A Four-E Policy: Energy, Employment, Equality and the Environment

Received: 18-Nov-2014 / Accepted Date: 05-Dec-2014 / Published Date: 24-Jan-2015 DOI: 10.4172/2090-5009.1000114

Abstract

The underlying principle of the proposed policy is to produce gradually increasing incentives for all parties in the US (and in other countries with appropriate inputs) to produce more “green” energy and less harmful pollution and to consume less fossil fuel. These incentives would come from fees put on fossil fuels and on easily measured (or fairly estimated) emissions. The fees would start at a low level and would be incrementally increased until a committee of Congress decides that the fee levels had reached an appropriate level. The fees would be entirely returned to legal adult (say aged 17 and over) residents of the US in monthly rebates transferred to their bank accounts or, for poorer people, distributed in debit cards. Thus the policy would be progressive, whereas taxation of fossil fuels and of emissions is regressive. The rebates would be included in the evaluation of the cost of living so that there would be virtually no direct inflationary effects.

Keywords: Energy; Employment; Equality; Environment

17699Introduction

The US government has many methods at its disposal to reduce the use of fossil fuels and to reduce pollutant emissions. One is “command and control”, such as the CAFÉ (corporate average fueleconomy) standards for highway vehicles, and the banning of the sales of incandescent light bulbs. These approaches show a faith in highefficiency technology to reduce fossil-fuel usage, even though there is a human tendency to be more wasteful when using cars and lights that use less energy, sometimes referred to as the “Prius effect”. An extreme “command and control” measure is rationing, not favored in the US. However, a near relative to rationing is the requirement that industries reduce pollutant emissions to, say, 50% of former levels, something that discourages firms from reducing emissions before such mandates come into force. Another is price control, such as the price fixed for interstate sales of natural gas in the 1970s at a level that made it uneconomic to look for, produce and sell gas. This low level encouraged industries with huge amounts of waste heat, such as nuclear power plants, to use natural gas to heat buildings rather than use their own waste heat.

Another method used to reduce the consumption of undesirables is taxation, for tobacco and alcohol, for instances. When applied to something like petroleum in widespread use, taxation has three major disadvantages: it is highly inflationary; it takes a large amount of money out of normal circulation and transfers it to the government for possibly frivolous purposes like bridges to nowhere; and taxes are regressive, hurting the poor far more than the rich. A rather strange form of taxation is cap-and-trade, which is a complex system of taxing some pollution, replete, however, with permits to pollute freely.

The Economist described a US bill as “Cap and trade, with handouts and loopholes [1]. They have, it seems, granted some rather generous concessions to Midwestern Democrats from states dependent on coal or heavy industry.” This bill gave away 85% of carbon permits for nothing, with only 15% being auctioned, according to the quoted article.

The author, in debating with himself and others on which of these alternatives or some other would be most appropriate to handle energy shortages and pollution excesses, became intrigued by a variation of the tragedy of the commons known as the shared-lunch syndrome. It can be illustrated by a group of twenty who eat lunch every day at the same restaurant. One day, someone says “Let’s save the server writing out 20 checks. Just have her write one check and we’ll divide it by 20.” One of them realizes that now he can order lobster thermidor and pay only 1/20 of the difference over the cost of his usual egg-salad sandwich. Within a week, everyone has copied him. They are all saying “Why is lunch so expensive, and why am I getting so fat?”

The first version of the proposed policy

The incentives in the shared-lunch situation were so obviously negative and were so similar to the use of energy and to other aspects of life in the US that the author became concerned with the need to reverse these incentives. In 1973 he came up with something that was close to a simple reversal of the shared-lunch arrangements [2]. A gradually increasing fee would be added to the price of petroleum and coal products. All the fees would go into an impregnable trust fund. At the end of every month the entire contents of the trust fund would be divided equally by the number of legal adults (say seventeen and older) in the country and an exactly identical amount would be deposited in each person’s bank account. Thus fossil fuels would become more expensive, but the average user would get a rebate that would cover the increased cost even if she or he did not reduce fossil-fuel usage or emissions. Poor people, getting the same rebate but being likely to use much less fossil fuels, would get a rebate that was larger than the added costs. The rich would, if they didn’t change their purchasing patterns, be financially somewhat disadvantaged, but would have far greater freedom to change their life-styles than do the poor, They would buy everything that promised to reduce or eliminate their added fees. There would be a strong stimulus to job growth, e.g., in high-tech jobs and in highly insulating replacement windows. This policy was named the “modified free market” and “tax-pus-rebate” (later changed to “fee-plusrebate” recognizing that taxes always go to the government, whereas a fee can have a more advantageous destination.) With regard to the trust fund, it was recognized that to have so large an amount of money that could not be raided by Congress may seem fanciful. However, if the funds were raided, the policy would become immediately inflationary and regressive in the same way as would carbon taxes.

