Review Article Open Access

An Evaluation of the First Five Years of China's Anti-Monopoly Law

Liyang Hou*Associate Professor, KoGuan Law School, Shanghai Jiao Tong University, China

- *Corresponding Author:

- Liyang Hou

Associate Professor

KoGuan Law School

Shanghai Jiao Tong University, China

Tel: +86 21 5474 0000

E-mail: liyang.hou@sjtu.edu.cn

Received Date: October 10, 2014; Accepted Date: November 28, 2014; Published Date: December 11, 2014

Citation: Hou L (2014) An Evaluation of the First Five Years of China’s Anti- Monopoly Law. J Civil Legal Sci 3:136. doi:10.4172/2169-0170.1000136

Copyright: © 2014 Hou L. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Visit for more related articles at Journal of Civil & Legal Sciences

Abstract

The Anti-Monopoly Law of the People’s Republic of China came into effective on 1 August 2008. The last five years have witnessed a great deal of progress made by the Chinese competition authorities. This article aims to evaluate the enforcement of the AML at its fifth anniversary. It first introduces the process of establishing competition authorities and the adoption of enforcing guidelines, and then provides an overview of public and private enforcement during the period between 2008 and 2013. An assessment of enforcement is not only reflective of some weaknesses of the law but also a level of dissatisfaction from the general public. An in-depth analysis is offered to underpin some key reasons for this general dismay. In the end, some general comments are offered.

Keywords

Anti-Monopoly; Enforcement; China

Introduction

The People’s Republic of China (hereinafter: China) adopted its Anti-Monopoly Law (hereinafter: AML) on 30 August 2007 and had it entered into effect on 1 August 2008 [1]. Due to China’s economic strength and growth, the AML, even before its adoption, has attracted much international attention. Until now almost five years have passed. Many have happened in the last years and the AML has gradually become an essential part of China’s legislative framework, as well as an integral part of the international competition community. In a sense, Chinese competition agencies have stood alongside with other important competition agencies, such as European Commission, Federal Trade Commission and Department of Justice of the USA. An interesting question would thus be raised how the AML was enforced in the last years, and to which extent it has affected the international community.

This article aims to provide an evaluation of the enforcement the AML for its first five years. In the following, the second part describes the institutional arrangements and the enforcing guidelines published until now. Subsequently, the third part gives an overview of the public enforcement of China’s competition authorities and the private enforcement before Chinese courts. Some problems will also be touched upon. An initial conclusion is that the AML was not enforced to a level that could meet the public expectation. Nevertheless, the fourth part takes a second consideration and identifies three underlying reasons that may justify such an unsatisfactory situation. In the end, the last part gives some general comments.

Institutional Developments

Modern competition law was arguable to originate from the Sherman Law of the USA in 1890 and afterwards the model of the Sherman Law was transplanted in other jurisdictions, including China. The main feature of the Sherman Law is that it contains only principles with no enforceable guidelines. While the selection of such a model has its historical background, another reason relates to the uncertainties of the interaction of competition law with other laws, such as property law, contract law and so on. Although the purpose of competition is generally accepted as maintaining competition on the market, its analysis has nevertheless been never crystal clear, which differentiates itself from, for example, continental civil law. Furthermore, competition law subjects all the anti-competitive conducts to the rule of reason, with a few of exceptions analysed according to the per se illegal rule. In other words, so long as companies can justify their act competition law does not apply. To make it more complicated, the evaluation of those justifications has always been changing mainly due to the evolving economics. By the reason of its rough provisions, competition law produces little certainties by itself, and hence its enforcement relies heavily on the secondary rules, ie guidelines [2]. There is no exception for China. Soon after the entering into effect of the AML, China’s competition authorities made most of their efforts in introducing enforcing guidelines. The following paragraphs first introduce the process of establishing competition authorities after the promulgation of the AML, and then give an overview of all the guidelines adopted by those authorities in the last five years.

Competition authorities

According to the AML, enforcing guidelines should be published by competition authorities. However, the AML in itself does not establish or appoint any competition authorities, and leaves the choice to the State Council of China (hereinafter: State Council). This was later proved to be a difficult process, and remained one of the factors to delay the process of enforcement.

The establishment of a competition authority or competition authorities was not an easy job. One of the main reasons was the fight among three ministries [3], ie the National Development and Reform Commission (hereinafter: NDRC), the State Administration of Industry and Commerce (hereinafter: SAIC), and the Ministry of Commerce (hereinafter: MOFCOM). Although the AML became effective only in 2008, China did have prototype competition rules dispersing in different legislations. The three authorities were roughly the former “competition authorities” active in different areas. During the pre-AML era, the NDRC, as a central planning authority, took charge of price-related regulation; the SAIC dealt with non-pricerelated anti-competitive market conducts or activities, such as tying; and the Mofcom was responsible to conduct merger control review involving international companies and cross-border transactions [4]. The fight for power began even before the adoption of the AML, and led to no winner. Only on 21 March 2008, almost seven months after the adoption of the AML, the State Council released the Notice on Institutional Establishment [5] based on the decision of the National People’s Congress of China. This notice in principle confirmed the traditional power division between the three authorities. Consequently, three competition authorities were designated, with the NDRC dealing with price-related monopolistic behaviour [6], the SAIC handling cases of non-price-related anti-competitive agreements, abusing dominance positions and abusing administrative power [7], and the MOFCOM reviewing concentrations [8]. The expectation of many scholars to establish a unified competition authority [9] was not materialised.

In addition to the three competition authorities, Article 9 of the AML also requires a formation of the Anti-monopoly Commission. This Commission, while having no enforcing competence, is responsible for coordinating and supervising competition authorities. Its launching process was not less difficult as sector-specific regulators’ interests were affected. Only on 28 July 2008, four days before the coming into effect of the AML, the State Council published the Notice on the Main Responsibility and Members of the Anti-monopoly Commission [10]. This Commission is composed not only of competition authorities but also sector-specific regulators. The then Vice Prime Minister of State Council, Mr. Qishan Wang, was appointed as the president, and the ministers of the three competition authorities plus Vice Secretary General of the State Council were appointed as vice presidents. Fourteen commissioners included vice ministers from fourteen ministries regulating economic affairs, including Ministry of Finance, Ministry of Industry and Information Technology (hereinafter: MIIT), State Intellectual Property Office, State Electricity Regulatory Commission, Ministry of Transport, etc. The involvement of such a big number of ministries leaves many uncertainties. The most noticeable one is how this Commission will effectively work. So far no specific information has been revealed. As will be indicated later, in the last five years what this Commission did was only to publish the Guide for the Definition of Relevant Markets [11].

Both the three competition authorities and the Anti-monopoly Commission have competence in adopting enforcing guidelines. In addition, two other bodies also enjoy such a competence, which are the State Council and the Supreme Court. The power of the State Council is derived from Article 56 of the Legislation Law [12]. The Supreme Court, on the other hand, cannot publish enforcing guidelines for any law in a strict sense. Nevertheless, it has the power to adopt judicial interpretations for laws that explain how Chinese courts should apply laws in specific cases [13]. These judicial interpretations in practice produce similar binding effects, and thus are considered as enforcing guidelines in this article.

Guidelines

Since the crude provisions of the AML cannot guarantee legal certainty, the first problem confronted by those authorities was to draft enforcing guidelines. This, as later suggested, consumed the most resources of those authorities in the first more than two years, i.e from August 2008 till end 2010. Although the State Council quickly released the Provisions on Thresholds for Prior Notification of Concentrations of Undertakings [14] two days after the entering into effect of the AML, no action was taken in the following almost ten months until May 2009 when the Anti-monopoly Commission published the Guide for the Definition of Relevant Markets [15-20]. Only afterwards other guidelines were gradually published (Table 1). The delay in setting up competition authorities (more or less one year) may account for this ten-month gap, which suggests that the Chinese government was not well prepared to enforce the AML. All the guidelines seemed to be drafted with no preparation in advance. After this silent period until Mid-2009, the number of guidelines increased steadily [21-26], with most guidelines published before the end of 2010. Until now the NDRC, the SAIC, the Mofcom and the Supreme Court all together promulgated 14 guidelines, with 6 from the Mofcom, 5 from the SAICI [27-30], 2 from the NDRC and 1 from the Supreme Court.

