that showed interest in the type. Thus, the EMB-110C Bandeirante (Figure 20) was developed and later its Larger version EMB-110P (Figure 21). The EMB-110C twin turboprop was able to accommodate 12 passengers in the military version, and also had some important advances when compared with the first EMB-100 prototypes. For example, the EMB-110C version featured a retractable landing gear with wheels fully accommodated in the engine nacelle; the airplane was fitted with engines that are more powerful, a strengthened structure, and newer and streamlined engine nacelles that were incorporated into the configuration. The type was then designated C-95 by the Brazilian Air Force (Figure 20).

On August 9th, 1972, the first EMB-110 Bandeirante left assembly line and carried out runway tests. The first flight took place on August 19th, 1972, the date of the third anniversary of EMBRAER. The certification of the EMB-110 CTA came in December of that year. In February 1973, FAB commissioned its three first Bandeirantes [16]. Transbrasil received its first Bandeirante on April 11 of that year. The Transbrasil order for the type had been placed just three months before that date. It was the first aircraft designed and built in Brazil to be operated by a Brazilian airline. The first commercial flight of the Bandeirante took place on April 16th, 1973, in Southern cities. The reliable Pratt & Whitney PT6-34 turboprop was selected for Bandeirante. This powerplant featured a very low maintenance cost and was a key factor to Bandeirante’s success. The Brazilian turboprop met the requirements of the regional airline market in the 1970s. Nevertheless, it was strongly regulated and subsidized by the federal government. The airplane was well received by the public and airlines. It was robust and of low operational cost.

Bandeirante attracted the interest of airlines after the first oil crisis in 1973, when the dramatic increase in fuel prices made the operation of many jet aircraft and larger airplanes in regional routes unprofitable. In 1975, EMBRAER exported the first Bandeirante: two units were sold to the Uruguayan Air Force [18]. On December 21, 1977, the Bandeirante airliner received certification of DGAC (Directorate General for Civil Aviation). On August 15th 1978, the Bandeirante received a type certificate issued by CAA UK, Civil Aviation Authority of that country (currently, European Aviation Safety Agency, EASA, is responsible for aircraft European certification). The first airline that operated Bandeirante outside Brazil was the French airline Air Littoral [18]. Despite these orders, sales on the civilian market were still not significant. The Brazilian Air Force had ordered 200 units of Bandeirante. This order would guarantee the production for a long time, but would not make EMBRAER viable in the long run. Thus, the Brazilian government offered incentives for companies that purchased EMBRAER shares and many governmental agencies also ordered the corporate version of Bandeirante. FAB made some production slots available for Brazilian airlines that had ordered the airplane.

The Bandeirante airliner was a competitive product on the international market and the big push came with the certification in the United States in June 1978, year of the Airline Deregulation Act. After winning the official approval of various countries, the company sought official approval of the United States FAA (Federal Aviation Administration). Table 7 revealed that deliveries of Bandeirante soared after 1978 [19].

| Year | 1972 | 1973 | 1974 | 1975 | 1976 | 1977 | 1978 | 1979 | 1980 | 1981 |

| Production | 0 | 13 | 26 | 36 | 50 | 26 | 36 | 50 | 65 | 61 |

Table 7: Yearly production rate of the twin-turboprop Bandeirante [19].

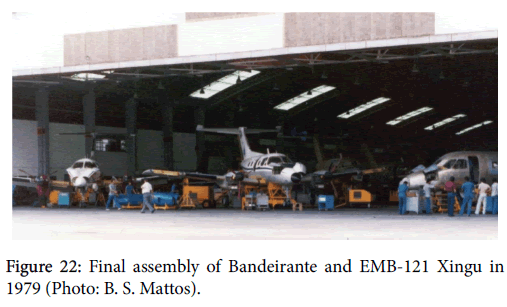

Figure 22 shows the final assembly line of Bandeirante in São José dos Campos. Two EMB-121 Xingus, an executive twin-turboprop, can be seen at left. The same wings of Bandeirante were basically employed for Xingu. The wings were slightly cut at the wingtip region for the executive airplane variant. With this approach, EMBRAER cut development costs and shortened the time-to-market of Xingu. Contrary to Bandeirante, Xingu fuselage was pressurized. Counting on help of United Technologies Group, EMBRAER introduced chemical machining to manufacture the component parts of its fuselage.

