Economic and Financial Effects of the 1918-1919 Spanish Flu Pandemic

Received: 02-Nov-2020 / Accepted Date: 17-Nov-2020 / Published Date: 24-Nov-2020 DOI: 10.4172/2332-0877.1000439

Abstract

The 1918-1919 Spanish Flu represented the biggest worldwide health threat prior to the 2020 coronavirus pandemic. Although its mortality effects have been widely studied, much less has been done to assess its economic and financial impact. This mini review incorporates findings from recent studies of the Spanish Flu’s effect on economic performance and stock market performance in the United States and worldwide. Although US impacts may have been very short-lived, more pervasive effects seem evident in other countries. It also appears that contemporary stock market participants reacted significantly, and negatively, to the surging death rates that were seen during the Spanish Flu.

“In the year nineteen eighteen

We’re killed by the disease called influenza

Which finished our beloved relatives

Mothers, fathers, sisters and brothers

In other households no one was left

It took young women and men

It chose the beautiful ones

It even took the good looking men

It took the teenagers

It took even the young maidens

It took the engaged ladies

It took the strummers (bridesmaids)

Even the grooms

It was like there was a black cloud over the earth”

(First stanza of “Influenza 1918” by Reuben Tholakele Caluza -- as presented in English translation by Okigbo, p. 96)

Keywords: Spanish flu; Economic performance; Stock markets; Europe; United States

Introduction

There remains much uncertainty regarding the full impact of the 1918-1919 pandemic widely referred to as the “Spanish Flu.” Although there is now a consensus that it actually began at a US army base in Kansas in March 1918, estimates of its toll vary owing to difficulties in determining exactly how many of the recorded deaths were actually caused by the epidemic. It was clearly highly deadly, however. The flu was accompanied, for example, by the first decline in the population of England and Wales since records of civil registration began in 1837 – with the epidemic “stated to be a primary or contributory cause of death in 98,998 cases, or 41 per cent. of the total.” (Economist [1]). Meanwhile, US death rates in 1918 were 5-20 times above the levels consistent with standard seasonal influenza effects [2]. Unlike the usual pattern where the youngest and eldest cohorts are most vulnerable to epidemics, the Spanish Flu deaths tended to be concentrated in younger adults, with the peak effect being felt by those in their twenties and early thirties. In addition to the tragic human consequences, this meant that the Spanish Flu had a disproportionately high impact on the working population.

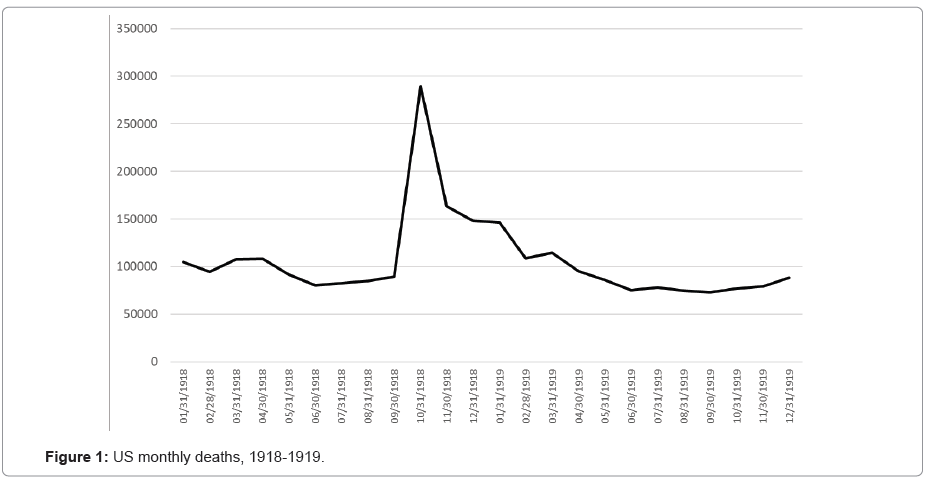

Although the Spanish Flu began in March 1918, its most deadly effects were concentrated under the second September-November 1918 wave – followed by a less serious, and final wave, experienced by many nations in early 1919. The pronounced fall 1918 spike in US death rates shown in (Figure 1) (data source [3]) was similar to the pattern experienced in most major European countries (see Burdekin [4]). Any assessment of its impact remains complicated by the fact that the peak virus deaths occurred while World War I was still in progress [5,6]. Continuing for some months after the Armistice of November 11, 1918, the remainder of the pandemic is then conflated with the effects of demobilization and a return to peacetime production.