In addition to the guidelines listed in Table 1, more are in preparation. Three are of particular importance [31]. First, the SAIC is working on the Guide for Enforcing the AML in the Area of Intellectual Property, and requested feedbacks from invited parties on 19 April 2013 [32]. Secondly, the Mofcom recently published a draft Interim Provision on the Thresholds for Simple Cases of Concentrations for public consultation in April 2013 [33]. Thirdly, another document is under preparation also by the Mofcom is the Provision on Conditional Approval of Concentrations [34]. All of them are expected to be finished within 2013.

| Date of Publication | Effective Date | Issuing Bodies | Titles of Guidelines | Subject Matter |

|---|---|---|---|---|

| 3 Aug. 2008 | Same day | State Council | Provisions on Thresholds for Prior Notification of Concentrations of Undertakings [16] | Concentrations |

| 24 May 2009 | Same day | Anti-Monopoly Commission | Guide for the Definition of Relevant Markets [17] | Relevant Markets |

| 26 May 2009 | 1 Jul. 2009 | SAIC | The Provisions on the Procedure to Stop Acts of Abusing Administrative Power for Excluding or Limiting Competition [18] | Abusing Administrative Power |

| 26 May 2009 | 1 Jul. 2009 | SAIC | The Provisions on the Procedures to Investigate and Handle Cases of Monopolization Agreements and Abuse of Dominant Market Position19] | Anti-competitive agreements and Abuse |

| 15 Jul. 2009 | 14 Aug. 2009 | Mofcom | Measures for Calculating the Turnover for the Notification of Concentrations of Business Operators in the Finance Industry [20] | Concentrations |

| 15 Jul. 2009 | 1 Jan. 2010 | Mofcom | The Measures for the Undertaking Concentration Declaration [21] | Concentrations |

| 15 Jul. 2009 | 1 Jan. 2010 | Mofcom | The Measures for the Undertaking Concentration Examination [22] | Concentrations |

| 5 Jul. 2010 | Same Day | Mofcom | Interim Provisions on the Divestiture of Assets or Business in the Concentrations of Business Operators [23] | Concentrations |

| 29 Dec. 2010 | 1 Feb. 2011 | NDRC | Anti-price Monopoly Regulations[24] | Anti-competitive Agreements and Abuse |

| 29 Dec. 2010 | 1 Feb. 2011 | NDRC | Regulations on the Procedures Governing Administrative Enforcement of Anti-price Monopolies [25] | Anti-competitive Agreements and Abuse |

| 31 Dec. 2010 | 1 Feb. 2011 | SAIC | Regulation Concerning the Prohibition of Monopoly Agreements [26] | Anti-competitive Agreements |

| 31 Dec. 2010 | 1 Feb. 2011 | SAIC | Regulation Concerning the Prohibition of Abuse of Market Dominant Positions [27] | Abuse |

| 31 Dec. 2010 | 1 Feb. 2011 | SAIC | Regulation Concerning the Prohibition of the Abuse of Administrative Power to Eliminate or Restrict Competition [28] | Abusing Administrative Power |

| 29 Aug. 2011 | 5 Sep. 2011 | Mofcom | Interim Provisions on Evaluating the Impact of Concentrations of Business Operators on Competition [29] | Concentrations |

| 30 Dec. 2011 | 1 Feb. 2012 | Mofcom | Interim Measures for Investigating and Handling Failure to Legally Declare the Concentration of Business Operators [30] | Concentrations |

| 3 May 2012 | 1 Jun. 2012 | Supreme Court | Provisions on Several Issues concerning the Application of Law in the Trial of Civil Dispute Cases Arising from Monopolistic Conduct[31] | Private Enforcement |

Table 1: Guideline to enforce the AML (as of May 2013).

Enforcement and problems

The establishment of competition authorities and the adoption of enforcing guidelines are only preparation, and the enforcement is the goal. In the past years all the authorities, including the NDRC, the SAIC, the Mofcom and courts, in particular after having published their most important guidelines, has begun to enforce the AML. In the following their enforcement will be examined and evaluated.

SAIC’s enforcement: Although the AML became effective in 2008, the SAIC had already worked in these fields since 1999. Its early antitrust enforcement began in dealing with abusing dominant positions of public enterprises, and was gradually extended to handling cases of anti-competitive agreements and abusing dominant positions by international companies, and even interfered with some international merger cases [35]. After being appointed as one of the enforcing competition authorities, the SAIC acquires the power to review non-price related cases of anti-competitive agreements, abusing dominant positions and abusing administrative power to affect competition. It designates its power to the Anti-monopoly and Antiunfair Competition Enforcement Bureau [36]. In addition, the SAIC also delegates the power to its provincial agencies that is granted with the competence to deal with cases affecting their provinces [37].

Since the coming into effect of the AML, the SAIC nevertheless has never handled an antitrust case by itself. All the cases were dealt with by its provincial agencies. Until the end of 2012, 10 provincial agencies opened investigations in 18 cases, and issued infringement decisions in 8 cases. Almost all the 18 cases related to anti-competitive agreements but one abusing administrative power [38-43]. Attention should be paid to the fact that the SAIC and its provincial agencies are subject to no obligation of transparency. Consequently, all those decisions are not published [44-46]. As a result, this article only collects 7 decisions via public channels, as showed in Table 2.

| Time | Authorities | Cases | Conduct | Remarks |

|---|---|---|---|---|

| Aug. 2010 | SAIC Agency in Jiangsu Province | Concrete Cartel in Lianyungang City [39] | Market Allocation and Price Fixing | First Anti-monopoly case in China |

| 2010 | SAIC Agency in Jiangxi Province | Liquid Gas Cartel in Taihe County [40] | Market Allocation | Oral Agreements |

| 2011 | SAIC Agency in Guangdong Province | Abusing Administrative Power to Promote a Particular Brand of GPS by the Shenzhen Government [41] | Abusing Administrative Power | First and only case to apply the AML to administrative power |

| Jul. 2011 | SAIC Agency in Liaoning Province | Cartel Organised by a Cement Association [42] | Market Allocation and Price Fixing | First case to apply for re-evaluation by the Liaoning Government |

| Jan. 2012 | SAIC Agency in Henan Province | Second-hand Car Cartel in Anyang City [44] | Market Allocation and Price Fixing | |

| 2012 | SAIC Agency in Hunan Province | Car Insurance Cartel in Changsha City [45] | Market Allocation | |

| Nov. 2012 | SAIC Agency in Zhejiang Province | Concrete Cartel in Jiangshan City [46] | Market Allocation and Price Fixing | Oral Agreements |

Table 2: Overview of decisions of SAIC till early 2013.

NDRC’s enforcement: The NDRC is the price regulator in China, and is designated with the power to investigate price-related anticompetitive behaviour. This power is executed by the Bureau for Price Surveillance and Inspection and Antitrust [47-51]. Same as the SAIC, the NDRC also delegates the power to its provincial agencies. According to Mr. Kun Xu, director of the Bureau for Price Surveillance and Inspection and Antitrust, the NDRC and it provincial agencies have opened 49 investigations in the last more than four years, and imposed infringement decisions in 20 cases [52-55]. Nevertheless, similar to the situation for the SAIC, neither is there a transparency requirement for the NDRC. Consequently, those 20 infringement decisions are not published. This article only collects 6 of them, as indicated in Table 3.

| Time | Authorities | Cases | Prohibited Conduct | Remarks |

|---|---|---|---|---|

| 2010 | NDRC Agency in Hubei Province | A Salt Company Abusing its Dominance Position by Tying [49] | Tying the main product of salt with laundry power | |

| 2010 | NDRC Agency in Guangdong Province | The Anti-pest Association in Shenzhen City Fixing Prices[50] | The anti-pest association required its member to fix the retail price. | NDRC did not report whether it finally imposed an infringement decision [51]. |

| 2011 | NDRC | Two Pharmacies Monopolising price for Compound Reserpine [52] | The pharmacies engaged in price fixing and market allocation. | |

| 2012 | NDRC Agency in Guangdong Province | Sea Sand Cartel [53] | The Association of sea sand allied to increase price. | First case of leniency |

| 2013 | NDRC Agency in Guizhou Province | Resale Price Maintenance by Maotai Co [54]. | Maotai Co. restrained its dealers to sell liquor below agreed prices | Highest antitrust fine in history, up to 247 Million RMB |

| 2013 | NDRC Agency in Sichuan Province | Resale Price Maintenance by Wuliangye Co [55]. | Wuliangye Co. restrained its dealers to sell liquor below agreed prices | Antitrust fine up to 202 Million RMB |

Table 3: Overview of decisions of NDRC until early 2013.

Another factor accounting for the difference between the number of cases announced by the NDRC and the number collected by the article is that most of cases claimed by the NDRC were as a matter of fact handled under the Price Law [56], rather than the AML. For example, one of the eye-catching cases, “Price Fixing Cartel of Six International TV Producers”, was decided based on the Price Law [57]. Although it was a clear cartel case, the conduct concerned took place between 2001 and 2006 when the AML was not adopted. This may be a legitimate case to apply the Price Law. However, it is also observed that the NDRC applied the Price Law to antitrust cases even after the AML has been effective [58]. This cannot be justified. According to the Legislation Law [59], the AML is superior over the Price Law when applying to antitrust issues [60]. The NDRC’s preference over the Price Law in the last years implies its lack of confidence in enforcing the AML and thus chose the law that it ever applied for many years.

Dissatisfaction with SAIC’s and NDRC’s enforcement: Both the SAIC and the NDRC have authority to review cases of anti-competitive agreements, abusing dominant positions and abusing administrative power. The only difference is that the SAIC deals with non-pricerelated cases while the NDRC handles price-related cases. However, it is in practice rather difficult to differentiate price-related conducts from non-price-related ones. As observed from the cases decided by the two authorities, many cases involved both price and non-price related behaviour. The SAIC and the NDRC have not raised public conflicts with each other. In view of such a harmony, the following paragraphs discuss the problems regarding the two authorities’ enforcement together. The critics to their enforcement mainly come from the subsequent three perspectives.