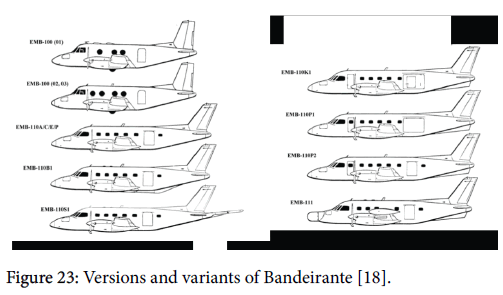

Thanks to increased orders and crescent interest, EMBRAER developed several versions and EMB-110 variants and brought them on the market, including a variant of maritime patrol (EMB-111) armed with rockets and equipped with search radar, which became known as Bandeirulha. Figure 23 shows various versions and variants of the Bandeirante. EMBRAER also carried out some conceptual studies for a jet variant of Bandeirante, which did not leave the drawing board (Figure 24).

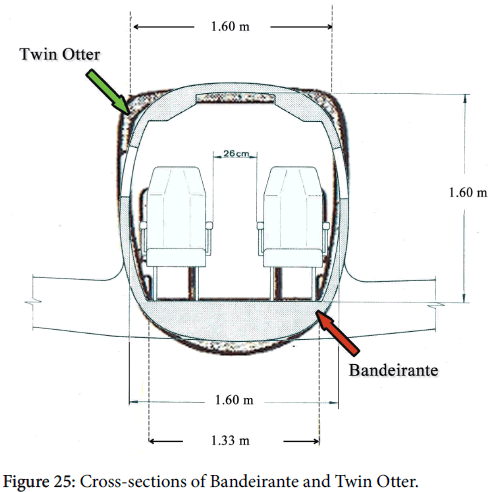

Bandeirante faced strong competition from other aircraft. One of the strongest competitors was the de Havilland Canada DHC-6 Twin Otter, which is a Canadian 19-passenger STOL (Short Takeoff and Landing) rugged utility aircraft developed by de Havilland Canada and currently produced by Viking Air [20]. The aircraft's fixed tricycle undercarriage, high wing, and high rate of climb have made it a successful cargo, regional passenger airliner and MEDEVAC aircraft [20]. In 1969, the Series 300 was introduced (Table 8), beginning with serial number 231 [20]. Both aircraft performance and payload were improved by fitting more powerful PT6A-27 engines [20]. This was a 680 hp (510 kW) engine that was flat-rated to 620 hp (460 kW) for use in the Series 300 Twin Otter. The Series 300 proved to be the most successful variant by far, with 614 Series 300 aircraft and their subvariants sold before production in Toronto by de Havilland Canada ended in 1988 [20]. Figure 25 compares the cross-sections of Bandeirante and Twin Otter, which are very similar.

| Bandeirante EMB-110C | Twin Otter Series 300 | |

| Passengers | 19 | 19 |

| MTOW (kg) | 5,670 | 5,670 |

| Empty weight (kg) | 3,393 | 3,363 |

| Cruise speed (km/h) | 341 | 278 |

| Service ceiling (m) | 6,550 | 7,620 |

| Range with 19 passengers (km) | 203 | 1,150 |

| Wingspan (m) | 15.3 | 19.8 |

| Motorization | 2 X PT6A-34 of 750 shp each | 2 X PT6A-27 of 680 shp each |

Table 8: Comparative data for EMBRAER Bandeirante and DHC Twin Otter airplanes [20].