The next version of this policy followed the description of it in 1974 to Senator Proxmire’s Joint Economic Committee [3], and he pointed out that at a time when inflation was over fifteen percent, it would add to inflation. The direct inflationary aspects were eliminated by requiring that the “basket” of goods and services used to assess inflation would be modified to include the rebates as reducing the cost of living, counterbalancing the increases from the effects of the fees. Later versions incorporated fees on emissions where these could be measured at low cost or could be fairly estimated. Poor people who are unlikely to have bank accounts could receive their rebates in debit cards, as used for poor relief in many countries.

The modified free market produced by this policy could also be universal in that there would need to be no other government taxes or fees on fossil energy, with two exceptions. The Department of Defense could need to fund some fuel and energy systems that would not be produced by the free market. And if there were catastrophic events like earthquakes, tsunamis or asteroid impacts there may be need for crash programs under government financing and control.

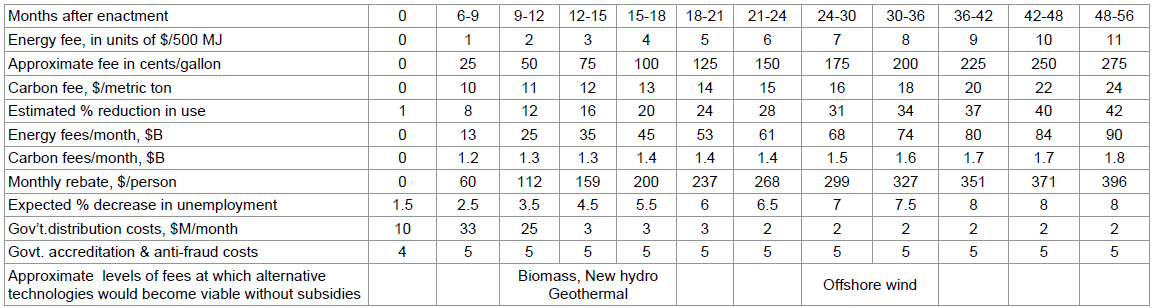

A modeling table, with notes

The accompanying table illustrates how the policy could be scheduled. Some notes on the table are the following.

1. No fees are put on fossil fuels or emissions during the six months after enactment, to allow time for preparation. This delay could be varied (by the chosen Congressional committee) to be shorter or longer.

2. After the six-month fallow period, fees on all fossil fuels are started at $1.00 per 500 MJ, which for gasoline is about 25 cents per gallon. The fee is increased by a further $1.00/500MJ each quarter until two years after enactment, after which the increase would occur every six months for two years, and thereafter every year. The starting fee could be increased or decreased and its rate of increase could be speeded up or slowed down by Congress. Different starting fees and rates of change could be applied to different fuels. The author prefers the uniform fee applied to the energy value in the fuels coupled with an additional fee on the emissions from the different fuels and power systems, being charged as in note 5 below.

3. The expected decreases in fossil-fuel use and in unemployment are from the conditions at enactment, and are simply the author’s judgments.

4. There would be large savings in government expenditures on energy, environment, welfare, etc., many of which would no longer be required. No attempt to estimate these savings has been made here.

5. Either simultaneously or subsequently, fees would be required from emitters of greenhouse or toxic gases such as ozone (O3), methane (CH4), nitrous oxides (NOx), carbon monoxide (CO) and carbon dioxide (CO2), where they can be estimated or measured fairly and inexpensively, and the collected fees would be deposited in the same trust fund and distributed. The author has used as a starting point the fees for carbon derived from the carbon taxes in British Columbia, where a partial trial of this policy was instituted in 2008 and has achieved considerable success [4] The carbon tax in British Columbia increases from $10 to $30 per metric ton over three years [5]. In the third line of Table 1 the author has shown his suggestion of a gradual increase for this fee. Data from the US Energy Information Administration were used for the most-recent year, 2010, to calculate the effects of this policy [6]. The US consumption of petroleum, natural gas and coal was given as 35 quads, 25 quads and 20 quads respectively to estimate the carbon fee, the same US administration gave the CO2 produced by the three classes of fossil fuels as 73, 54 and 95 kg per million Btu of energy in the fuel. The results are shown in the seventh line of the table. (The fees for emissions are considered by the author as too small, but the rate used is an economic/political choice.) The carbon content of a kilogram of CO2 is 273 grams, so that the fees and rebates can be calculated. A fee for methane emissions is highly desirable. Recent research has stated that methane contribution to global warming is over eighty times that of CO2 per unit mass, and that there is much more methane emitted than was previously believed [7]. The author recommends that methane and ozone is included in this policy when better data are available.

6. The points at which other energy technologies would become viable without subsidies (in the last line) are taken from the Annual Energy Outlook, 2010 (DOE, 2010). Solar thermal and solar photovoltaic would become viable at a higher range of fuel fees than those in this table. New technologies for these and other alternatives could bring economic viability sooner (i.e., at a lower fee level).

7. Data from the Energy Information Administration (DOE, 2009) indicate that households with an income of $40,000 would, if the members did not change their patterns of consumption, receive rebates equal to their outlays in fees. Households in the income range $15,000-$20,000 would use only 86% of their rebates to pay their fees, while households with income more than $75,000 would have fees 36% higher than the rebates they would receive.

