Economic Assessment of PV Investments in Jordan

Received: 13-Nov-2017 / Accepted Date: 22-Nov-2017 / Published Date: 29-Nov-2017 DOI: 10.4172/2576-1463.1000159

Abstract

Energy has been considered as one of the most important merchandises for the countries as it is related to the prosperity and the development of the countries. Nowadays, the investment in renewable energy resources became an attractive option with bright and optimistic future of such investment. Jordan is a Mediterranean country that has high protentional of renewable energy resources especially solar resources which makes the investment in solar projects in Jordan attractive in the presence of supportive governmental regulations. This study aims to assess the economics of PV power plant investments in different regions in Jordan in order to specify the best regions for such investment. The results indicate that the investment in PV projects is profitable in all the regions where Ma'an is the best region in Jordan for PV projects with NPV of 1531.7 USD/KWp and LCOE of 0.0916 USD/KWh.

Keywords: PV Systems; Energy economics; Sustainability; Renewable energy; PVGIS software

Introduction

Energy is one of the most vital merchandises for the civilizations since it is considered as the engine for the economic growth as well as the development of the communities. The tremendous population growth and the change in the lifestyle of the people caused a massive increase in the energy demand which in return caused the increase in the energy prices [1]. Conventional energy sources have limited reserves; therefor, governments seek to find alternative energy resources that can ensures the energy security of their countries. Solar energy is one of the renewable energy resources that can be a suitable alternative of conventional energy systems as it is abundant and can be utilized in affordable ways.

The investment in renewable energy projects became popular these days with the significant decrease in the prices of the utilization technologies as well as the legislations of supportive laws. Jordan is one of the developing countries in Middle East that spends almost 20% of its gross domestic product on importing the energy causing a serious challenge for the government [2]. The government starts to promote the investment in renewable energy projects by legislating attractive laws such as feed in tariff and Independent Power Producers Laws (IPP) (“Jordan Electric Power Company” 2017).

Photovoltaic power plants are one of the suitable projects in Jordan as it is characterized by its sunny climate with an average of 300 to 330 sunny days with high potential of solar energy [3,4] as it is located within the solar belt [5]. Several studies in the literature assessed the installation of PV systems in Jordan as separate and as hybrid system. For instance, Al-Salaymeh et al. [6] studied the techno-economic feasibility of both on-grid and off-grid PV system for household use in Amman, Jordan. They concluded that the installation of PV system is not economically feasible without supportive regulations such as feed in tariff. Furthermore, Al-Soud and Hrayshat [7] analyzed the first stage of rural PV electrification program which was launched in 2002 in Jordan to provide nine houses with PV systems to meet the lighting, radio and television demand. They concluded that the PV system was satisfactory to the customers based on the house owner’s feedback. Moreover, Al-assad and Ayadi [8] assessed the economic feasibility of a grid-tied PV system to cover the demand of University of Jordan. They concluded that a 15.03 MW fixed PV system is the best solution from economic point of view with net present value of 35.7 million JD and a payback period of 2.9 years.

In addition, OkonKWo, OKWose, and Abbasoglu [4] studied the technical and economic feasibility of installing an off-grid PV/wind hybrid system to meet the demand of a hotel in Jordan and compared it with an on-grid system using HOMER software. They concluded that 20 KW PV system and 10 KW wind turbine can meet the demand of the hotel where the on-grid system have higher economic profits. Moreover, Al-Ghussain, Taylan, and Fahrioglu [1] made a study to determine the optimal size of a hybrid PV/wind-oil shale system in Al- Tafilah Jordan. They concluded that a system with 3.5 MW PV, 6 MW wind turbines and 12 MW oil shale system without energy storage system can meet 87.2% of Al-Tafilah city demand with net present value of 34.8 million USD and a payback period of 4.8 years.

This study aims to determine the most suitable regions in Jordan for PV investment by assessing the economics of the installation of PV systems in 21 regions in Jordan. PVGIS online software is used to estimate the yearly energy production from the PV power plants in the 21 regions. Net Present Value (NPV), Internal Rate of Return (IRR), simple Payback Period (PBP) and Levelized Cost of Electricity (LCOE) are the economics parameter used to assess the economics of the projects while the annual capacity factor is used to assess the technical feasibility.