First, at the time when the AML was adopted the public placed high expectation on applying the AML to state-owned enterprises. According to a survey designed by the Sina Website in 2007, 54.5 per cent of those surveyed considered that the most affected group by the adoption of the AML was state-owned enterprises [61]. However, the enforcement of the SAIC and the NDRC shows that most of the cases handled actually concerned small and media-sized undertakings’ behaviour with minor anti-competitive effects. This was mocked by some scholars as “antitrust with Chinese characteristics” [62].

Secondly, although the Chinese market has been opened for competition for about thirty years, more sectors are still tightly controlled by governments. The AML was originally viewed as an effective weapon to fight against abuses of administrative power to eliminate free competition [63]. However, the weapon equipped by the AML is ineffective. Once such an abuse has been confirmed, what competition authorities can do is only to suggest their supervisors of the administrative bodies concerned to correct the anti-competitive conduct concerned [64], and no direct punishment is available. The AML was thus criticised by Professor Wang as “a toothless tiger” when handling cases of abusing administrative power [65]. The enforcement was as a matter of fact very disappointing as in the last five years only one case of abusing administrative power emerged, ie the case “Abusing Administrative Power to Promote a Particular Brand of GPS by the Shenzhen Government” [66]. Moreover, it was unclear whether the reason why that local government finally decided to drop the proposal was due to the fear of the AML or strong public opposition.

Lastly, the AML is also criticised not to draw a clear borderline between industry-wide competition law and sector-specific regulation [67]. Due to historical reasons, many key industries, such as network industries, are only licensed to state-owned enterprises that currently occupy more than 20 per cent of China’s economy [68], and those enterprises hold close ties with administrative regulators [69]. This special feature, plus the complex relationship between competition law and sector-specific regulation [70], significantly limits the applicable scope of the AML. The NDRC surprised the whole world by initiating an investigation against China Telecom and China Unicom, two stateowned telecommunications companies [71]. However, it turned out that the investigation ended silently [72]. This conforms to an argument made years ago by Professor Li that “the AML is unlikely to effectively foster competition in China’s telecom industry” [73]. The enforcement in the last five years has not been able to answer this question.

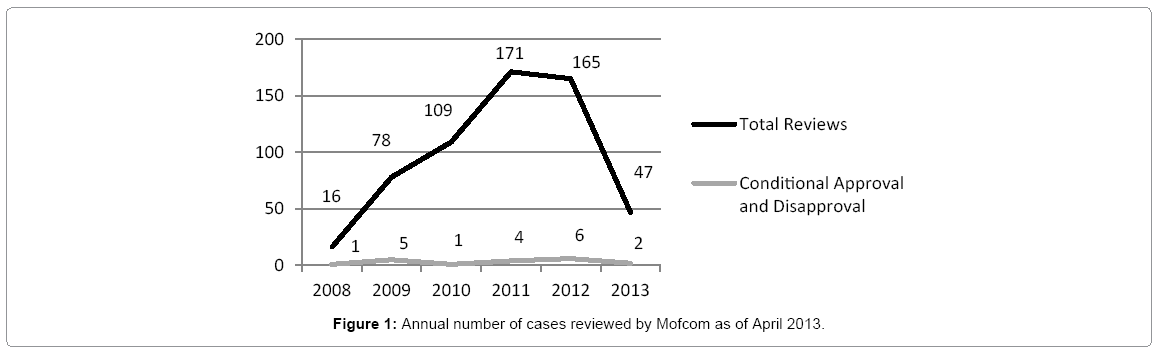

Mofcom’s enforcement and problems: Mofcom designates the authority for merger review only to the Anti-monopoly Bureau [74] and has not delegated this power to provincial bodies, which is different from the SAIC and the NDRC. According to Article 21 of the AML, mergers exceeding the thresholds must be pre-notified [75-80]. Based on the pre-notification obligation, Mofcom enjoys a wide edge over the SAIC and the NDRC in terms of the number of cases handled. As of the first quarter of 2013, Mofcom has reviewed 586 mergers, and adopted 18 conditional approval decisions and 1 disapproval decision.

Based on Figure 1, it can be observed that the number of case submitted annually has not reached maturity until 2011. Attention may be paid to another fact that the Mofcom adopted all its guidelines in 2011. The AML cannot be self-enforced without accompany of sufficient enforcing guidelines. Before reaching this point, most of merged entities hold a wait-and-see attitude due to the uncertainties. Starting from 2011, the number of notifications became stabilised, with 171 cases in 2011 and 165 cases in 2012. In 2013 the Mofcom has reviewed 47 cases within the first quarter, and thus it can be speculated that the number of cases reviewed for the whole year will be more or less the same as the previous two years.

As far as transparency is concerned, Article 30 of the AML requires Mofcom to publish all the decisions of conditional approval and disapproval. Consequently, Mofcom has published all the 18 conditional approval and 1 disapproval on its website [81-89]. Furthermore, Mofcom has been self-committed to offering more by promising to publish quarterly the information of unconditional approval cases starting from November 2012 [90-98]. Nevertheless, the information released by Mofcom only contains names of the merged entities and thus an in-depth analysis of unconditional approval cases is not possible [99-108].

As a general impression, the 19 cases comprised 13 horizontal mergers and 6 vertical mergers. Various types of remedies (both behavioural and structural) were chosen to clear anti-competitive concerns. The Mofcom has been able to adopt decisions with relatively more elaborate and detailed competition analyses in comparison with the less than half page decision in the first merger case, i.e Case Inbev/ Anheuser-Busch [109]. Moreover, two other positive observations can also be drawn from Table 4. First, most of the decisions were adopted after the European Commission had made a decision. Although it is unclear to what extent the Mofcom learned from the European Commission, it goes without doubt that the Mofcom did give courtesy to its international counterpart. Secondly, the Mofcom managed to remain independent when reviewing those worldwide mergers. Within 5 out of the 11 cases reviewed both by the Mofcom and the European Commission, Mofcom gave conditional clearance while the European Commission cleared them unconditionally. Although more in-depth examination has not been carried out, a preliminary conclusion may be reached that the particular market situations in China must be key for these differences.

| Notification | Acceptance | Decision | Cases | Merger Types | Remedies | European Commission |

|---|---|---|---|---|---|---|

| 10 Sep. 2008 | 27 Oct. 2008 | 18 Nov. 2008 | Inbev/Anheuser-Busch | Horizontal | Behavioural[79] | |

| 18 Sep. 2008 | 20 Nov. 2008 | 18 Mar. 2009 | Coca-Cola/Huiyuan | Horizontal | Negative [80] | |

| 22 Dec. 2008 | 20 Jan. 2009 | 24 Apr. 2009 | Mitsubishi Chemical Holdings/Mitsubishi Rayon | Horizontal | Structural [81] | Unconditional approval [82] |

| 18 Aug. 2009 | 31 Aug. 2009 | 28 Sep. 2009 | General Motors/ Delphi | Vertical | Behavioural[83] | Unconditional approval [84] |

| 9 Jun. 2009 | 15. Jun. 2009 | 29 Sep. 2009 | Pfizer/Wyeth | Horizontal | Structural [85] | Structural [86] |

| 21 Jan. 2009 | 30 Apr. 2009 | 30 Oct. 2009 | Panasonic/Sanyo | Horizontal | Structural [87] | Structural [88] |

| 20 Apr. 2010 | Same day | 13 Aug. 2010 | Novartis/Alcon | Horizontal | Behavioural[89] | Structural [90] |

| 14 Mar. 2011 | Same Day | 2 Jun. 2011 | Uralkali/Silvinit | Horizontal | Behavioural[91] | |

| 14 Jul. 2011 | 5 Sep. 2011 | 31 Oct. 2011 | Penelope/Savio | Horizontal | Behavioural[92] | |

| 13 Apr. 2011 | 16 May 2011 | 10 Nov. 2011 | General Electric/China Shenhua | Vertical | Behavioural[93] | |

| 19 May 2011 | 13 Jun. 2011 | 12 Dec. 2011 | Seagate Technology/The HDD Business of Samsung Electronics | Horizontal | Structural [94] | Unconditional approval [95] |

| 8 Aug. 2011 | 26 Sep. 2011 | 9 Feb. 2012 | Henkel Hong Kong/Tiande Chemical | Vertical | Behavioural[96] | |

| 2 Apr. 2011 | 10 May 2011 | 2 Mar. 2012 | Western Digital/Toshiba | Horizontal | Structural [97] | Structural [98] |

| 30 Sep. 2011 | 21 Nov. 2011 | 19 May 2012 | Google/Motorola | Vertical | Behavioural[99] | Unconditional approval [100] |

| 12 Dec. 2011 | Same Day | 15 Jun. 2012 | United Technologies/Goodrich | Horizontal | Structural [101] | |

| 16 Dec. 2011 | 16 Feb. 2012 | 13 Aug. 2012 | Wal-Mart/Yihaodian | Vertical | Behavioural[102] | |

| 4 May 2012 | 28 Jun. 2012 | 6 Dec. 2012 | ARM/GieseckeandDevrient/Gemalto | Vertical | Behavioural[103] | Behavioural[104] |

| 1 Apr. 2012 | 17 May 2012 | 14 Apr. 2013 | Glencore International/Xstrata | Horizontal | Structural and Behavioural[105] | Structural and Behavioural[106] |

| 19 Jun. 2012 | 31 Jul. 2012 | 22 Apr. 2013 | Marubeni/Gavilon | Horizontal | Structural [107] | Unconditional approval [108] |

Table 4: Decisions adopted by Mofcom and comparison with EU [78].