By the end of the 1970s, the use of small airplanes on regional routes was not allowed in the United States. After several agreement attempts, FAA established the requirements for the operation of smaller aircraft in May 1978. As a result, EMBRAER needed a purchase order to start the certification process with FAA. On June 21, 1978, Robert Terry, president of Aero Industries, signed an order for three Bandeirantes to be operated by Aero Commuter, a subsidiary of that company. Thus, on August 18, 1978, the EMB-110P1 Bandeirante was officially certified by FAA [18]. The deregulation of the North American aviation industry enabled the emergence of several small airlines, many specializing in cargo transportation to major airports from small and midsize towns. Soon after FAA certification, Bandeirante began to be exported to many other countries. The great success of Bandeirante's sales abroad was one of the factors that led EMBRAER to set up a subsidiary in the United States, EMBRAER Aircraft Corporation (EAC), in Fort Lauderdale, Florida, in 1979. Production of the Bandeirante ceased in May 1990 after 500 units were produced. The last Bandeirante that left assembly line was delivered to the Brazilian Air Force.

EMBRAER product evolution

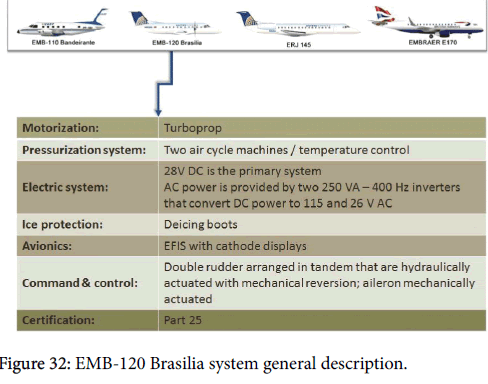

After the Bandeirante, EMBRAER brought the EMB-120 Brasilia twin-turboprop airliner to the regional aviation market. This airplane was considerably more sophisticated than Bandeirante and it was fitted with a pressurized cabin. Contrary to the Bandeirante certification odyssey, where certification in the U.S. took place five years after the Brazilian certification, EMBRAER received FAA certification for the EMB-120 airplane weeks after the type was certified in Brazil.

In the 1980s, EMBRAER’s joined Aeritalia and Aermacchi to develop AMX, an attack fighter bomber. Soon after, began the development of the highly successful EMB-312 Tucano advanced trainer. Meanwhile, the EMB-120 Brasilia twin turboprop gave EMBRAER international recognition. EMBRAER carefully analyzed data from extensive market surveys and took into consideration lessons learned from previous products to design Brasilia. After Brasilia started to book increasing sales, EMBRAER was on the battlefield again to search for a Bandeirante replacement. The Brazilian airplane manufacturer had conceived a regional turboprop family of airplanes. Previous concepts of the airplane originally designated EMB-123, involved the utilization of the same fuselage of EMB-121 Xingu. According to market surveys carried out by EMBRAER at that time, performance and comfort were strong drivers of the new commuter airplane. Thus, the successor of Bandeirante should utilize the larger fuselage of Brasilia, instead of the one with smaller cross section from Xingu. The search for high performance predominated in the definition of solutions adopted for the EMB-123, whose development began in 1986. The airplane should present a maximum cruising speed of 350 kts and service ceiling of 9,000 m, close to jets but offering lower operating costs. The configuration chosen by EMBRAER to meet all requirements was a twin-engine turboprop with the engines mounted at aft fuselage in pusher configuration. This way, the wings without nacelles put on them, should present improved liftto- drag ratio in the flight envelope envisaged for the airplane. Due to the creation of the South-American free-trade zone Mercosul, EMBRAER and the Argentinian Fabrica Militar de Aviones (FAMA) signed an agreement to jointly develop the EMB-123, which was redesignated CBA-123 (Figure 26), abbreviation for Cooperação Brasil-Argentina. Nevertheless, the Latin American debt crisis of the 1980s hit the Brazilian economy hard. By the early 1990s, unemployment topped record rates across the country. In addition, The CBA-123 did not attract interest from airlines and EMBRAER definitely cancelled the program in 1992. Because of all of this, EMBRAER debt rose enormously and the company reached an insolvency situation. The neoliberal government of Fernando Henrique Cardoso privatized EMBRAER on December 7, 1994.