Theory And Methodology

Energy production from PV system

Photovoltaic Geographical Information System (PVGIS) online software [9] provides the solar radiation- Global Horizontal Irradiation (GHI)- of the selected regions and it can be used to estimate the electrical energy from PV systems where the software takes into consideration all the systems' losses including: wiring, inverter and temperature losses and also take into consideration the optimal geometry of the PV panels. As aforementioned, the economic and technical assessments of the PV projects were done for 21 regions in Jordan. Table 1 shows the geographical information as well as the global irradiation on a horizontal surface for the 21 regions in Jordan.

| Region | Altitude (m) | Latitude (degree) | Longitude (degree) | GHI (KWh.m-2) |

|---|---|---|---|---|

| Amman | 776 | 31.93 | 35.92 | 6.14 |

| Irbid | 564 | 32.55 | 35.833 | 6.25 |

| Al-Salt | 795 | 32.05 | 35.72 | 6.19 |

| Al-Zarqa | 608 | 32.05 | 36.08 | 6.3 |

| Madaba | 789 | 31.72 | 35.78 | 6.38 |

| Kerak | 995 | 31.17 | 35.7 | 6.3 |

| Ma'an | 1120 | 30.18 | 35.72 | 6.77 |

| Al-Shobak | 1356 | 30.51 | 35.55 | 6.41 |

| Al-Tafilah | 1048 | 30.83 | 35.6 | 6.25 |

| Wadi Rum | 1000 | 29.53 | 35.4 | 6.66 |

| Aqaba | 29 | 29.52 | 35 | 6.79 |

| Al-Mafraq | 705 | 32.33 | 36.2 | 6.27 |

| Ajloun | 760 | 32.32 | 35.75 | 5.95 |

| Jerash | 559 | 32.27 | 35.88 | 6.25 |

| Al-Jafer | 859 | 30.3 | 36.18 | 6.71 |

| Al-Judayyidah | 792 | 32.53 | 35.65 | 6.49 |

| Kufr Rakeb | 529 | 32.45 | 35.68 | 6.05 |

| Na'ur | 904 | 31.87 | 35.82 | 6.27 |

| Dhiban | 714 | 31.48 | 35.77 | 6.33 |

| Al-Husun | 651 | 32.48 | 35.87 | 6.16 |

| Al-Mdayrej | 1483 | 30.35 | 35.97 | 6.49 |

Table 1: The geographical information of the selected regions in Jordan in addition to the average daily global radiation on a horizontal surface.

Economic assessment of PV system

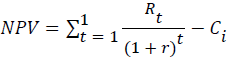

Investors in energy sectors aim to gain profits from their investments and in order to facilitate the selection process between the projects, investor usually use quantitative parameters such as net present value (NPV), payback period (PBP) and internal rate of return (IRR). From an investor point of view, the project with higher NPV, higher IRR and lower PBP is the most attractive. NPV and PBP can be calculated using Eq. (1) and Eq. (2) while IRR is equals to discount rate at which the NPV of the projects equals to zero.

(1)

(1)

where is the net present value of the PV project [USD/KWp], is the annual revenues of the PV project [USD/KWp], is the annual discount rate, is the lifespan of the system [years] and the capital cost of the PV project [USD/KWp].

PBP = Ci / Rt1 (2)

Where PBP is the payback period of the PV project [years] and Rt1 is the revenues of the PV project in the first year [USD/KWp].

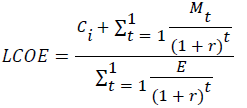

The levelized cost of electricity (LCOE) which represent the cost of energy produced by the energy system is one of the economic parameters that is used in the energy sector. The LCOE gives an indication on how attractive is the investment compared with other energy projects and compared with the price of electricity in the region. The project with LCOE lower than the price of electricity is considered as an attractive one and the lower the LCOE the more attractive the project is. The LCOE can be calculated as Eq. (3).

(3)

(3)

Where LCOE is the levelized cost of electricity [USD/KWh], is the annual maintenance cost [USD/KWp] and is the annual energy production from the PV power plant [KWh/KWp].