Despite these positive points, there are still at least two problems in relation to the Mofcom’s enforcement. First, transparency regarding the Mofcom’s reviewing process needs to be improved. This can be particularly observed by the time lag between the dates of submitting notification by the merged entities and the dates of acceptance by the Mofcom. Only in 3 cases out of the aforementioned 19 cases, the Mofcom accepted the notifications the same time when the parties concerned made their notifications. A time lag of one or two months was not unusual. An official reason announced by the Mofcom was that the materials submitted were not complete. However, the fact that almost no entities were able to provide complete application materials at one time, at least, suggests that the Mofcom does not make the required notification materials fully known to the public. The underlying reason may be the time limit confronted by Mofcom. According to the AML, the Mofcom can only have no more than 180 calendar days to review a merger case [110]. Therefore, the Mofcom is suspected to take inappropriate advantage of the time lag between dates of submission and dates of acceptance. Hopefully, the adoption of the Interim Provision on the Thresholds for Simple Cases of Concentrations in 2013 may mitigate this problem.

Moreover, the Mofcom was criticised to treat international mergers unfairly [111]. Almost all the 19 cases shown in Table 4 involved mergers purely between international companies, with only two cases where a domestic company was acquired by an international company.

According to the information released by the Mofcom about cases of unconditional clearance, about 20 per cent cases involved pure domestic mergers. Until now the Mofcom has never hindered domestic mergers. Most controversially, the only blocked merger, ie Case Coca-Cola/ Huiyuan, concerned an international company acquiring a Chinese company, Huiyuan [112], with a famous domestic fruit juice brand. This merger led to a national debate on whether famous domestic brands should be protected [113]. As a matter of fact, this was not the only case involving a foreign company purchasing a famous domestic brand. Two other cases are (1) Diageo acquiring Quanxing, a famous domestic brand of Chinese rice wine [114]; and (2) Nestlé acquiring Yinlu, a famous domestic brand for canning products [115]. No public debate was raised for these two cases. Put it closely, a major difference can be observed between Coca-Cola/Huiyuan and the other two. In the other two cases, the products offered by the companies involved are complementary. In comparison, Coca-Cola that also produces fruit juice under the brand name of Minute Maid, is a direct competitor of Huiyuan. The public was concerned that after the merger Coca-Cola may drop Huiyuan and promote only Minute Maid, and thus this domestic brand may disappear from the market [116]. In any case, this decision in Cola/Huiyuan was criticised as politically stretching the AML to appease the sentiment of Chinese, and may have a potentially adverse effect on China’s outbound investments [117].

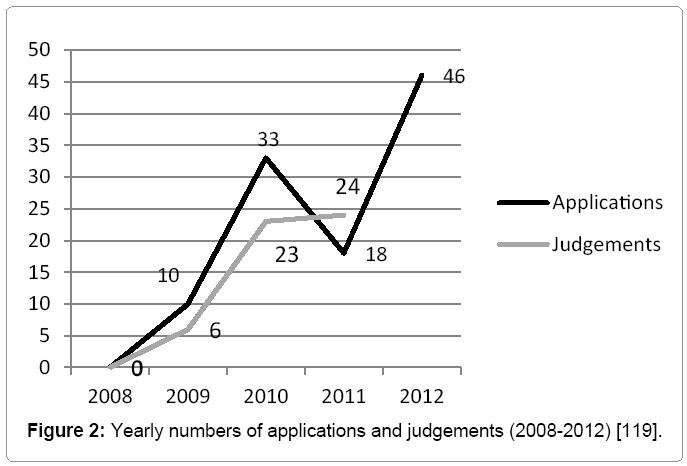

Private enforcement and problems: Surprisingly as it was, private enforcement has become a battlefield for antitrust disputes, even more so than public enforcement. This can be concluded from the fact that the cases submitted for judicial review were almost two times than those investigated by the NDRC and the SAIC together. As of mid- 2012 [118], 107 applications were initiated and 57 judgements were given (Figure 2).

In China, antitrust damages are limited to actual loss suffered from an anti-competitive conduct and are not punitive [119,120]. Given the difficulties in collecting evidence, victims in antitrust cases should have had less incentive to initiate private litigation. Such a large number of cases submitted to the Chinese justice suggest that the public was extremely unsatisfied with the slow progress of public enforcement. Moreover, the Honourable Jin, vice-chair of the Intellectual Property Chamber in the Supreme Court [121], indicated that cases of abusing dominant positions were much more than cartel cases [122]. This is different from the situation in other jurisdictions where the number of cartels cases is in general much higher than that of abuse cases. This difference may suggest that the public was even more unsatisfied with the public enforcement against abusing dominance. Therefore, private enforcement seemed to be regarded as an “effective” compliment to the inadequate public enforcement.

However, a question stands out whether private enforcement has turned into an “effective” compliment as the public expected. A straightforward answer is negative. Many scholars frankly expressed their immense disappointment on private enforcement [123]. The most noticeable fact is that within all the 57 judgements delivered by the courts, not even one plaintiff has ever won their case [124]. Such a zero per cent win rate is far from evidence that private enforcement was the saviour of the enforcement of the AML [125].

Underlying reasons of unsatisfactory enforcement

The previous part examines the current situation of the enforcement, both public and private, of the AML in the last five years, and concludes that the enforcement has still been far from fulfilling the public’s expectation [126]. Then, another question arises why the enforcement was such. In the following, this article attempts to analyse the underlying reasons for the disappointing enforcement from three perspectives [127].

Limited resources: The fight among NDRC, SAIC and Mofcom to be the sole competition authority after the adoption of the AML significantly delayed the process to establish competition authorities [128]. This results into domino effects that the process to adopt enforcing guidelines was also delayed. As shown in Table 1, the process of drafting guidelines substantially ended in 2011[129]. It is not a coincidence that as observed from Tables 2-4 a majority of decisions adopted by the three competition authorities came after 2011, with SAIC (71 per cent), NDRC (67 per cent) and Mofcom (63 per cent). This suggests that during the initial years the three competition authorities spend most of their attention on drafting guidelines, rather than investigating cases. Should the competition authorities been set up earlier, it might be expected that the public enforcement could have been better [130].

Furthermore, the delay in establishing competition authorities also affected the internal organisation of the three competition authorities. The antitrust investigation is never an easy job, and always involves a great amount of qualitative and quantitative analyses [131]. As a result, it is necessary for competition authority to recruit a decent number of staff. In the previous years, despite the team of the three competition authorities continued growing, their absolute number of personnel has not become sufficient vis-à-vis the economic size of China [132].

The whole team of Chinese competition authorities is much smaller than its counterparts in the USA and the EU. More specifically, the EU is approximately 2.86 times bigger than China [133-136]; and the USA is about 3.19 times bigger. It is hard to expect that the newly established Chinese competition authorities, in conjunction with its smaller size, could have been more efficient than their USA and EU counterparts. Moreover, given the similar economic size of the three jurisdictions, the actual number of antitrust complaints in China should in principle be approximately similar to that in the USA and in the EU. Nevertheless, as shown in Table 5, the USA competition authorities and the EU DG Competition handled much more cases than the Chinese competition authorities during the similar time period. In other words, the Chinese competition authorities have to place its limited resources to a few of complaints. This of course must disappoint most complainants. Hence, it is understandable that the public enforcement in China was not satisfactory in the view of the Chinese public in the last five years.

| Countries (total number of staff) |

Competition Authorities | Number of Staff | Antitrust investigations or decisions and merger notifications in 2008-2013 |

|---|---|---|---|

| China [125] (≈328) |

Anti-monopoly and Anti-unfair Competition Enforcement Bureau, SAIC | National>30 | 18 antitrust investigations |

| Provincial ≈ 124 [126] | |||

| Bureau for Price Surveillance and Inspection and Antitrust, NDRC | National>20 | 49 antitrust investigations | |

| Provincial ≈124 [127] | |||

| Anti-monopoly Bureau, Mofcom | National>30 | 586 merger notifications | |

| EU (943) | DG Competition | 943 [128] | 69 antitrust decisions [129] |

| 1471 merger notifications [130] | |||

| USA (1046) | Antitrust Division, Department of Justice | 790 [131] | 705 antitrust investigations [132] |

| Bureau of Competition, Federal Trade Commission | 256 [133] | 6487 merger notifications [134] | |

| 28 non-merger investigations [135] |

Table 5: Comparison between China, EU and USA.