In the post-privatization period, the company’s first product was the EMBRAER Regional Jet ERJ 145 (previously designated EMB-145), whose development started in the late 1980s. Originally developed under the government-controlled company, the aircraft later evolved into the ERJ-135/140/145 civilian aircraft family. In addition, the ERJ 145 airliner was the baseline aircraft for military variants: the EMB-145 AEW&C (airborne early warning and control), EMB-145 MULTI INTEL (Image intelligence), and EMB-145MP (Maritime patrol). EMBRAER also developed the EMB-314 Super Tucano counterinsurgency airplane in the late 1990s.

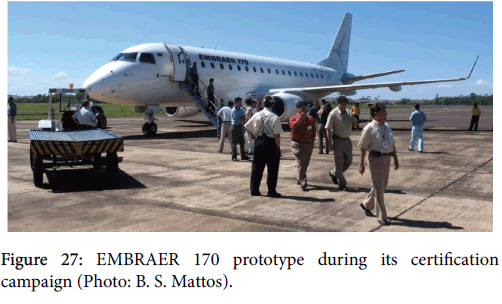

In the 2000s, EMBRAER portfolio grew significantly. Its commercial aviation arm experienced a large expansion with the introduction of the successful EMBRAER 170/175/190/195 airliners, known as E-Jets which present a high degree of communality among the airplanes. The first product of the family was the E170 (Figure 27), which entered service in 2004 with LOT, a Polish airline.

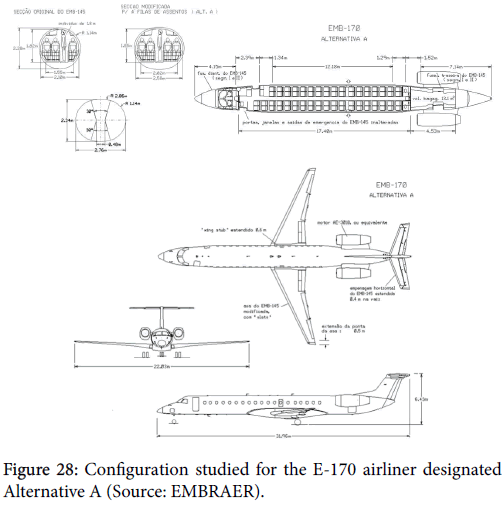

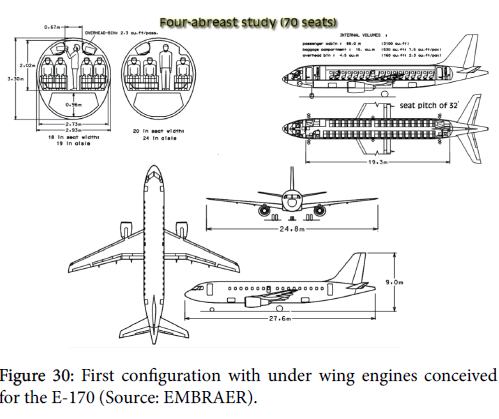

EMBRAER started studies on a 70-seat airliner in 1995. At that time, the airplane configuration was known as EMB-170, by 1999 being designated ERJ 170, after this EMBRAER 170 and finally E-170. In the very beginning, the utilization of the largest possible number of parts of the ERJ 145 was considered to reduce costs and development time. The first configuration studied by EMBRAER was designated internally Alternative A (Figure 28). The Alternative A fuselage was going to be composed of two parts of the ERJ 145 in a four-abreast configuration (The ERJ 145 features a three abreast seating arrangement). Two half-fuselage sections of ERJ 145 were going to be matched together in some way to produce an ellipse cross-section (Figure 28). The forward fuselage and the tail cone were going to be the same of the smaller 50-seat aircraft. The ERJ 145 wing was going to receive two segments, one at the tip and one at the root station, resulting into a wing with approximately 70 m2 of reference area. Allison AE3000 Series engines were initially considered to power the airplane.