Performance assessment of PV system

The annual capacity factor of the PV power plant is used to assessed its performance where it can be calculated using Eq. (4).

CF=E/365 × 24 (4)

where CF is the annual capacity factor of the PV power plant [%].

All the economic parameters in addition to the CO2 intensity of electricity in Jordan used in this study are listed in Table 2.

| Parameter | Value |

|---|---|

| PV System Capital Cost (USD/KW) | 1533 |

| PV System Annual Maintenance Cost ($/KW) | 24 |

| Feed in Tariff (USD/KWh) | 0.17 |

| Annual Discount Rate (%) | 8 |

| System's Lifespan (years) | 25 |

| CO2 intensity of electricity (kg/KWh) | 0.672 |

Table 2: The economic parameters of the PV systems as well as the CO2 intensity of electricity in Jordan [10-15].

Results and Discussion

The economics of the PV power plant depend highly on the geographical location of the project due to the variation in the solar resources as well as the ambient conditions since they affect the energy production. Investors prefer projects with the highest economic profits; therefore, a comparison between the economics of PV power plants in different regions in Jordan is carried out as shown in Table 3.

| Region | E (KWh/KWp) | LCOE (USD/KWh) | NPV (USD/KWp) | PBP (years) | IRR (%) | CF(%) | Rco2(tons/KWp) |

|---|---|---|---|---|---|---|---|

| Amman | 1660 | 0.101 | 1223.2 | 6.41 | 16.47 | 18.95 | 1116 |

| Irbid | 1690 | 0.0992 | 1277.7 | 6.29 | 16.82 | 19.29 | 1136 |

| Al-Salt | 1670 | 0.1004 | 1241.4 | 6.37 | 16.59 | 19.06 | 1122 |

| Al-Zarqa | 1690 | 0.0992 | 1277.7 | 6.29 | 16.82 | 19.29 | 1136 |

| Madaba | 1720 | 0.0974 | 1332.1 | 6.17 | 17.18 | 19.63 | 1156 |

| Kerak | 1710 | 0.098 | 1314 | 6.21 | 17.06 | 19.52 | 1149 |

| Ma'an | 1830 | 0.0916 | 1531.7 | 5.77 | 18.46 | 20.89 | 1230 |

| Al-Shobak | 1750 | 0.0958 | 1386.6 | 6.05 | 17.53 | 19.98 | 1176 |

| Al-Tafilah | 1710 | 0.098 | 1314 | 6.21 | 17.06 | 19.52 | 1149 |

| Wadi Rum | 1790 | 0.0936 | 1459.1 | 5.91 | 17.99 | 20.43 | 1203 |

| Aqaba | 1770 | 0.0947 | 1422.8 | 5.98 | 17.76 | 20.21 | 1189 |

| Al-Mafraq | 1690 | 0.0992 | 1277.7 | 6.29 | 16.82 | 19.29 | 1136 |

| Ajloun | 1600 | 0.1048 | 1114.3 | 6.68 | 15.76 | 18.26 | 1075 |

| Jerash | 1680 | 0.0998 | 1259.5 | 6.33 | 16.71 | 19.18 | 1129 |

| Al-Jafer | 1800 | 0.0931 | 1477.3 | 5.87 | 18.11 | 20.55 | 1210 |

| Al-Judayyidah | 1750 | 0.0958 | 1386.6 | 6.05 | 17.53 | 19.98 | 1176 |

| Kufr Rakeb | 1630 | 0.1028 | 1168.8 | 6.54 | 16.12 | 18.61 | 1095 |

| Na'ur | 1670 | 0.1004 | 1241.4 | 6.37 | 16.59 | 19.06 | 1122 |

| Dhiban | 1710 | 0.098 | 1314 | 6.21 | 17.06 | 19.52 | 1149 |

| Al-Husun | 1700 | 0.0986 | 1295.8 | 6.25 | 16.94 | 19.41 | 1142 |

| Al-Mdayrej | 1780 | 0.0942 | 1441 | 5.94 | 17.88 | 20.32 | 1196 |

Table 3: The energy production from the PV power plant in different regions in Jordan in addition to their economic and technical parameters.