Inadequate understanding of competition law: In comparison with the fewer number of cases of public enforcement, private enforcement seemed to be prosperous as the cases were almost double the cases investigated by the SAIC and the NDRC. However, it was disappointed that no plaintiff even won an application. One of the main reasons believed by this article was the lack of adequate understanding of competition law both from the public and the justice. In the following two cases will be examined in order to explain this situation.

The first case came out in 2009, and was claimed by some as the first private enforcement case. The litigation was initiated by Beijing Sursen Co. (hereinafter: Sursen) against the abusive conduct of Cloudary Art Ltd. (hereinafter: Cloudary). The dispute was such that in May 2008 Sursen began to post on its website a sequel to Xinchenbian (a novel) the copyright of which nevertheless belonged to Cloudary. This was soon discovered by Cloudary. Cloudary, instead of sending complaints to Sursen, warned the authors of the sequel. The authors immediately expressed public apology for infringing Cloudary’s copyright and promised to stop working on the sequel. Sursen then brought an application to the Shanghai First Intermediate Court claiming that Cloudary abused a dominant position by forcing the author to cease working on the sequel. On 23 October 2009 the court decided to dismiss the application based on the fact that Sursen did not provide enough evidence to prove that Cloudary had a dominant position, without analysing whether Cloudary’s conduct was abusive [137]. Had Cloudary been found dominant, a conclusion should nonetheless be reached that Cloudary’s conduct was not abusive. In accordance with Article 55 of the AML [138], even a dominant undertaking is entitled to take actions to protect their intellectual property rights that are violated. This was a clear case where Sursen infringed Cloudary’s copyright and Cloudary protected its right based the relevant copyright rules. Consequently, Sursen’s legal action indicated its lack of basic knowledge about what the AML should prohibit.

The second judgement was delivered rather recently, at the end of 2012, and dealt with the complaint of Shenzhen Huierxun Technology Ltd. (hereinafter: Huierxun) about a price cartel organised by the Shenzhen Anti-pest Association (hereinafter: the Association) [139]. The Association required its members not to offer prices for anti-pest services below its recommended tariffs. Huierxun was a client of a member, and negotiated a price lower than the recommended tariff. The Association later detected such a deviation and punished that member by revoking its operation license. As cheaper services were not available any more, Huierxun brought a case against the Association first in the Shenzhen Intermediate Court and appealed to the Guangdong High Court. Both courts decided to dismiss Huierxun’s claims [140].

The Association’s behaviour, ie recommended minimum fee for a given service, fell into the category of price fixing under the AML [141]. Worldwide this type of conduct is in general considered as per se illegal due to its clear intention to restrain competition. For example, the EU takes an unambiguous hostile attitude to price fixing, and views it as one of hardcore restrictions [142]. The USA’s opinion, on the other hand, is less clear-cut. Nevertheless, the USA considered price fixing as not per se illegal only in a very limited number of cases [143]. It is astonishing that the two Chinese court seemed to confuse the analysis of cartels with that of abusing dominance. The judgement of appeal dismissed Huierxun’s application based on the examination of the anticompetitive effects, and found that

“[t]here are 838 companies offering anti-pest services. 271 of them are members of the Shenzhen Anti-pest Association. Only 187 Members signed the agreement concerned, accounting only for 22.31 per cent out of these 838 companies in terms of numbers of operators […] No evidence shows that after the signing of the agreement concerned the number of companies on the relevant market has reduced, or the prices have increased, or the quality of the services has deteriorated. Consequently, based on the observations in the above, the available evidence cannot prove that the Shenzhen Anti-pest Association and the 187 companies have absolute influence on the anti-pest service market in Shenzhen, and that the agreement concerned significantly exclude or restrain competition on the relevant market” [144].

Rather oddly, the judgement seemed to convey a message that cartels infringe the AML only when their members have occupied a large amount of market shares on the relevant market. Needless of any further analysis, this practice is certainly contrary to the generally accepted theories on cartels.

The above two cases indicate that the general public and even the courts that should have been experts are lack of basic understanding of the general principles of competition law. The high expectation at one side and the substandard skills on the other inflicted unbearable heaviness on the AML. It is no wonder that dissatisfaction soon came out regarding its enforcement. In other words, the disappointment on the enforcement of the AML was probably a matter of over-expectation.

Complicated interplay between competition law and sectorspecific regulation: Due to the economic environment in China, the public is more concerned with abusive conduct of state owned enterprises, especially high prices of public utilities. The AML makes itself clear that it does not forbid its application to public utility sectors that are subject to sector-specific regulations in China [145]. However, the application of competition law to regulated sector involves not only political determination but also complicated legal dilemmas. It is even a delicate issue for antitrust veterans, such as the EU [146], not even to mention China. In particular, two major difficulties confront Chinese competition authorities in dealing with abusive conduct of public utility undertakings. The first one is more or less political. Public utility undertakings are not only regulated by other ministries, which are at the same governmental level as the NDRC or the SAIC, but also have inseparable connections with the latter. An initiation of investigating a public utility sectors is nothing less than announcing a war against a certain ministry. The second is more legal. This difficulty is bifurcated. At one side, the inspection of a public utility sector always require the equipment of a decent level of industrial knowledge which competition authorities, especially a new one, always lack. At the other side, undertakings in public utility sector in China are subject to sectorspecific regulation. This constantly raises an interesting issue whether those regulated undertakings’ behaviour is done at own discretion or in order to fulfil sector-specific regulations. It is arguable that competition law can force an undertaking not to abide by laws. All these difficulties cannot be more clearly observed in the NDRC’s investigation in the case against China Telecom and China Unicom, two state-owned telecommunications operators.

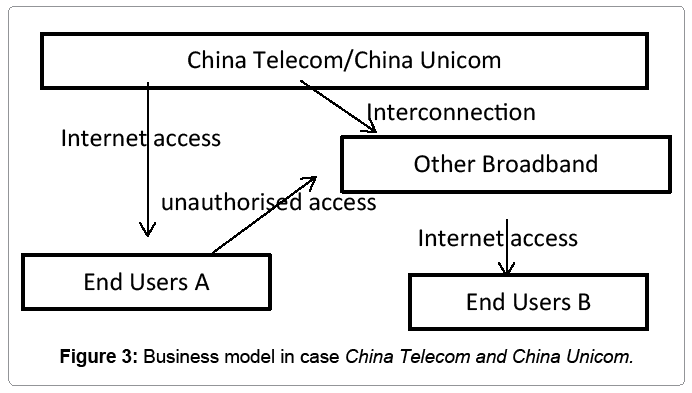

In April 2011, the NDRC received complaints about China Telecom and China Unicom exercising price-related anti-competitive practice. It was related to the interconnection between different fixed broadband networks. According to the complaints, China Telecom and China Unicom charged their competitors higher fees (fixed to RMB 1000 Yuan/Mb/Month) for interconnection while offering lower prices (RMB 200-300 Yuan/Mb/Month) to non-competitors [147]. This was suspected by the NDRC suspected discriminatory pricing or price squeeze, and then an investigation was opened. In December 2011, the two companies made public announcements that they had offered commitments to the NDRC for suspending the investigation [148]. Until now the investigation has not been officially ended, and the NDRC has not decided whether the conduct concerned was abusive. The commitments nevertheless made many believe that the two companies indeed engaged in abusing dominance [149]. However, if giving it a second consideration it may be concluded that this case is not as simple as it looks, and the two operators concerned did not violate the AML (Figure 3).

This incident emerged in relation to the interconnection services of fixed broadband networks. In Mainland China, China Telecom and China Unicom predominantly control the portal to the international Internet. As a result, other broadband networks must be connected to those two companies’ networks in order to access the outside world. The interconnection is regulated by the MIIT. According to the MIIIT’s regulation, other fixed broadband operators must pay for such an interconnection, and the price is fixed to RMB 1000 Yuan/ Mb/Month [150]. After interconnected with China Telecom or China Unicom, other broadband operators then offer Internet access services to end-users. The Internet access prices offered by China Telecom and China Unicom were as low as 200-300 Yuan/Mb/Month. Given this considerable difference, other broadband operators purchased from end users [151] of China Telecom and China Unicom Internet access services as a substitute with the high priced interconnection services, and resold them to their end users [152]. After detecting it, China Telecom and China Unicom shut down the Internet access service for those end users and thus caused Internet blackout for end users of those broadband operators . Thus came out the dispute.

This case is then re-examined based on the aforementioned background information. First and foremost, the AML seems not applicable in this case as the block of unauthorised access by China Telecom and China Unicom is a compliance with the MIIT’s regulation. In China, fixed broadband operators must obtain a license from the MIIT in order to provide Internet access services. It goes with no doubt that End Users A are not authorised operators. Consequently, it was in accordance the regulation imposed by the MIIT to shut down reselling End User A’s Internet access to other broadband operators. Unless the AML can repeal the licensing regime of the MIIT, it should in principle not prohibit China Telecom and China Unicom from complying with sector-specific regulation.