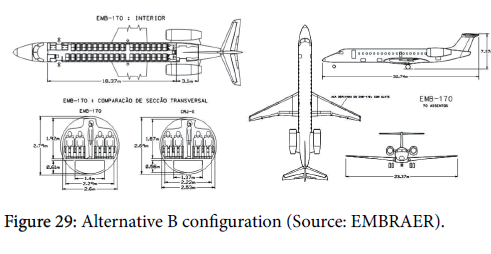

Due to the limitations of performance and comfort, Alternative A did not move forward. Thus, Alternative B (Figure 29), with a new circular fuselage with a four-abreast seating arrangement emerged. Different engines were considered to power the airplane, including one with short nacelles like those of Bombardier CRJ-700, which were supposed to be positioned at the rear fuselage. Although to some extent similar to the previous proposal, Alternative B was, in practice, a different airplane, no longer using most parts of the ERJ 145. The wing was conceived to be fitted with slats to improve field performance.

Even considering the production cost advantages of Alternative A and B, due to their performance limitations and the constraints to develop larger versions and variants they did not make a sufficiently attractive proposition. Thus, in August 1996, the first drawings of the new concept for a 70-seat jet emerged (Figure 30).

The concept departed radically from previous EMBRAER regional jets because the engines were placed in an underwing configuration and the fuselage cross section incorporated the shape of a double bubble, allowing both, an increased passenger cabin and cargo compartment volumes. Another great benefit was the reduction of turnaround time and the possibility of creating an aircraft family that could accommodate up to 110 seats. This configuration greatly resembled the E-170 in the current configuration but winglets, which were added later, and the larger forward fuselage, which was reshaped. EMBRAER goal was to offer a product that could compete with the Bombardier CRJ-700 in terms of Direct Operating Cost (DOC). The Bombardier’s airplane offers no room to transport cargo in compartments underneath the cabin floor, its thinner fuselage therefore producing lower drag. Larger cabin volume means greater aerodynamic drag and higher structural weight, resulting in higher fuel consumption, increasing the DOC. Thus, EMBRAER sized the cross section of its 70-seater accordingly to comply with the DOC requirement, while at the same time providing the greatest possible comfort to passengers.

On February 11, 1999, EMBRAER announced the launch of a program comprising the development of an aircraft family seating 70 to 110 passengers, but still subject to confirmation of a launch customer for the 70-seat airplane, the first to enter service. In June of that year, at Le Bourget Air Show, EMBRAER announced an initial sales agreement with Crossair, a Swiss regional carrier. At the time, the contract was valued at US$ 4.5 billion and contemplated 50 firm orders and 30 options for a 70-seat twinjet, then called ERJ 170; 50 firm orders and 30 options for a 108 passenger jet, called ERJ 190-200, plus 25 firm orders and 15 options for the smaller ERJ 145 regional jet.

The program was renamed ERJ 170/190, foreseeing a new form of management and the use of new and advanced engineering tools and new manufacturing processes. From the beginning, the program included the following: a fly-by-wire command and control system; a simultaneous development of the various models; a risk-partnership structure; aggressive performance requirements and deadlines. To meet the challenges, a multidisciplinary team with managers from different areas of the company was formed (core team) for the program management.

EMBRAER also started business in the executive jet market with the introduction of the Legacy 600 in 2001. By mid-August 2015, the Brazilian company marketed the Phenom 100, Phenom 300, Legacy 450, Legacy 500, and the Lienage 1000 business jets, the latter a variant of the E-190 airliner.