Economic and Financial Effects on the United States

US output effects of the Spanish Flu appeared to be only transitory in nature and primarily reflected in a negative labour supply shock. Velde [7] uses high frequency data to show how this negative labour supply shock is confirmed by coal industry data, but finds that this impact was very brief and not accompanied by any major demandside or balance sheet effects. Although some familiar containment measures were applied, including closing churches, schools and places of entertainment, banning mass gatherings and requiring masks, the enforcement of these controls was uneven across the country and much shorter in duration than the lockdowns later employed in the face of the 2020 coronavirus. Restrictions were, in fact, rarely maintained for much more than a month (see Bootsma and Ferguson’s [8] Appendix). The war effort itself limited the potential restrictions in New York City given that it was the main departure point for troops heading to Europe – with President Woodrow Wilson insisting that transports continue even as the epidemic hit hard in October 1918 (Spinney [9], p. 104). Nevertheless, data on Major League Baseball attendance provides a window into the potential impact on leisure spending. Overall attendance fell by over 50% from 4,762,705 in 1917 to 2,830,613 in 1918 before more than doubling to 6,532,439 in 1919 after the pandemic came to an end [10].

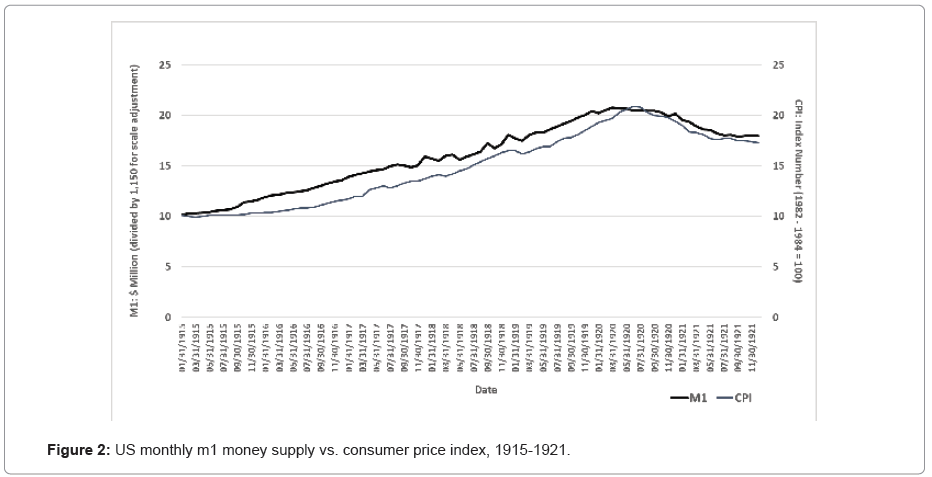

The possibility that the baseball data are indicative of a more far reaching pent-up demand could help explain the fact that, after the pandemic came to an end, rising bank loans financed a “speculative orgy of 1919” (Wicker [11], p. 236). Such bank loans add to the amount of money in circulation, in turn fueling inflation insofar as too much money ends up chasing too few goods. As shown in Figure 2, the acceleration in both US money supply and price increases through most of 1919 followed a slackening around the time of the second wave of the Spanish Flu in late 1918 (data from Friedman and Schwartz [12], pp. 708-711 and Global Financial Data). Although it is unclear whether the temporary pause was truly driven by effects of the epidemic, it is notable that the re-acceleration in money and price growth was delayed until March 1919 whereas the war ended in November 1918. Despite a number of cities removing their restrictions in October or November 1918, others such as Kansas City, Milwaukee, San Francisco, Spokane and St. Louis continued interventions into January or February 1919 [8].

Quantifying the International Effects

The US experience, where expansion resumed by March 1919, was not necessarily indicative of the experience in the rest of the world. Karlsson, Nilsson, and Pichler [13], for example, not only identify initial negative effects of the Spanish Flu on Swedish capital income but also find evidence of a sustained increase in poverty rates continuing after 1920. Whereas they do not find any initial significant effects on Swedish earnings, other countries may well have experienced wage declines as demand fell in the face of the pandemic. For Spain, which faced one of the highest death rates in Europe at 12.3 per thousand, Basco, Domènech and Rosés [14] find that the Spanish Flu’s effects were actually concentrated amongst wage rates – with short-lived negative declines of up to 15% in 1918. Guimbeau, Menon and Musacchio [15] identify long-term effects using data from the State of Sao Paulo in Brazil, suggesting carryover in the pandemic’s effects on literacy rates, in-patient hospital admissions and productivity that was still evident in 1940. More generally, Jordà, Singh and Taylor [16] find evidence of sustained reductions in real rates of return in the aftermath of the Spanish Flu as well as other pandemics.

Short-term effects of the Spanish Flu are assessed in Barro, Ursua, and Weng’s [17] analysis of how the deaths from the pandemic affected GDP, stock prices and inflation across 43 countries. Although they find no significant effects of the flu deaths on realized real returns on stocks, a significant negative effect on short-term government securities is identified in their analysis. Barro, Ursua and Weng [17] also find support for temporary inflationary effects combined with substantial declines in GDP and consumption. Their analysis is limited to annual data, however, thereby abstracting from the dramatic month-to-month fluctuations in the death rate that were especially pronounced around the October-November 1918 peak.