Moreover, even if the conduct of China Telecom and China Unicom may be governed by the AML, it should nonetheless not be considered as price discrimination or price squeeze either. First, it was true that significant price differences existed between other broadband operators and End Users A. However, the two were not offered as the same service. Other broadband operators received interconnection services while End Users A obtained Internet access. Since the two were different relevant products, the significant price difference, at least, could not lead to an immediate conclusion of discrimination. Secondly, interconnection services always involved dedicated bandwidth. In comparison, internet access services, though possibly offered under dedicated bandwidth to a few of end users (including End Users A) on a contractual basis, most household users and small or medium sized enterprises (End Users B) got shared bandwidth. Most importantly, the shared bandwidth has been always over-supplied in China, and that group of end users seldom enjoy the bandwidth advertised by broadband operators. In other words, a certain dedicated capacity on the market for interconnection was sold multiple times on the market for Internet access. Hence it is understandable that prices on the interconnection market should be much less than those on the Internet access market. This on the one hand consolidates the conclusion that it was not a straightforward case of discrimination, and on the other hand also affects the analysis of price squeeze. Due to the oversupply strategy on the Internet access market, it is unclear that other broadband operators would be excluded out of the relevant market by the conduct of China Telecom and China Unicom without carrying out a price-cost analysis. However, no such an analysis was ever mentioned by the NDRC.

All in all, this case shows the difficulties to apply the AML to regulated industries. The difficulties relate not only to the institutional conflicts between competition authorities and sector-specific regulators, but also to the sector-specific industrial knowledge that must be equipped by competition authorities. Although major antitrust complaints from the Chinese public concerned regulated sectors, it should be noted that the application of the AML there is not as simple as it looks. Without sufficient inspection and consideration, it is not unexpected that the investigation on the behaviour of China Telecom and China Unicom went silent in the end.

Conclusion

The AML was adopted on 30 August 2007 and set its official launch day as 1 August 2009. This one-year preparation period was all spent on designating competition authorities. The fight for the sole enforcing authority among the NDRC, the SAIC and the Mofcom nevertheless delayed such a process. Only about seven months later since the announcement of the law, the State Council reached a compromised solution and decided to establish a Cerberus authority. Moreover, another competition authority, ie the Anti-monopoly Commission, was instituted only three days before the effect day. No progress of enforcement was seen in this period.

The enforcement of competition law, different from other laws, requires the adoption of enforcing guidelines. The delay in establishing competition authorities leads to domino effect for this process. As observed, the first guideline adopted by the four competition authorities (excluding the guideline published by the State Council in August 2008) came out at the end of May 2009, almost one year after the entering into effect of the AML. Furthermore, it can also be seen that most of the enforcing guidelines were adopted before the end of 2010. This corresponds to the fact that early antitrust cases reviewed by the NDRC and the SAIC also extensively emerged in the year 2010. Thus, it may be concluded that within the first more than two years the NDRC and the SAIC were busy at internal organisation and guideline publication, and thus had no time to actually deal with antitrust complaints. Moreover, the situation for the Mofcom was better as it did review many merger notifications in the same period. However, the work process of the Mofcom is different from the NDRC and the SAIC in that merger cases are reviewed ex ante while antitrust cases are investigated ex post. This difference gives an edge to the Mofcom in terms of number of cases handled. However, the number of merger notifications reaches its peak only in 2011, which suggests that within the first more than two years the Mofcom at least did not work to its full strength either. It may be speculated that much of Mofcom’s resources were also concentrated on internal organisation and guideline adoption, thus no difference from the NDRC and the SAIC. Given such a situation as a whole, should the process of setting up competition authorities went quicker, more or less one year could have been added to the actual enforcement. In that case, the enforcement could become better.

However, the enforcement of the AML as a matter of fact substantially started at the beginning of 2011, in other words more than two years until now. During this period, both the NDRC and the SAIC set clear targets of applying the AML to cartels based on the cases they have handled. Priorities were thus not given to vertical anticompetitive agreements, abusing dominance and anti-competitive behaivour of state-owned enterprises. This did not meet the expectation of the Chinese public. As having been indicated, what were complained most were nevertheless abusive activities in particular of state-owned enterprises. However, due to the limited resources and the complicated interplay between competition law and sector-specific regulation it was in fact difficult, if not impossible as the NDRC tried and failed in Case China Telecom/China Unicom, for the NDRC and the SAIC to set up their enforcing priorities as such. Those types of antitrust problems may be inspected extensively when more resources and experience have been acquired in the coming years. Moreover, as far as merger cases are concerned, Mofcom’s work should be praised. Its decisions have been developed from half-page long in early cases to up to more than five pages in recent cases. More sophisticated economic analysis can be frequently observed now. During this process, a clear reference to the decisions made by other more experienced jurisdictions, such as the EU, can be noticed. Although the Mofcom’s decisions show to some extent an inclination of protecting domestic industries, Mofcom should not be blamed too much as in such a capacity-building period a more cautious approach toward domestic merger should be considered proper. In addition, with regard to private enforcement although Chinese courts’ analyses in some cases should be criticised, it may be argued that that was a price that we must pay at such an early stage. Nevertheless, it should be not denied that Chinese antitrust judges must be subject to more antitrust training in the coming years.

Consequently, the ideal enforcement expected by the public placed unbearable heaviness onto the AML. As the enforcement of the AML is still an on-going process, it is strongly believed that the enforcement will certainly become more in line with the expectation in the next five years with the improving capacity development of the Chinese competition authorities and justice.

Last but not least, despite all the reasons discussed in the above, one problem that should be solved in no time is transparency. Transparency can on the one hand keep the authorities accountable and on other hand allow scholars to assist the authorities in speeding up the capacity building process. However, the transparency obligation is so far only imposed upon the Mofcom regarding decisions of conditional clearance and disapproval. Moreover, it is heartening to see that the Mofcom has started to publish names of merged entities in cases of unconditional approval. However, it is still not enough. In comparison with the Mofcom, transparency with others is much worse. The NDRC and the SAIC have never published any of their decisions; and courts did not do better in view of the handful of judgments that can be accessed via public channels.

Acknowledgements

The author acknowledges the financial support of China Ministry of Education’s Project of Humanities and Social Sciences (No.12YJC820037).

References

- Wang X (2007) Several Questions about Our Anti-monopoly Agencies. Dong Luncong (Dongyue Tribune 28: 30-41.

- Zhang B (2005) The Establishment of Our Anti-monopoly Authorities – Questioning the Current Institutional Design. FaXue (Science of Law) 2: 113-121.

- State Council of China (2008) Notice on Institutional Establishment, Guofa.

- NDRC (2013) Rules on the Main Responsibility, Internal Institutions and Staff in NDRC.

- SAIC (2013) Rules on the Main Responsibility, Internal Institutions and Staff in SAIC.

- MOFCOM (2013) Rules on the Main Responsibility, Internal Institutions and Staff in SAIC.

- Wang X (2002) Discussion on the Establishment and Responsibilities of China’s Anti-monopoly Agencies. China Public Administration 8: 60-64.

- State Council (2008) Notice on the Main Responsibilities and Members of the Anti-monopoly Commission.

- Anti-Monopoly Commission (2009) Guide for the Definition of Relevant Markets.

- National People’s Congress (2000) Legislation of Law of People’s Republic of China.

- National People's Congress (1979) Organic Law of the Peoples’ Courts of the People’s Republic of China.

- State Council (2008) Provisions on Thresholds for Prior Notification of Concentrations of Undertakings.

- National People's Congress (1989) Organic Law of the Peoples’ Courts of the People’s Republic of China.

- State Council (2009) Provisions on Thresholds for Prior Notification of Concentrations of Undertakings.

- SAIC (2009) The Provisions on the Procedures to Investigate and Handle Cases of Monopolization Agreements and Abuse of Dominant Market Position.

- SAIC (2010) The Provisions on the Procedures to Investigate and Handle Cases of Monopolization Agreements and Abuse of Dominant Market Position.

- Mofcom (2009) Measures for Calculating the Turnover for the Notification of Concentrations of Business Operators in the Finance Industry.

- Mofcom (2009) The Measures for the Undertaking Concentration Declaration.

- Mofcom (2010) The Measures for the Undertaking Concentration Examination.

- Mofcom (2010) Interim Provisions on the Divestiture of Assets or Business in the Concentrations of Business Operators.

- NDRC (2010) Anti-price Monopoly Regulations.

- NDRC (2010) Regulations on the Procedures Governing Administrative Enforcement of Anti-price Monopolies.

- SAIC (2010) Regulation Concerning the Prohibition of Monopoly Agreements.

- SAIC (2010) Regulation Concerning the Prohibition of Abuse of Market Dominant Positions.

- SAIC (2010) Regulation Concerning the Prohibition of the Abuse of Administrative Power to Eliminate or Restrict Competition.

- Mofcom (2011) Interim Provisions on Evaluating the Impact of Concentrations of Business Operators on Competition.

- Mofcom (2011) Interim Measures for Investigating and Handling Failure to Legally Declare the Concentration of Business Operators.

- Supreme Court (2012) Provisions on Several Issues concerning the Application of Law in the Trial of Civil Dispute Cases Arising from Monopolistic Conduct.

- SAIC, Press Release (2013) SAIC Organises a Public Hearing In order to Receive Comments and Suggestions.

- Mofcom (2013) Interim Provision on the Thresholds for Simple Cases of Concentrations (Draft).