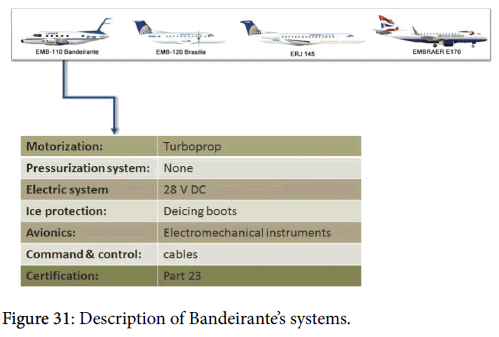

Figures 31 to 34 show the general aircraft system descriptions from Bandeirante to the EMBRAER 170 twinjet. Thus, the technological evolution of these airplanes can be somehow tracked. In fact, the Brazilian company was able to correctly capture the evolution of the regional aviation market, which was steadily demanding increased airplane capacity, performance, and more comfort to passengers. The innovation that EMBRAER brought to its product line was the incorporation of technologies that were already consolidated in larger airplanes.

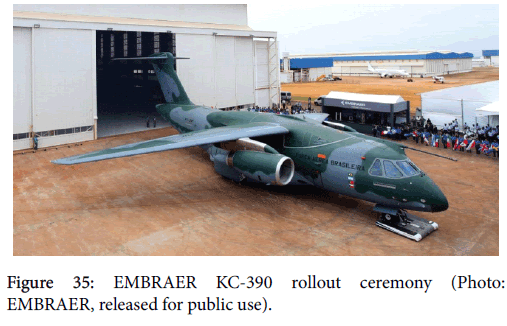

Although EMBRAER has suffered some setbacks with its intentions to expand into the U.S. defense market, the company has developed the KC-390 airlifter and tanker (Figure 35) under contract of the Brazilian Defense Ministry. This full fly-by-wire airplane powered by two IAE2500 turbofans will compete head-to-head with Lockheed Martin C-130H Super Hercules. KC-390 is capable of transporting large amounts of cargo and performs tanker missions, lifting a maximum of 23 tons at a distance of 1,400 nautical miles. Currently, the company is the third largest aircraft manufacturer in the world, with international offices or assembly lines in the United States, France, Portugal, China and Singapore. The progress after 1994 has been huge, with its E-Jets airliners recording more than 1,200 orders by late 2014.

Concluding Remarks

Aviation is an essential element of today's global society, bringing people and cultures together by moving more than 2 billion people annually worldwide, thus creating economic growth across the globe. Globally about 32 million jobs are dependent on air transport, out of which about 5.5 million are in the aviation industry. Aviation's global economic impact is estimated at US$ 3.560 billion representing 7.5% of the world Gross Domestic Product.

Regional carriers are intrisincally low-cost and they are facing strong competition from other types of low-cost carriers. However, the regional aviation is a strong business and will remain so, according to reports by the European Regions Association.

The impact of the Airline Deregulation Act of 1978 on the aviation, immigration and in particular on EMBRAER’s fortune was analyzed. The Airline Deregulation Act of 1978 was one of the most important events in the history of aviation. It reshaped the airport infrastructure, the aircraft industry, the way airlines do business, and the world population map. The commercial success of EMBRAER, which has lasted to the present day, can be credited to the airline Deregulation of 1978. There is a huge disproportion between commercial aircraft sold in Brazil by EMBRAER and those exported. Without the conquest of the aviation international market, the fate of EMBRAER would be different. Although the deregulation of the aviation sector was a key factor for EMBRAER success, the deregulation alone would not have been sufficient to keep the company aloft for so many years. The bankruptcy of many manufacturers of regional airplanes like Jetstream, Fokker, Fairchild Dornier, supports this assertion. In fact, the Brazilian company was able to correctly capture the evolution of the steadily more demanding regional aviation market. Its airplanes featured increased capacity, performance, and more comfort to passengers. The innovation brought by EMBRAER to its product line was the incorporation of technologies that were already mature in larger planes.