It can be clearly seen from Table 3 that the investments in all the regions in Jordan are profitable since they have NPV larger than zero and LCOE lower than the feed in tariff. Moreover, notice that Ma'an followed by Al-Jafer has the highest energy production and so the highest economic benefits which make them the most preferable regions for investment in PV projects.

Conclusion

The investments in renewable energy projects became more favorable for investors due the existence of high potential profits. Jordan has legislated new laws in order to promote for the investments in renewable energy sectors. Jordan is located within the solar belt region with high solar radiation which makes the investments in solar energy attractive. This study aims to assess the economics of PV power plant in 21 regions in Jordan where the energy production from the PV systems was estimated using PVGIS online software. The simulation results indicate that the investment in PV projects in all the regions is profitable where Ma'an is the best region for PV investments in Jordan with NPV of 1531.7 USD/KWp, LCOE of 0.0916 USD/KWh, IRR of 18.46% and a PBP of 5.77 years.

References

- Al-Ghussain, Loiy, Taylan O, Fahrioglu M (2017) Sizing of a PV-Wind-Oil Shale Hybrid System: Case Analysis in Jordan. J Solar Energy Eng: Including Wind Energy and Building Energy Conservation.

- Essalaimeh S, Al-Salaymeh A, Abdullat Y (2013) Electrical Production for Domestic and Industrial Applications Using Hybrid PV-Wind System. Energ Convers Manage 65: 736-743.

- El-Tous Y, Al-Battat S, Abdel HS (2012) Hybrid Wind-PV Grid Connected Power Station Case Study : Al Tafila, Jordan 3: 605-616.

- Hrayshat ES (2008) Analysis of Renewable Energy Situation in Jordan. Energy Sources, Part B: Economics, Planning and Policy 3 (1): 89-102.

- OkonKWo, CheKWube E, OKWose CF, Abbasoglu S (2017) Techno-Economic Analysis of the Potential Utilization of a Hybrid PV-Wind Turbine System for Commercial Buildings in Jordan. Int Journal Renew Energ Research 7: 908-914.

- Al-Salaymeh A, Al-Hamamre Z, Sharaf F, Abdelkader MR (2010) Technical and Economical Assessment of the Utilization of Photovoltaic Systems in Residential Buildings: The Case of Jordan. Energ Convers Manage 51: 1719-1726.

- Al-Soud MS, Hrayshat ES (2005) Rural Photovoltaic Electrification Program in Jordan. J Assoc Arab Univ Basic Appl 46: 21.

- Al-assad, Rami, Ayadi O (2017) Techno-Economic Assessment of Grid Connected Photovoltaic Systems in Jordan. In the 8th International Renewable Energy Congress (IREC 2017) 0-4.

- Fichter T, Trieb F, Moser M, Kern J (2013) Optimized Integration of Renewable Energies into Existing Power Plant Portfolios. Energy Procedia 49: 1858-1868.

- Sangster, Alan J (2014) Solar Photovoltaics. Green Energ Technol 194: 145-172.

- http://www.jepco.com.jo/jepco/index.php?option=com_content&view=frontpage&Itemid=1&lang=en

- Jaber JO, Al-Sarkhi A, Akash BA, Mohsen MS (2004) Medium-Range Planning Economics of Future Electrical-Power Generation Options. Energy Policy 32: 357-366.

- Breu FX, Guggenbichler S, Wollmann JC (2003) Carbon Dioxide Intensities of Fuels and Electricity for Regions and Countries. IPCC. Vol. 5.

Citation: Al-Ghussain L (2017) Economic Assessment of PV Investments in Jordan. Innov Ener Res 6: 159. DOI: 10.4172/2576-1463.1000159

Copyright: © 2017 Al-Ghussain L. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Select your language of interest to view the total content in your interested language

Share This Article

Recommended Journals

Open Access Journals

Article Tools

Article Usage

- Total views: 8525

- [From(publication date): 0-2017 - Nov 14, 2025]

- Breakdown by view type

- HTML page views: 7546

- PDF downloads: 979