8. This policy provides a convenient low-cost framework for achieving other social goals. As an example, the gross pollution of the land and more significantly the oceans by plastic bottles, cups and bags was considered using data from the Clean Air Council (Wills, 2010) for the collection and disposal of these items in the US to suggest a range of fees to be assessed (not shown here). The proposed rise in fees was stopped at a level at which use of disposable plastic bottles was reduced by 90 percent when similar fees were added in the Republic of Ireland. The use of water is considered to be greatly underpriced in many areas, and could also be considered for the addition of a fee and redistribution as a rebate.

Besides calculating the fee rebates per person per month based on the above data and estimates, the author has guessed at government monthly distribution, accreditation and anti-fraud costs and at likely reductions in US unemployment.

A note on inequality

Some people have objected to the favorable treatment of the poor in this policy. Since at least 1980 there has been overwhelmingly favorable treatment of the rich in the US [8] Ben Bernanke has recently (December 2010) drawn attention to the extraordinary level of inequality that has been reached in the US and the need to correct it. Rotman in Technology Review and an article in The Economist have added strong views on the subject [9,10] Gross inequality in any society promotes instability and a general malaise that can reach the rich.

Inevitable consequences of the proposed policy

1. The use of fossil fuels – natural gas, gasoline, diesel and fuel oil, coal, nuclear fuel etc. – and emissions of pollutants would be gradually but strongly reduced. The one-billion dollars we formerly spent every day to buy non-US fuel would also be reduced.

2. Business in general would rejoice at the reduction in uncertainty about energy prices and, in consequence, would make vigorous plans for future developments of all kinds.

3. Inventors, entrepreneurs, individuals and companies would start projects to produce energy from wind, sun, biomass etc. and to reduce emissions in ways governed by the market, and would hire huge numbers of people to work in them.

4. All these new employees would start paying taxes, reducing the country’s deficit.

5. People would start buying more-efficient vehicles, using buses more, walking and bicycling when convenient, buying better homeheating systems, refrigerators etc.

6. Poor people would get a little richer because their energy and other expenditures would increase less than those of the rich, but they would get the same rebates. They would receive something like a guaranteed income and have greater self-pride. If the rebates continued to increase, virtually all would come off welfare.

7. The rich would pay out more than they would get in their rebates. However, they would have far more freedom than do the poor to change their life-styles. They would buy everything available to lower their fees: fuel-efficient cars, air-conditioning systems, LED lighting, photo-voltaic generators and so on.

8. Congress would have the right to roll back, stop or accelerate the increases in any of the individual fees put on energy or emissions at any time. They would be hearing cries of joy from many and of anguish from the rich. They might even receive evidence that would convince them that global warming has been exaggerated, and they might therefore decide to roll back fees. All these possibilities would be democratic applications of Congressional power if the pressures came from voters rather than from lobbyists.

9. Congress would be discouraged from advocating one technology over another, because the modified free market would work its magic.

10. The government could cease to put stimulus money from our taxes to increase employment and to decrease the use of fossil fuels etc. The deficit would drop fast.

11. Almost the only expenditure required of the government would be for the system for transferring the monthly rebates – surely a relatively low-cost operation - and a step up of enforcement on people seeking opportunities to cheat.

This policy would shrink government, would provide incentives for all of us to solve problems, and would greatly reduce government expenditures. (https://lessgovletsgo.org/).

References

- Anon (2009) “Cap and trade, with handouts and loopholes.†The Economist.

- Wilson, David Gordon: News release from MIT to Associated Press, United Press International, individual newspapers on a new energy policy, November 30, 1973 This was published in papers of December 2 and 4, 1973, and resulted in a WGBH radio interview of December 4, 1973.

- Wilson, David G (1974) Hearings before the Subcommittee on Priorities and Economy in Government of the Joint Economic Committee, Congress of te United States Ninety-Third Congress, pp 39.

- Litman Todd (2008) “Carbon taxes: tax what you burn, not what you earn†Victoria Transport Policy Institute, Victoria, BC.

- Hamburg Steve (2011) “Methane: The other important greenhouse gas; methane is 84x more potent than CO2 in the short term†Environmental Defense Fund, NY, NY.

- Rotman, David “The disparity between the rich and everyone else is larger than ever in the United States and increasing in much of Europe. Why?†MIT Technology Review, Cambridge MA, 117: 8.

- Anon (2014) “Free Exchange: It is the 0.01% who are really getting ahead in Americaâ€, The Economist, p. 7.

Citation: Wilson DG (2015) A Four-E Policy: Energy, Employment, Equality and the Environment. Innovative Energy Policies 4: 114. DOI: 10.4172/2090-5009.1000114

Copyright: ©2015 Wilson DG. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Share This Article

Recommended Journals

Open Access Journals

Article Tools

Article Usage

- Total views: 14546

- [From(publication date): 2-2015 - Dec 18, 2024]

- Breakdown by view type

- HTML page views: 10049

- PDF downloads: 4497