Finally it is worth mentioning that global warming is a fact and immediate actions to reduce its effects on the environment must be taken. In this context, there are some important moves of the European Union and NASA to research technologies that will enable more fuelefficient future aircraft with less noise and pollution levels. These moves are represented by the Clean Sky and ERA programs. The new generation of airliners has to incorporate technologies that enable them to burn less fuel, be quieter and less pollutant.

References

- Poole RW, Butler V (1998) The Airline Deregulation: the Unfinished Revolution. Tech. Report, Reason Public Policy Institute, Polict Study No. 255, Los Angeles, California.

- (2014) Air Passenger Forecasts Global Report. IATA, Oxford Economics, Oxford, UK.

- (2014) Aviation Benefits beyond Borders. Tech. Report, Action Trans Group (ATAG).

- (2014) The Economic Impact of Civil Aviation on U.S. Economy. Tech. Report, U.S. Department of Transportation.

- (2014) Japan Aircraft Defense Corporation. Worldwide Market Forecast 2014-2033. Tech. Report, Japan Aircraft Defense Corporation, Tokyo.

- Belobaba P, Hernandez K, Jenkins J, Powell R, Swelbar W (2011) Productivity Trends in the US. Passenger Industry 1978-2010. Tech. Report, MIT.

- Burghouwt G (2007) Airline Network in Europe and its implication for Airposrt Planning, Ashgate eBook, Burlington.

- Eunsuk Yang (2009) Design Methodology for Evolutionary Air Transportation Networks. PhD Thesis, School of Aerospace Engineering, Georgia Institute of Technology.

- Connell JFO, Williams G (2005) Passengers' perception of low cost airlines and full service carriers: A case study involving Ryanair, Aer Lingus, Air Asia and Malaysia Airlines. J Air Transport Management 11: 259-272

- Van der Zwan J (2015) Low-cost Carriers-Europe

- (2015) European Travel Network. Low Cost Airlines Graveyard-about fake or sponsored low cost airlines.

- (2015) Official Airline Guide. OAG Database Statistics July 2015. OAG, 2015. Available: [Accessed August 21st, 2015].

- (2014) European Regions Airline Association.The Case for Investing in the Regional Airline Industry. European Regions Airline Association, Surrey, UK.

- Ramsay M, Stamp J, Regueiro J, Richards D, McGilvery S (2013) 2013 Airline Disclosures Handbook. KPMG Consultancy, Switzerland.

- (1991) More than a Stretch-SAAB 2000 Described. Flight Magazine 11-17.

- Boeing Co (2012) 2012 Market Outlook.

- EMBRAER (2015) EMBRAER entrega 30 jatoscomerciais e 52 executivos no 4º trimestre de 2014, EMBRAER Press Release: January 13th, São José dos Campos, Brazil.

- Mattos BS (2003)Historia da Aviacao: o EMBRAER Bandeirante. ABCM Engenharia 9: 31-37.

- Saraiva LC, Bernsmuller M, Bernsmuller G, de Oliveira Neto N,et al. EMBRAER EMB-110 Bandeirante- Lista de Producao (naoOficial)

- Wikipedia (2015) de Havilland Canada DHC-6 Twin Otter. Wikipedia.

Relevant Topics

- Advance Techniques in cancer treatments

- Advanced Techniques in Rehabilitation

- Artificial Intelligence

- Blockchain Technology

- Diabetes care

- Digital Transformation

- Innovations & Tends in Pharma

- Innovations in Diagnosis & Treatment

- Innovations in Immunology

- Innovations in Neuroscience

- Innovations in ophthalmology

- Life Science and Brain research

- Machine Learning

- New inventions & Patents

- Quantum Computing

Recommended Journals

Article Tools

Article Usage

- Total views: 36502

- [From(publication date):

September-2016 - Apr 01, 2025] - Breakdown by view type

- HTML page views : 35145

- PDF downloads : 1357