- Mofcom (2012) Anti-monopoly Enforcement Progress Report 2012.

- Zhou P (2013) Eliminating Market Monopoly and Encouraging Free Competition: the history of the enforcement of competition law by the SAIC.

- Anti-monopoly and Anti-unfair Competition Enforcement Bureau (2013).

- The Provisions on the Procedures to Investigate and Handle Cases of Monopolization Agreements and Abuse of Dominant Market Position.

- Shen J (2013) 8 Infringement Decisions have been adopted by the SAIC in 18 Cases.

- Case Concrete Cartel in Lianyungang City (2013).

- Case Liquid Gas Cartel in Taihe County (2013).

- Zhou P, Pan C (2013) Applying the AML to Local Governments: the SAIC Agency in Guangdong Province Investigated Abusing Administrative Power to Exclude Competition.

- Case Cartel Organised by a Cement Association (2013).

- The relevant parties, after receiving a decision from the SAIC or its provincial agencies, can either file an application to competent courts or apply for a re-evaluation by the upper-level government. For decisions made by the Anti-monopoly and Anti-unfair Competition Enforcement Bureau, the authority for such a re-evaluation is the SAIC; for decisions adopted by provincial agencies, it is the relevant provincial government.

- Taini, Li C (2013) On the Way to Justice: the SAIC Agency in Henan Province Decided the First Monopoly Case in the Market for Second-hand Cars.

- Xia Y (2013) The SAIC Agency in Hunan Province Opened Investigation on New Car Insurance Monopoly.

- Case Concrete Cartel in Jiangshang City (2013).

- Bureau for Price Surveillance and Inspection and Antitrust (2013).

- Yu L, Zhou R (2013) Breakthrough in Anti-Price Monopoly: 49 Cases under Investigation.

- NDRC (2010) News Release A Salt Company Abusing its Dominance Position by Tying.

- NDRC, News Release (2013) 10 Price-related Cases Dealt with by the NDRC Agency in Guangdong Province.

- INDRC Agency (2012) In Guangdong Province did not finally impose an infringement decision.

- NDRC News Release (2013) Serious Punishment Against Two Pharmacies Monopolising price for Compound Reserpine.

- NDRC (2011)News Release “Serious Punishment Against Two Pharmacies Monopolising price for Compound Reserpine”, 14 November 2011.

- NDRC(2012) News Release “Guangdong Handled Case Sea Sand Cartel in order to Secure the Progress of National Key Project”, 26 October 2012.

- NDRC(2013) Agency in Guizhou Province News Release “Resale Price Maintenance by Maotai Co.”, 22 February 2013.

- NDRC (2013) Agency in Sichuan Province News Release “Resale Price Maintenance by Wuliangye Co.”, 22 February 2013.

- National People’s Congress (1988), “Price Law of People’s Republic of China”, Decree Nr. 92 [1998], 29 December 1997.

- NDRC (2013) News Release “Price Fixing Cartel of Six International TV Producers”, 4 January 2013.

- See (2011) eg NDRC news releases, “Serious Punishments on the Paper Producer Cartel in Fuyang City Zhejiang Province”, 4 January 2011.

- See n 12 above.

- Li C, Wan J, “Study on the Selection of the Applicable Law in case of Conflict between the Price Law and the Anti-Monopoly Law”, ZhongguoJiageJianduJiancha (China Price Supervision and Check) No. 12 (2012), pp 23-25.

- Sina Website(2007)“A Questionnaire for the Anti-monopoly Law”, 16 August 2007.

- Wei Zhao(2011) “Antitrust with Chinese Characteristics”, (2011) Zhejiang Jingji (Zhejiang Economy) No. 3 (2011), pp 30.

- Xinhua News Agency (2013) “Applying the Anti-monopoly Law to Suppress Abusing Administrative Power and Imposing Liabilities on the Governments”, 5 December 2008.

- See, The AML, n 1 above, Art 51.

- Wang X (2008) “Four Bottlenecks Confronted by the Enforcement of the Anti-monopoly Law”, presented in the conference “2008: Strategy and Forecast” organised by the Caijing Journal, 13 December 2008.

- See, Case Abusing Administrative Power to Promote a Particular Brand of GPS by the Shenzhen Government, n 41 above.

- Shi J (2008) “Our Anti-monopoly Law’s Special Feature, Highlighted Features and Significant Drawbacks”, Faxuejia (Jurists Review) No. 1 (2008), pp 14-19.

- Zhao H (2012)“Follow Objective Rules and Expand State-owned Economy”, GuanliXuekan (Journal of Management) Vol. 25 No. 6 (2012), pp 1-11.

- Mary JHanzilk (2008) “The Implications of China’s Anti-monopoly Law for Investors: Problematic Protection of Intellectual Property”, (2008) 3 Entrepreneurial Business Law 1, pp 75-94.

- Hou L (2012) Competition Law and Regulation in the EU Electronic Communications Sector: A comparative legal approach (Alphen aan de Rijn: Kluwer, 2012), pp 35-38.

- See the report of this case in Ning S, Yiming S, Jia L (2011)“Chinese Antitrust Enforcement Agencies Ready to Show Teeth to Large State-owned Enterprises?” (2011).

- This case will be discussed in detail later on in “Complicated Interplay between Competition Law and Sector-specific Regulation” later.

- Li G (2009) “Can the PRC’S new anti-monopoly law stop monopolistic activities: Let the PRC’S telecommunications industry tell you the answer”, (2009) 33 Telecommunications Policy 7, 360-370.

- See the official website of the Anti-monopoly Bureau.

- The two alternative thresholds are (1) “the combined worldwide turnover of all the undertakings concerned in the preceding financial year is more than RMB 10 billion Yuan, and the nationwide turnover within China of each of at least two of the undertakings concerned in the preceding financial year is more than RMB 400 million Yuan”, and (2) “the combined nationwide turnover within China of all the undertakings concerned in the preceding financial year is more than RMB 2 billion Yuan, and the nationwide turnover within China of each of at least two of the undertakings concerned in the preceding financial year is more than RMB 400 million Yuan.” See, Provisions on Thresholds for Prior Notification of Concentrations of Undertakings, n 14 above, Art 3.

- All those decisions are available at.

- See unconditional approval cases between 1 August 2008 and 30 September 2012.(see cases reviewed in the last quarter of 2012.and cases reviewed in the first quart of 2013 .

- 11 of the 19 mergers were also reviewed by the European Commission.

- Mofcom(2008) Case Inbev/Anheuser-Busch, Nr. 95, 18 November 2008.

- Mofcom(2009)Case Coca-Cola/Huiyuan, Nr. 22, 18 March 2009.

- Mofcom(2009) Case Mitsubishi Chemical Holdings/Mitsubishi Rayon, 24 April 2009.

- European Commission, Case No Comp/M.5712 - Mitsubishi Chemical Holdings/Mitsubishi Rayon Co, 25 February 2010.

- Mofcom(2009) Case General Motors/Delphi, Nr. 76, 28 September 2009.

- European Commission, Case No COMP/M.5617 – General Motors/Delphi, 2 October 2009.

- Mofcom(2009)Case Pfizer/Wyeth, Nr. 77, 29 September 2009.

- European Commission, Case No COMP/M.5476 - Pfizer/Wyeth, 17 July 2009.

- Mofcom (2009) Case Panasonic/Sanyo, Nr. 82, 30 October 2009.

- European Commission, Case No COMP/M.5421 – Panasonic/Sanyo, 29 September 2009.

- Mofcom(2010), Case Novartis/Alcon, Nr. 53, 13 August 2010.

- European Commission, Case No COMP/M.5778 – Novartis/Alcon, 9 August 2010.

- Mofcom(2011) Case Uralkali/Silvinit,Nr. 33, 2 June 2011.

- Mofcom (2011) Case Penelope/Savio,Nr. 73, 31 October 2011.

- Mofcom(2013) Case General Electric/China Shenhua, [2011] Nr. 74, 10 November 2011.

- Mofcom(2012) Case Seagate Technology/The HDD Business of Samsung Electronics, Mofcom [2011] Nr. 90, 12 December 2012.

- European Commission, Case No COMP/M.6214 - Seagate/HDD Business of Samsung, 19 October 2011.

- Mofcom(2012) Case Henkel Hong Kong/Tiande Chemical, Nr. 6, 10 February 2012.

- Mofcom, Case Western Digital/Toshiba, Nr. 9, 2 March 2012.

- Later Toshiba purchased the divested assets of Western Digital and was unconditionally approved by the Mofcom(2012) number 429 of the list of cases of unconditional approval before 30 September 20012,

- European Commission, Press Release “Mergers: Commission clears Western Digital’s acquisition of Hitachi's hard disk drive business subject to conditions”, IP/11/1395, 23 November 2011, See also, European Commission, Case No COMP/M. 6531 - Toshiba / HDD Assets of Western Digital, 26 March 2013.

- Mofcom(2012) Case Google/Motorola, Mofcom [2012] Nr. 25, 19 May 2012.

- European Commission, Case No COMP/M.6381 – Google/Motorola Mobility, 13 February 2012.