Burdekin [4] finds that the use of higher frequency monthly data, rather than the annual series employed by Barro, Ursua, and Weng [17], suggests that stocks may indeed have been significantly impacted by the pandemic. In order to assess the potential stock market effects of the rise in deaths during the three main waves of the epidemic (March 1918-March 1919), the year-on-year increase is calculated based on the monthly data on civilian deaths for each country (Bunle [18]; US Department of Commerce [3]). This is consistent with deaths stemming from the Spanish Flu being typically assessed in terms of “excess deaths,” meaning deaths above the norm from the pre-epidemic years [19,20]. By comparing each month’s value to its counterpart a year earlier, seasonal effects (such as typical increases in deaths during the regular flu season) are minimized. Combining US data with nine European countries for which both monthly death and stock market data are available for 1918-1919, the empirical results show the deaths variable to be statistically significant with the expected negative sign. Although the size of the implied stock market response to increased deaths is very small when evaluated at the mean, the stock market reaction at maximum deaths is several times higher than the average change in market returns over the 1918-1919 samples.

Conclusion and Qualifications

Despite the main effects of the Spanish Flu being concentrated at the time of the spike in the death rates in late 1918, international evidence suggests there may have been a generalized economic and financial impact. The negative impact was almost certainly exacerbated by wartime pressures facing the European economies, and to some extent the US economy, in 1918. Even neutral European nations were inevitably facing major supply-chain disruptions at the time. This may well have magnified the economic disruptions associated with the death rate amongst the civilian population and thereby factor into the negative stock market responses identified in Burdekin.

References

- Taubenberger JK, Morens DM (2006) 1918 influenza: 1918 Influenza: The mother of all pandemics,Emerging Infect Dis 12: 15-22.

- US Department of Commerce (1919-1921). Mortality Statistics. Washington, DC: Government Printing Office (various issues).

- Burdekin RCK (2021) Death and the stock market: International evidence from the spanish flu. Appl Econ Lett 1:9.

- Patterson KD, Pyle GF (1991) The geography and mortality of the 1918 influenza pandemic, Bulletin of the History of Med 65: 4-21.

- White LF, Pagano M (2008) Transmissibility of the influenza virus in the 1918 pandemic, PLoS One 3: e1498.

- Velde FR (2020) what happened to the us economy during the 1918 influenza pandemic? A view through high-frequency data,WP 2020-11, Federal Reserve Bank of Chicago (April 17).

- Bootsma MCJ, Ferguson NM (2007) The effect of public health measures on the 1918 influenza pandemic in U.S. cities, Proc Natl Acad Sci 104: 7588-7593.

- Spinney L (2017) Pale Rider: The Spanish Flu of 1918 and How It Changed the World. New York: Public Affairs. Population and dev rev 44: 843-845.

- Wicker ER (1966) A reconsideration of federal reserve policy during the 1920-1921 depression, J of Eco His 26: 223-238.

- Friedman M, Schwartz AJ (1963) A monetary history of the united states, 1867-1960. Princeton, NJ: Princeton University Press.

- Karlsson M, Nilsson T, Pichler S (2014) The impact of the 1918 spanish flu epidemic on economic performance in sweden: An investigation into the consequences of an extraordinary mortality shock J of Health Eco 36: 1-19.

- Basco S, Domènech J, Rosés JR (2020) The redistributive effects of pandemics: Evidence on the spanish flu, Centre for Economic Policy Res.

- Guimbeau A, Menon N, Musacchio A (2020) The brazilian bombshell? the long-term impact of the 1918 influenza pandemic the south american way. Nat Bureau of Eco Res.

- Jordà Ò, Singh SR, Taylor AM (2020) Longer-run economic consequences of pandemics. Nat Bureau of Eco Res.

- Barro RJ, Ursua JF, Weng J (2020) The coronavirus and the great influenza epidemic: Lessons from the ‘spanish flu’ for the coronavirus’s potential effects on mortality and economic activity.

- Burdekin RCK (2021) Death and the stock market: International evidence from the spanish flu. Appl Econ Lett 1:9.

- Ansart S, Pelat C, Boelle P-Y, Carrat F, Flahault A, et al. (2009) Mortality burden of the 1918-1919 influenza pandemic in europe, Influenza Other Respir Viruses 3: 99-106.

- Okigbo AC (2017) South african music in the history of epidemics, J Folklore Res 54: 87-118.

Citation: Burdekin RCK (2020) Economic and Financial Effects of the 1918-1919 Spanish Flu Pandemic J Infect Dis Ther 8: 439. DOI: 10.4172/2332-0877.1000439

Copyright: © Burdekin RCK. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Share This Article

Recommended Journals

Open Access Journals

Article Tools

Article Usage

- Total views: 2773

- [From(publication date): 0-2020 - Feb 22, 2025]

- Breakdown by view type

- HTML page views: 2157

- PDF downloads: 616