- Mofcom(2012)Case United Technologies/Goodrich, Mofcom [2012] Nr. 35, 15 June 2012.

- Mofcom(2012) Case Wal-Mart/Yihaodian, Mofcom [2012] Nr. 49, 14 August 2012.

- Mofcom(2012) Case ARM/Giesecke&Devrient/Gemalto, Mofcom[2012] Nr. 87, 6 December 2012.

- European Commission, Case No COMP/M.6564 – ARM/Giesecke&Devrient/Gemalto/JV, 6 November 2012.

- Mofcom, Case Glencore International/Xstrata, Mofcom [2013] Nr. 20, 16 April 2013.

- European Commission, Case COMP/M.6541 – Glencore International plc / Xstrata plc, 17 December 2012.

- Mofcom, Case Marubeni/Gavilon, Mofcom [2013] Nr. 22, 23 April 2013.

- European Commission, Case No COMP/M.6657 - Marubeni Corporation/ Gavilon Holdings, 24 August 2012.

- Henry LT Chen, Schoneveld F, An A, FuB, Wang A (2012)“China’s New Merger Control Regime Makes Major Progress in Its First Three Years” (2012).

- The review of the Mofcom can be divided into two stages. According to Art 25 of the AML, the first stage comprises 30 calendar days. After the first stage, mergers with serious competition concern go to the second stage. Art 26 provides that the time limit for the second stage is 90 calendar days, and Mofcom may extend this period by an extra 60 calendar days.

- Masseli M(2012) “The Application of Chinese Competition Law to Foreign Mergers: Lessons from the Draft New Guidelines”, (2012) 3 Journal of European Competition Law & Practice 1, 102-109.

- It is now difficult to conclude that Huiyuan is a domestic company because Huiyuan has moved its registration from China to Cayman Islands. However, due to the high recognition of its brand name in China, the public still views it as a domestic company.

- See supporters’ view in Yongjun Li, “The Gaps and Possible Bridges in Cases of Foreign Companies Acquiring Domestic Famous Brands: Taking Case Coca-Cola/Huiyuan as an Example”, Faxue (Legal Science) No. 12 (2008), pp.103-112; see opposing view in Jin Sun and MengZhai, “Thinking Over the Anti-Monopoly Law on China’s Foreign Investors’ Merger and Acquisition: Taking Coca-Cola from America acquired Huiyuan in China as an example”, Xinjiang DaxueXuebao (Journal of Xinjiang University) No. 3 (2009), pp 45-51.

- Mofcom (2013) “List of cases of unconditional approval before 30 September 20012”, Nr. 255.

- Ibid, Nr. 305.

- See a detailed analysis of this case in SwapnaPragada, “Coca-Cola's Acquisition of China’s Huiyuan Juice: A Juicy Deal?”, in IBS Case Development Center (ed), The Case For Learning (UK, USA: Ecch Press, 2009).

- Sundeep Tucker, Peter Smith and JamilAnderlini(2009) “China blocks Coca-Cola bid for Huiyuan”, Financial Times, 19 March 2009.

- More recent data are not available.

- Kesheng Jin (2013) “Annual Report on China’s Competition Policy and Law 2012”, presented in the Annual Conference of Competition Policy and Law in China, 7 January 2013, Beijing.

- See, Judicial Interpretation, see n 31 above, Art 14.

- In China the judicial systems are of four levels, from top to bottom the Supreme Court (national level), high courts (provincial level), intermediate courts (regional level) and basic courts (county level). The intellectual property chamber is equipped with the competence of reviewing antitrust cases. Moreover, this chamber is established normally at intermediate courts and above, and exceptions are only given to a limited number of basic courts. Therefore, the subject-matter jurisdiction for antitrust cases falls into the authority of intermediate courts and beyond. See, Judicial Interpretation, ibid., Art 3. See n 119 above.

- Unirule Institute of Economics, “Why was It Difficult to Enforce the Anti-Monopoly Law”, ZhongguoGaige (China Reform) No. 12 (2010).

- WeichenSun(2012) “No Plaintiffs Won Any Antitrust Cases in the Last Years”, ZhongguoJingji Wang (China Economic Weekly) No. 20 (2012).

- The number of staff of Chinese competition authorities has never been published. Thus the number of staff comes from various sources and some are even calculated based on speculation.

- Only NDRC and SAIC appoint provincial-level bodies as antitrust agencies. According to the information collected by the article, the number of staff for provincial agency is around 3-5. This article selects 4 as the average number. There are 31 provincial-level bodies in Mainland China (excluding Taiwan, Hong Kong and Macao). Consequently, the number of staff at the provincial level for SAIC and NDRC is around 124 (4*31).

- Ibid.

- European Commission, “Human and Financial Resources by ABB Activity” (2011).

- European Commission, “Antitrust Cases” (2013).

- European Commission, “Merger Statistics”, 30 June 2013.

- Department of Justice of the USA, “2011 Contingency Plan”, pp 7 (2011).

- Department of Justice, “Workload Statistics in 2003-2012” (2012).

- Federal Trade Commission, “Inside BC”, August 2012.

- Federal Trade Commission, “Hart-Scott-Rodino Annual Report - Fiscal Year 2012”, Annex A (2012).

- Federal Trade Commission, Nonmerger Enforcement Actions, 31 May 2013.

- The number of antitrust staff in the EU is as a matter of fact much bigger given the fact that EU Member States still have national competition authorities.

- Yuyan W (2009)Sursen Sued Cloudary Breaking the Anti-monopoly Law and was not Supported, MeiriJingjiXinwen (National Business Daily), 28 October 2009.

- Emch A, LovellsJLH (2013) Art 55 of the AML (see n 1 above) provides that “[t]his Law does not govern the conduct of business operators to exercise their intellectual property rights under laws and relevant administrative regulations on intellectual property rights; however, business operators’ conduct to eliminate or restrict market competition by abusing their intellectual property rights shall be governed by this Law” (translation).

- Emch A, Lovells JLH (2013) The cartel organized by the Association was investigated by the NDRC Agency in Guangdong Province in 2010. However, no decision was given. See n 50 above.

- Guangdong High Court, Case Huierxun vs. Shenzhen Anti-pest Association, (2012) Guangdong High Court Civil Third Final, Nr. 155.

- The AML, n 1 above, Art 13; and also Anti-price Monopoly Regulations, n 24 above, Art 7.

- European Commission, “Notice on agreements of minor importance which do not appreciably restrict competition under Art 81(1) of the Treaty establishing the European Community”, 2001/C 368/07, O.J. C 368/13, 22 December 2001, Art 11.

- In a limited number of case, such as Case Broadcast Music [441 U.S. 1 (1979)], the Supreme Court of the USA took a more prudent approach and held it compatible with the Sherman Law that owners of music copyrights agreed on a fee for a blanket license to all of their works. One of the main reasons was that such a price fixing was necessary to offer a new and use product, ie the blanket license. However, other than these exceptions, pricing fixing, in particular naked price fixing, is predominantly considered as per se illegal in the USA. See, Joseph W. Defuria Jr., “Reasoning Per Se and Horizontal Price Fixing: An Emerging Trend in Antitrust Litigation?”, (1987) 14 Pepperdine Law Review 1, pp 39-68; and Malcolm B. Coate, “Should Economic Theory Control Price Fixing Analysis?” (2013).

- Case Huierxun vs. Shenzhen Anti-pest Association, n 140 above, para 26.

- The AML, n 1 above, Art 7; see also, YanbeiMeng, “A Study on Applying the Anti-Monopoly Law to Regulated Sectors”, Faxuejia (The Jurist) No. 6 (2012), pp 44-57.

- See n 70 above, pp 36-37.

- Vivian Ni(2011) “China Telecom, China Unicom Face Anti-Monopoly Probe”, China Briefing, 10 November 2011.

- Susan Ning, Wu Han, Sun Yiming (2012) “Latest Development re NDRC’s Antitrust Investigation against China Telecom”. China Law Insight, 16 March 2012.

- XiaoyeWang(2013) Reconsideration on the Abusing Dominance Case of China Telecom and China UnicomJiaodaFaxue (SJTU Law Review) Vol. 2 :No. 2 , pp 5-15.

- MIIT(2007) The Method to Calculate Fees for Broadband Internet Interconnection, MIIT Decree [2007] Nr. 557, 30 November 2007.

- These end users are usually chain Internet cafe operators who consume a huge amount of bandwidth. They receive dedicated bandwidth from China Telecom and China Unicom.

- KailiKan(2011) China Telecom and China Unicom Monpolise Broadband and Backbone Operators Must be Increased Xin lang Xinwen.

- Liu F (2013), “Clearing Broadband Access: China Telecom Read Magic Spell”, ErshiyiShiji Wang (21st Century Business News), 3 September 2010.

- Hou L (2011) Some Aspects of Price Squeeze within the EU: a case-law analysis. European Competition Law Review 5: 250-257.

Relevant Topics

- Civil and Political Rights

- Common Law and Equity

- Conflict of Laws

- Constitutional Rights

- Corporate Law

- Criminal Law

- Cyber Law

- Human Rights Law

- Intellectual Property Law

- International public law

- Judicial Activism

- Jurisprudence